Bakken Update: Well Economics Are Improving As Costs Decrease And Enhanced Completions Improve Production, Part 2

<< Read Part I: Bakken Update: Economics Improve As Costs Decrease And Enhanced Completions Improve Production

As part two of this series, we continue to look at production increases and cost cuts in the unconventional oil industry. This is not limited to any play, although economics is considered the best in the Permian and STACK. Cost decreases have been seen through better oil service contracts, including frac sand and fluids prices.Water costs are down, as water depots are not as busy and most operators have or are putting pipe in the ground.Operators continue to decrease drilling and completion times, while improving production. As efficiencies have improved, so has source rock stimulation.This is how the operator breaks or fracs the rock to release oil and natural gas. By doing this well, it increases production significantly. Operators are focusing on the best geology.Core operations produce more resource per foot. When coupled with better well designs performance increases.These are the reasons unconventional US well economics is improving. This is part of the reason the current oil glut has kept prices low for a very long time, and with it the US Oil ETF (USO).

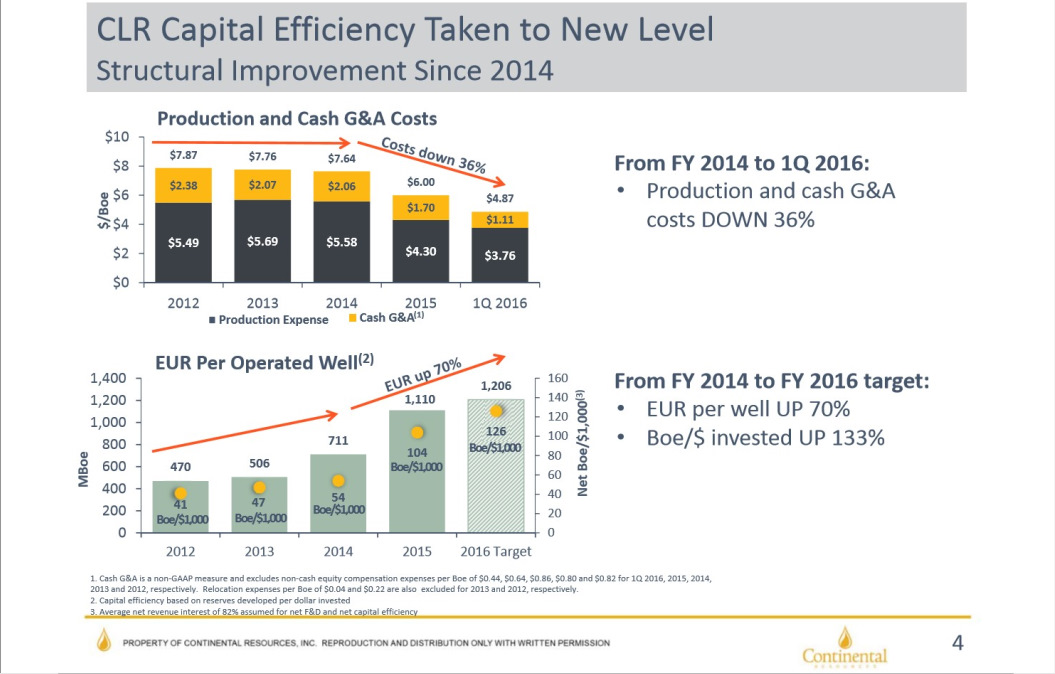

Continental (CLR) has seen cost improvements. Since 2014, production and cash G&A are down 36%. Over that same time frame, EURs are up 70%. EURs are not a great way to measure well productivity, but it does provide an estimate or starting point. Wells produce approximately half of resource in the first years.If EURs are up 70%, in theory the same could be said for the first five years of production. Some wells will outperform EURs over the first few years, while others lag.In CLR’s case, the improvements have been great.It has moved rigs to its core Bakken leasehold, and realized improvements through the STACK. By adding this Oklahoma acreage, it has provided a better core than North Dakota.

(Source: Continental)

CLR continues to improve production per dollar.Some of this is due to the STACK, but we are seeing better completions in North Dakota.EURs are up, but some of this is due to high-grading. If we look back to 2012, it is up over 300%.Well costs continue to improve.

(Source: Continental)

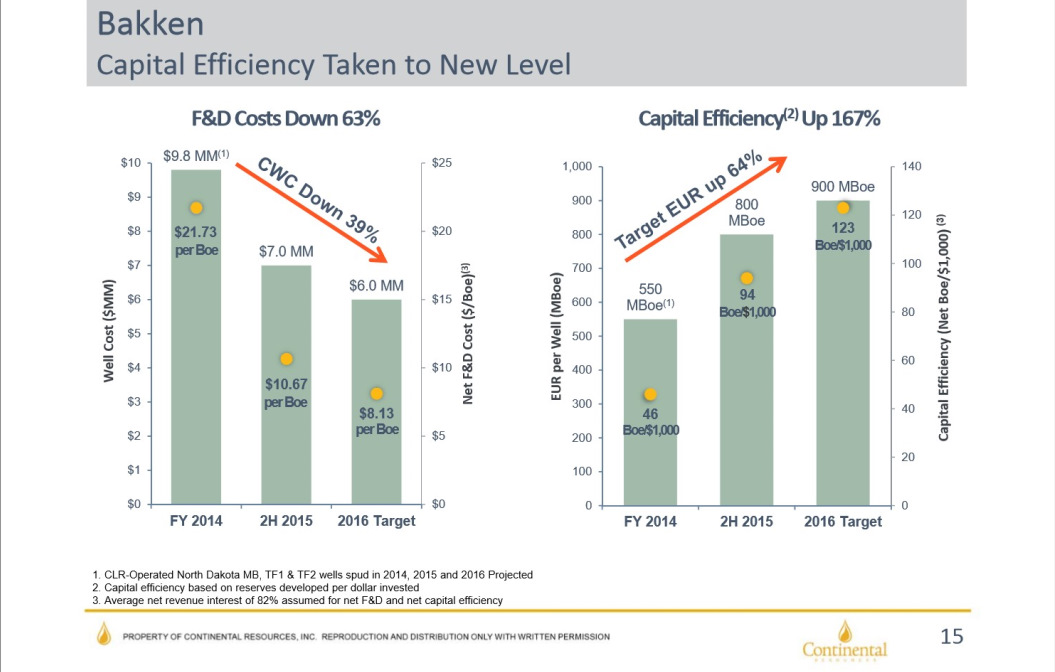

Bakken well costs have seen improvements.Although it is highlighted here, we have seen this throughout all plays.There was a time when one-mile laterals in the Bakken were around $10 million, but now most operators are doing it for a little more than half that.The above slide shows well costs on an average two-mile lateral.This is the North Dakota average.Operators have tried three mile laterals but it is too difficult to control the entire length.On average, an operator does produce more per foot doing a one-mile lateral, but has to bear the cost of drilling twice as many holes.Now CLR can drill and complete a location for approximately $6 million.

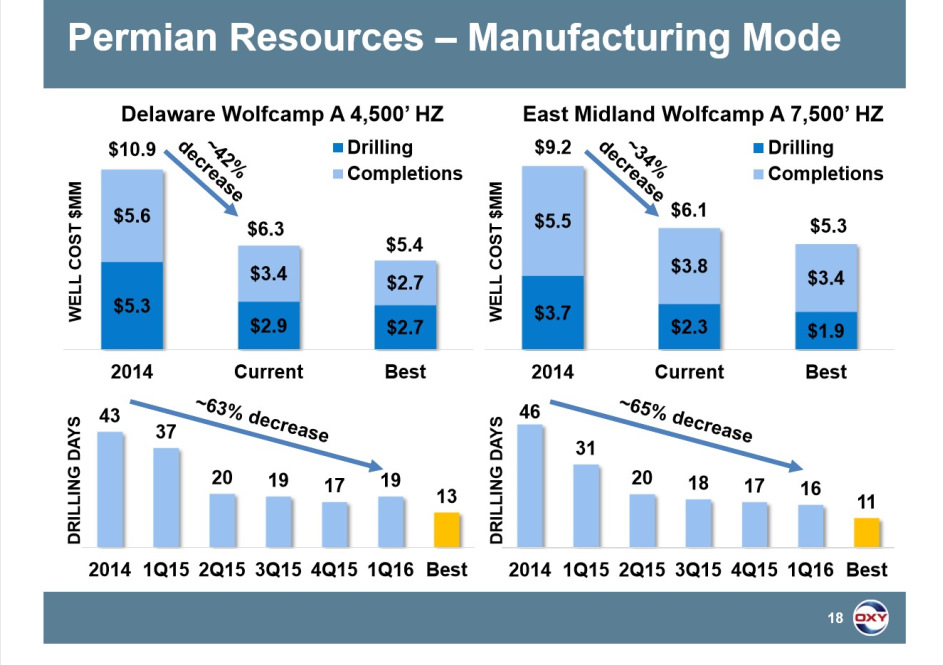

Occidental (OXY) paints a decent picture of changes in the Permian.

(Source: Occidental)

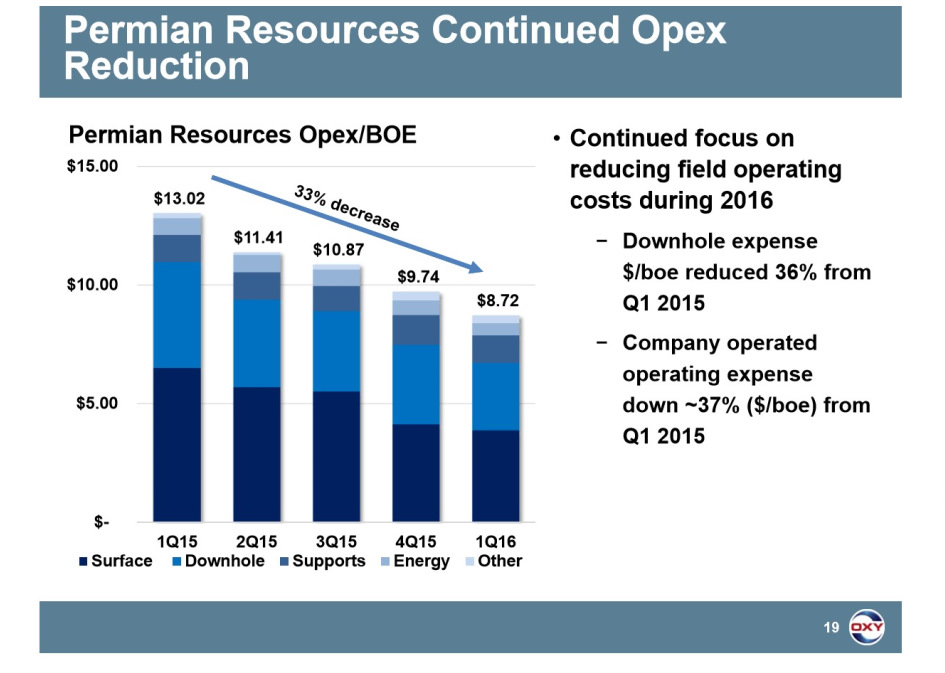

Well costs are down from 34% to 42% since 2014.Drilling days are down 63% to 65%.These are big moves and not independent of Texas and New Mexico.Operating expenses per BOE are improving.

(Source: Occidental0

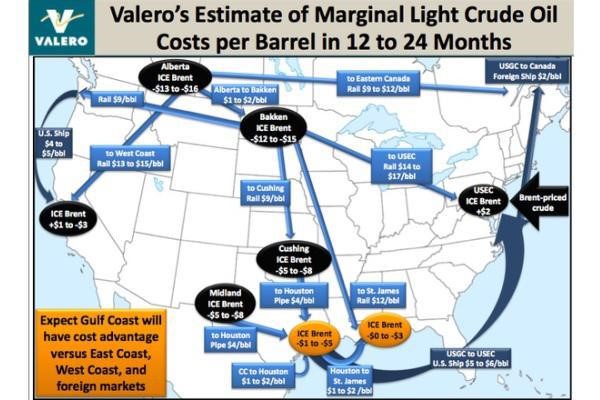

Cost reductions are occurring for all operators in all plays.In areas like the Permian, additional pipelines to move crude and water are important.Less trucking means lower logistical costs.Many pads have implemented systems that use natural gas to run equipment.In Texas plays, many areas already had much of this set up, but not as much in North Dakota.Lower oil prices have motivated operators to get logistics set up before well completion work is begun.North Dakota also has wider differentials, but this is improving.It is hoped that next year, there will be enough pipe in the ground to move all Bakken crude out of the state.This will limit the need for trains to move to the Northeast and supply refiners like PBF Energy (PBF).The same goes for railing to the west, where California has begun to stop the movement of crude via train.This could prove instrumental for refiners like Tesoro (TSO) to begin importing more Brent.The same would be said for refiners in the northeast.

(Source: Valero)

Valero (VLO) provides an idea of costs derived from moving crude to key refining areas of the US.Although there is sporadic refining capacity through the Midcontinent, the main destination for crude is the Gulf.Texan refining capacity is the greatest, and it makes sense.Not only has Texas been a crude production leader, there are several very large ports.North Dakota is a relative newcomer, and this is why there is one main TSO refinery in Mandan.There are also some smaller diesel refineries that have popped up, but it only cracks the surface of the volumes of Bakken Light being produced.

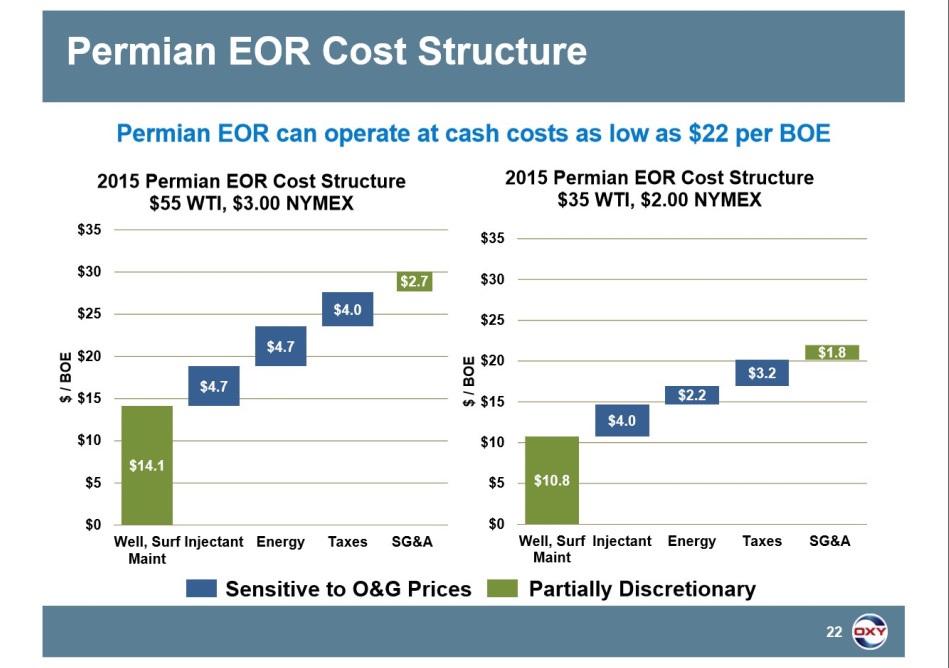

Decreased oil and natural gas prices also affect direct costs, whether it’s a reduction in taxes or decreased costs through oil service contracts.

(Source: Occidental)

Occidental is the world leader in CO2 EOR production.It currently operates 31 EOR projects and pumps 1.9B cubic feet/day.This is more than Exxon (XOM), Chevron (CVX), Denbury (DNR), Kinder Morgan (KMI), Anadarko (APC), and Hess (HES).EOR work is also sensitive to oil prices.The $20/bbl decrease in the price of crude and $1/Mcf of natural gas decreases cash costs significantly.This created a reduction from $30.50/BOE to $24/BOE.

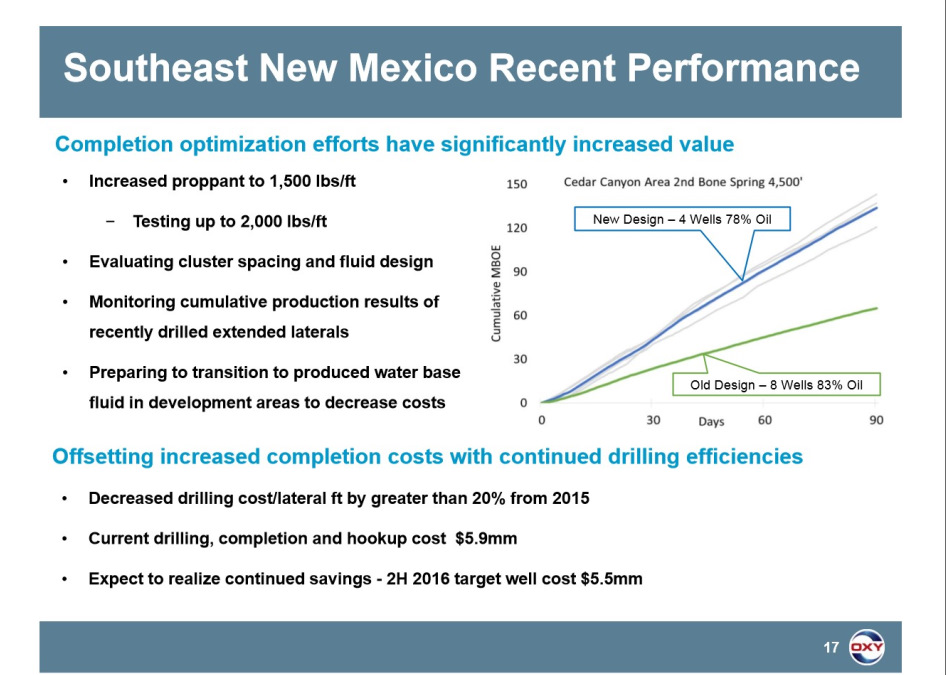

(Source: Occidental)

Occidental is also seeing better well results.Its acreage in New Mexico, has shown excellent results through several intervals.This includes the Wolfcamp and Bone Springs.As with other operators, it is using better stimulation techniques which create better fractures within the source rock.Fracs are better controlled and closer to the wellbore.This is important, as it increases production from the induced fractures.More resource is collected over the first year.We expect cluster spacing will continue to tighten, improving stimulation.This will also require more frac fluids.OXY’s new design has more than doubled production over the first 90 days when targeting the 2nd Bone Spring.While some intervals produce more overall resource from a BOE standpoint, this is oil focused with its most recent designs producing about 78% oil.It is accomplishing this while decreasing drilling costs/ft by more than 20% since last year.It expects to reduce those costs by another $400K/well sometime in 2H16.

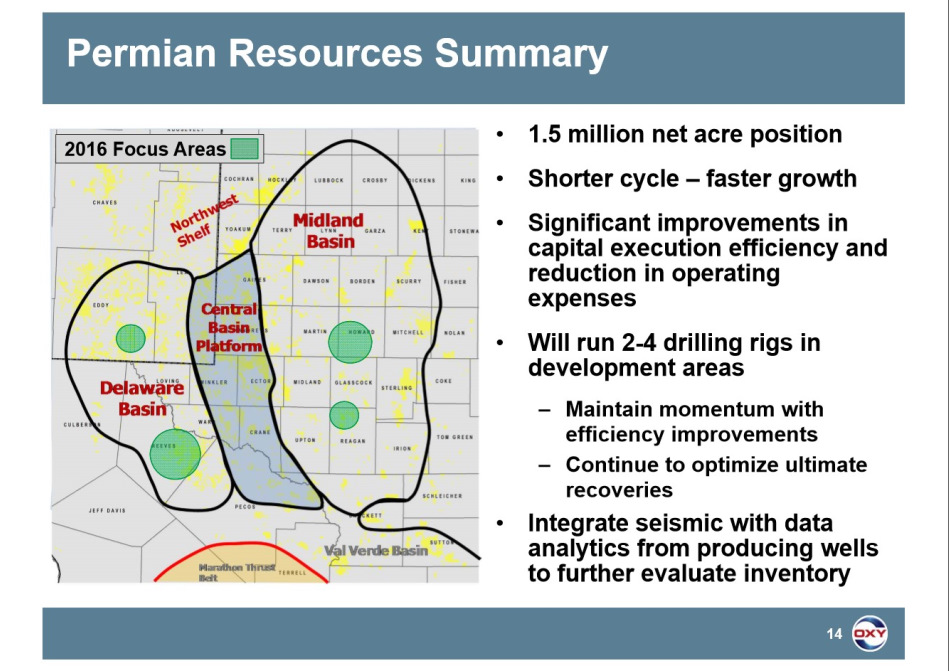

(Source: Occidental)

OXY is still focusing 2 to 4 rigs on the Permian, even with the dip in oil price.It is important to focus on where its activity is.Although many think that Midland/Martin counties in the Midland Basin are best in play, it continues to drill to the northwest of that core position.Its Reeves and Eddy county leasehold is very good, and could be as good as Midland.

In summary, the US oil industry is experiencing changes.These may be long term as there is a new oil price environment.When oil was selling for $100/bbl there was a much easier credit market to operate outside cash flows.Although some may see the decrease in oil prices as something that will crush the unconventional oil industry, they may be incorrect.

The reason I say this, is we will see changes that in some ways are good.When oil prices were high, many operators were moving ahead with projects without a regard for cost.A large number of wells were being drilled and everyone was getting paid large sums of money to get it done.This led to flaring of natural gas and many sites being completed without the proper logistics.So operators have decreased moving into fringe areas to get acreage held by production.

It is also now focusing on the best core plays.This means rigs will focus on the Permian and STACK, with decreases in work away from the Bakken and Eagle Ford fringe areas.Operators will work large pad projects to decrease costs per well.There are many variables that could occur changing how we view oil prices.We expect oil around $60 to $65/bbl by year end with the possibility of it occurring in 1Q17.We also expect oil prices to be below $50 through Q3.The overhang of the oil glut will create issues through refinery maintenance.Although OPEC sees the market already balanced, there is the possibility that transient crude production disturbances will correct in Canada.These flows will return, but we don’t see Nigerian production coming back on line as quickly.Forest fires affect the industry in a much different way than terrorist bombings.Nigerian production could come back in some form, but it will first need to figure out how to protect its infrastructure.

The dollar probably continues to strengthen in Q3 with decent job reports and fears of what Brexit means in the short term.So the question is how do oil prices correct to a $60 to $70 range next year?The answer is quite simple, as many operators have decreased capex in a meaningful way.This may affect offshore more than US unconventional work.There are many large deep sea projects that have been scrapped and while world demand increases, these projects will not be there to fill the natural decline void upcoming in concert with increased world demand.

While demand increases are good in the US for gasoline, it is more about prices.We are moving from a significant oil glut, to what many believe is a refined product glut.This could stimulate demand more than anticipated as gasoline prices could continue to decrease in a significant way.If this occurs (and there is no major recession next year), there will be higher oil prices, with significant volatility through next year.We expect the US oil markets will continue to consolidate and weaker players go bankrupt.This should allow US operators and the market to re-emerge as a stronger industry.Given the current glut of oil and refined product, we think the price of oil is probably headed lower in the short term.We believe there may be a rebound by year end.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more

Thanks James,

We currently own $CLR and like it more for its STACK leasehold than core Bakken. It seems to be doing the right things, hopefully Mr. Hamm continues to do so.

Good article, thank you. I read in the Financial Times recently that break-even prices in the SCOOP and STACK are down to around $35-$39 per barrel. This is highly significant when considering that break-even prices in countries like Saudi have to take into account national budget issues and they need around $90 to break-even. Many #OPEC producers need that figure or more.

I use to own $CLR and will probably buy back in again soon.

Thanks James,

Some think it could be the best geology in the US, but we don't know for sure. It will take some time, but given the initial results it will be an excellent play whether it is better than the Permian or not. The nice thing is those breakevens are coming down even more this year. Things should get interesting by year end.