China's November Economic Data On A Strong Footing

The fresh set of economic reports from China released last week showed that the economic engine of the world's second largest economy continued to keep its pace of expansion. A measure of various reports covering manufacturing and services sectors managed to beat expectations with some indicators rising at the fastest pace in two years.

China's official manufacturing PMI rose to 51.7 in November, according to official data from the National Bureau of Statistics. It was higher than forecasts of 51.0 and extended the gains from October's print of 51.2. Non-manufacturing PMI, according to official data was also higher, rising to 54.7 after registering 54.0 a month ago.

However, the Caixin indicators showed a more moderate increase. Manufacturing was seen expanding in November but at a slower pace. The Caixin manufacturing PMI registered a print of 50.9, just shy of the 51.0 forecast and down from October's print of 51.2. According to the Caixin's report, companies reported a soft pace of expansion on total new orders while exports remained largely stable after declining in October.

Despite the minor differences between the official and Caixin PMI data on manufacturing, the data showed that Chinese firms have been doing fairly well underpinning hopes that the pace of economic growth will maintain its momentum.

The latest figures have given more validity for those bullish on China who expects the economy to grow past the 6.5% minimum GDP target that was set for this year. November's data reflected that the manufacturing sector in China grew at the strongest pace in a couple of years.

In the third quarter, GDP advanced 6.7% on an annualized basis, which was a welcome change after growth slowed in 2015. China had set a GDP growth target of 6.5% - 7.0% for 2016, and with the third quarter GDP at 6.7%, it is quite likely that China will be meeting its GDP targets for this year.

Meanwhile, authorities have embarked on clamping down on the capital outflows on a weaker yuan. According to Reuters, the Peoples Bank of China has issued a new set of rules targeted at companies that make yuan-denominated loans to overseas entities to curb the outflows. The move is being seen as an apparent attempts to stabilize the yuan which has fallen by nearly 7% this year.

China, Week Ahead: Inflation and Trade Balance figures

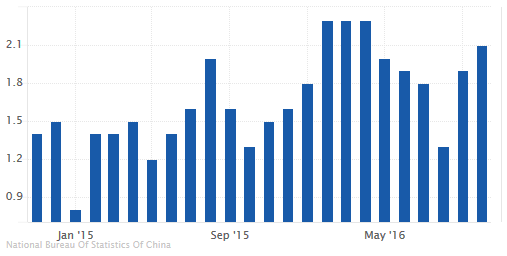

Last month's inflation report also showed that consumer prices were stabilizing. After slipping to 1.9%, China's CPI edged higher to rise 2.1% on a year over year basis in October. This was led by a steady increase in the producer prices which registered a 1.2% increase for a second consecutive month and has been steadily improving over the past few months.

While experts initially expected the PBoC to continue to maintain an easing bias, this view has shifted in recent months with the PBoC seen to be on the sidelines in the near term.

China Inflation y/y 2.1% (October 2016)

For November, economists are expecting to see inflation rise 2.2% which marks a modest increase from the 2.1% increase in inflation a month ago. On producer prices index, the forecasts are bullish with estimates showing a 2.2% jump, up from 1.2% previously.

The trade balance figures will also be in focus after October's data showed an expansion in the trade surplus. China's trade surplus rose to 325 billion yuan during October, which was up from 278.4 billion yuan previously. It was higher than the forecasts of 300 billion. In US-denominated terms, trade surplus widened to $49.06 billion, expanding from the $42 billion September.

However, the value of exports fell at a bigger rate than expected by 7.3% on an annualized basis and comes after a 10% drop previously.

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission ...

more