Australian Dollar Could Resume Its Slide

Weakness in iron and copper prices and tensions with China could weigh on the Australian dollar, short AUD/JPY?

Political mayhem in Australia pulled Australian dollar to a weekly high.

Despite the political upheaval, the Australian dollar rallied on optimism that new PM Morrison would not seek to radically change economic policies. He is the 6th Prime Minister in 10 years. The markets actually reacted positively to the news, with the AUD gaining strength following Morrison's victory. Morrison had served as the country's treasurer for three years and is viewed by the markets as unlikely to radically change the country's economic policies.

However, we must note that in the political arena, it is unlikely to have much geopolitical impact on its currency. It could be just an ephemeral sentiment before the Australian dollar resumes its original course: downwards.

Last week, we saw Acting Home Affairs Minister Scott Morrison and Communications Minister Mitch Fifield effectively banning Chinese telecommunications giant Huawei from participating in the development of its new 5G mobile phone network, citing national security concerns. The controversial decision would also block other Chinese firms, like ZTE, which has bid for the project.

"The Australian government has made the wrong decision and it will have a negative impact to the business interests of China and Australia companies," China's Commerce Ministry, which rarely comments directly on Australian government decisions, said in a statement. If the tensions between Australia and China were to escalate, we could see China denying Australia of more business opportunities which could hurt Australia’s exports.

China is Australia's largest trading partner in terms of both imports and exports. Australia is China's sixth largest trading partner; it is China's fifth-biggest supplier of imports and its tenth biggest customer for exports.

Next, the weakness of iron ore and copper prices could also weigh on any significant gains on Australia dollar. Iron ore fell to one-month low last Thursday but has since rebounded slightly based on news that Chinese steel inventories fell last week.

Similarly, copper prices fell on Thursday as the trade dispute between the United States and China escalated and the dollar strengthened on expectations of higher US interest rates soon. Benchmark copper ended down 0.3 percent at $5,986.5 a tonne, heading towards the 14-month low of $5,773 a tonne hit last week. Earlier this week it touched a one-week high at $6,076 a tonne.

Another major factor which we feel could support the Australian dollar could be the strengthening of yuan. China’s central bank said on Friday that it was adjusting its methodology for fixing the yuan’s daily midpoint in order to keep the currency market stable, amid broad dollar strength and ongoing trade tensions between Washington and Beijing. This caused CNH to strengthen against the USD, from a high of 6.90 on Friday to close the day at a low of 6.80.

All in all, we could see a healthy retracement of AUD/JPY to 82.00 price levels as we can see a short-covering rally. With no Australian economic reports scheduled for release, AUD/JPY could resume its slide this week.

Our Picks

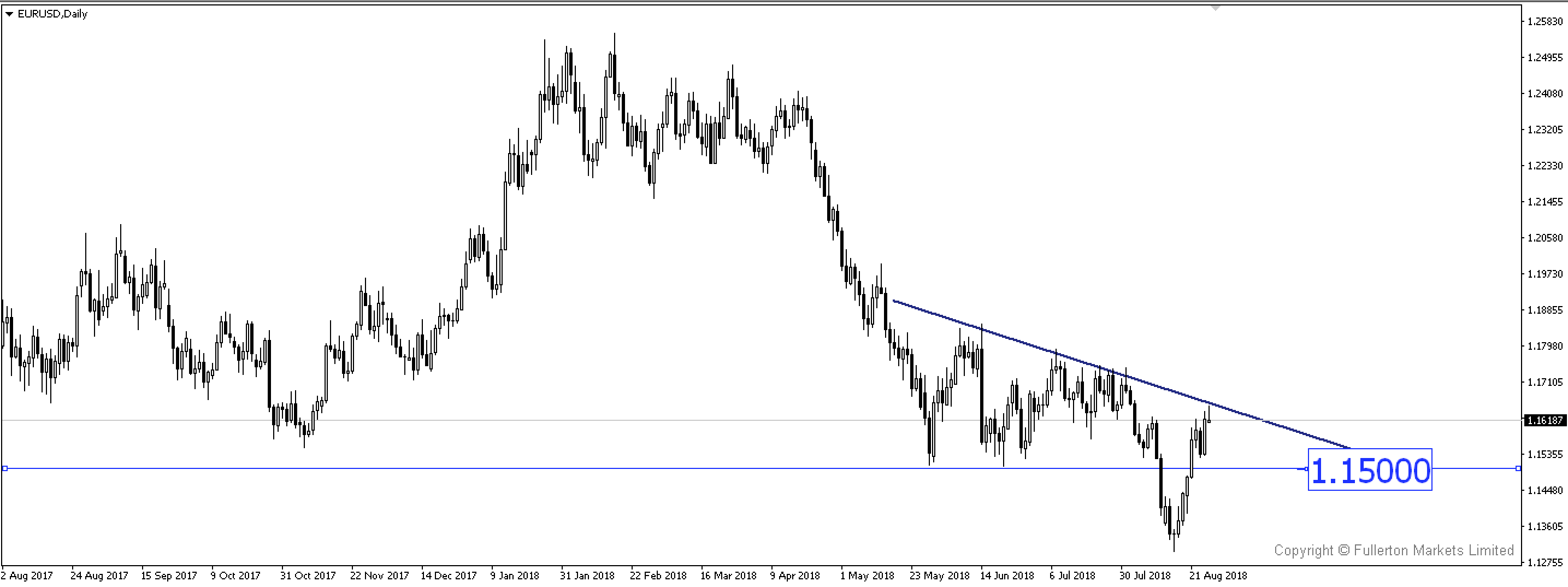

EUR/USD – Slightly bearish.

This pair is hitting a potential resistance and with no major news this week, we could see technical factors coming into play. We could see 1.1500 being retest again.

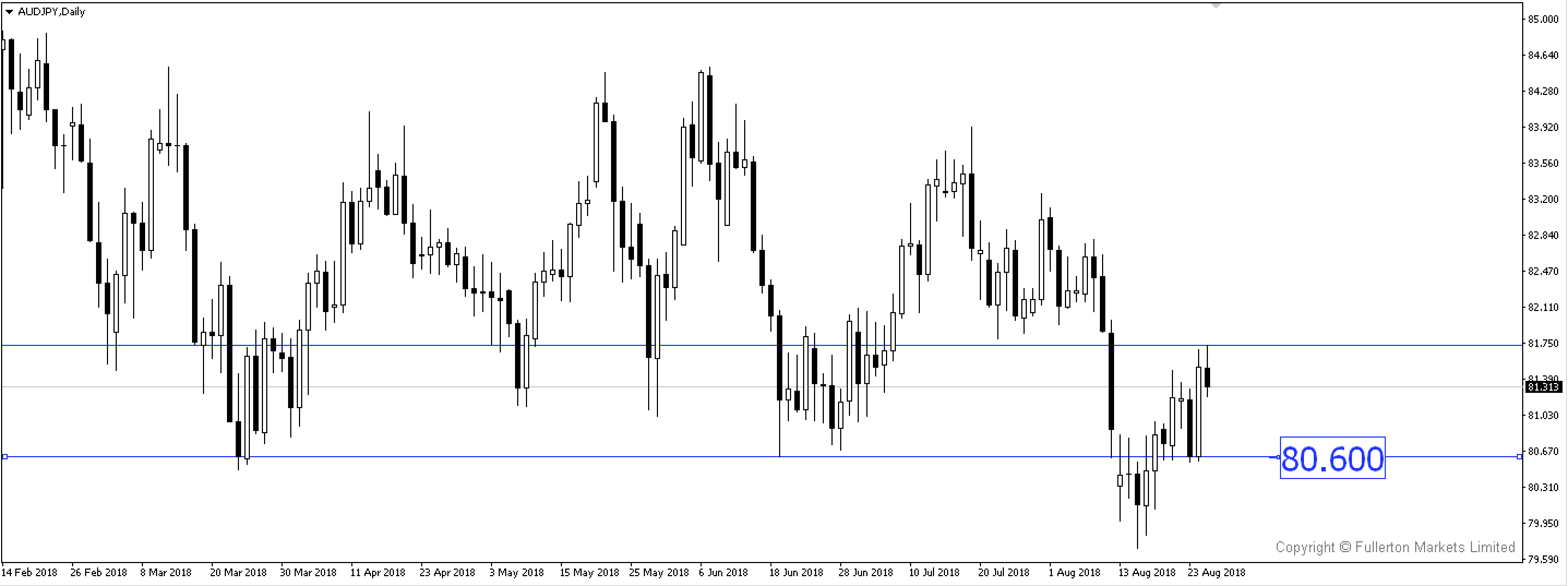

AUD/JPY – Slightly bearish.

As long as 82.00 price region is not breached, we could see this pair retest the support at 80.60.

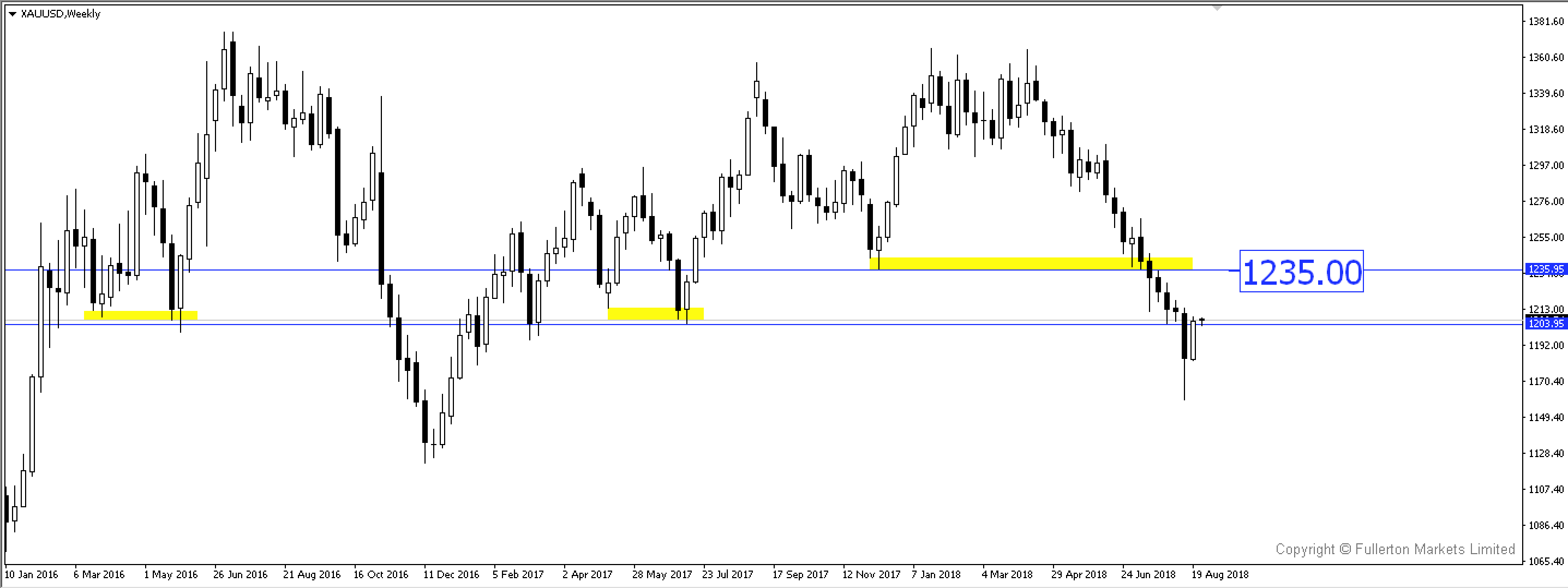

XAU/USD (Gold) – Slightly Bullish.

The bullish momentum could continue as short-covering and a dovish Fed chair’s speech continue to boost gold. We could see 1235 price level get re-test this week.

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more