A Very Tepid Move By The Bank Of Canada

As widely expected the Bank of Canada (BoC) increased the overnight bank rate by 25bps, however the accompanying statement reveals a central bank that is far from overly optimistic that the economy is on a sustained growth path.

The BoC has only one mandate: to maintain price stability. So far, it has not been successful in achieving its inflation target of 2% annually; in fact, that target continues to be very elusive. The BoC acknowledges recent softness in inflation “but judges this to be temporary”. A similar phrase has been often used by the Federal Reserve when grappling with the problem of why actual inflation falls so far short of its target. Many do not accept this facile explanation that low inflation is just “temporary”. It, simply, has been trotted out time and again by central bankers to explain away why inflation remains subdued.

The BoC does not give any hint regarding the future path of rate increases. Here it takes the safe route and says that future decisions are data dependent. That is, the evolution of interest rates will hinge entirely on macroeconomic data such as GDP and its major components and overall inflation. The Federal Reserve used to place great stock on developing policy in response to incoming data. Now, the BoC has adopted that similar stance.

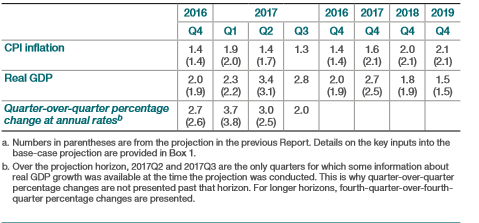

As the accompanying chart [1] shows the strong results of the first half of 2017 are not expected be replicated in 2018 and 2019. The BoC estimates real GDP growth will moderate further over the projected horizon, from 2.8 per cent in 2017 to 2.0 per cent in 2018 and 1.6 per cent in 2019. As for inflation, the BoC, as usual, expects to reach its target of 2% in 2018 and 2019. For a data dependent central bank, it is hard to imagine why short-term rates would increase in 2018 and 2019, given that it expects that growth will moderate and inflation will remain stable.

Figure 1 Projected Growth and Inflation for Canada

The BoC identifies a number of risks regarding the inflation outlook. These risks include, notably:[2]

* the possibility of a major shift toward protectionist global trade policies;

* the recent slowdown in inflation may not be accounted for by temporary factors;

* Canadian exporters may not be competitive, leading to further loss in the market share;

* all of the above which could postpone prospective investment projects.

These risks are significant and it is understandable why the BoC is moving very cautiously. There are too many uncertainties that go the heart of the Canadian economy. Taken as a whole, the BoC was very careful not to make any commitment to a predetermined path of more hikes.

[1] http://www.bankofcanada.ca/wp-content/uploads/2017/07/mpr-2017-07-12.pdf

[2] http://www.bankofcanada.ca/wp-content/uploads/2017/07/mpr-2017-07-12.pdf, page 21

Disclosure: None.