Canadian Economy Reverses Course In January

Anyone anticipating a rate hike in Canada this year will have to explain away the slowdown in last quarter of 2017 and now the January 2018 contraction in GDP. Statistics Canada’s monthly data reveals an economy in some distress, as major components either contracted or weakened resulting in a 0.1 per cent decline in total output.

Economic growth decelerated sharply in the last two quarters of 2017. At annual rates, real GDP expanded 4% in Q1 and 4.4% in Q2, and then growth slowed dramatically to 1.5% in Q3 and 1.7% in the fourth quarter. Readers will recall that the Bank of Canada removed some monetary accommodation starting in July last year with the first of three rate hikes, largely on the belief that the strong growth in the first half of 2017 provided sufficient tailwinds to tighten credit. Much of the slow down originated in the external sector which proved to be a drag on total output for the last half of the year.

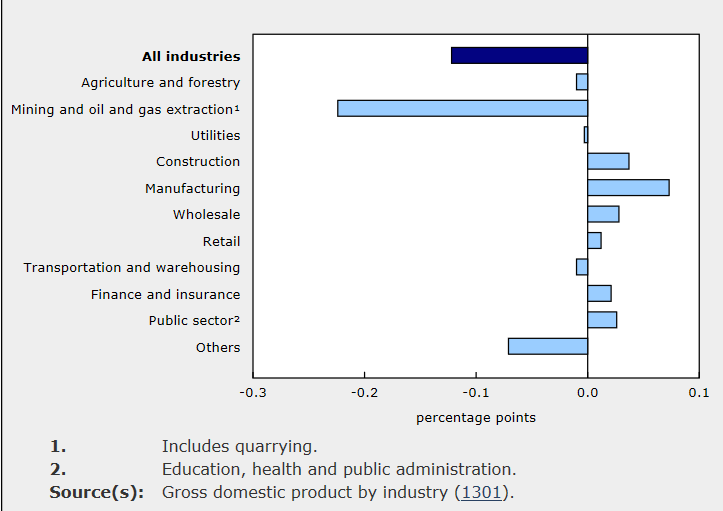

The decline in January output can be traced to two important sectors ---natural resource extraction and real estate. The remaining sectors were about evenly split between growth and contraction. (Figure 1).

Figure 1 Canadian GDP by Sector January, 2018

Oil and gas extraction declined 3.6% (annualized) in January, featuring a 7.1% drop in non-conventional oil extraction. Conventional oil and gas extraction was down for the third consecutive month.

The Federal government announced tighter regulations regarding mortgages in October 2017 which took effect in January 2018. The market reaction to these new rules was relatively swift. Real estate agents and brokers experienced a 12.8% drop in business in January, the largest monthly decline since November 2008. Home resale activity was down in most Canadian cities; the rental and leasing activity declined 0.5% in January following six consecutive months of growth. In particular, there was marked a slowdown in the Toronto and Vancouver markets as the new rules pushed many potential buyers to the sidelines.

The slowdown since the summer of 2017 and now the signs of continued weakness are showing up in the credit markets. Curve flattening in Canada is well underway. The 30-year yield is now only 26 bps above the 5-year yield, compared to well over 100 bps a year ago. Bond investors are no longer penciling in rate hikes for 2018, but more importantly, the flattening curve is signaling that the economy will advance very slowly without any uptick in core inflation as the year unfolds.