2 Stocks Cashing In On The Largest Gambling Mecca In The World

The growth of gambling on the enclave of Macau over the last decade has been simply been extraordinary to observe. The former Portuguese colony has started from nothing to become the gambling mecca of the world. Its annual gaming revenues easily dwarf those of Las Vegas by multiples. The growth in gambling in Macau has been fueled by China’s remarkable rise as a global economic power as the Middle Kingdom has gone from impoverished three decades ago to the second largest economy in the world. As China continues to develop and the middle class continues to grow, Macau’s gaming and shopping revenues will surely grow with it. With the end of this growth nowhere in sight as China brings more and more of its almost 1.5 billion person population into the middle class, investing in these stocks seems like a no-brainer.

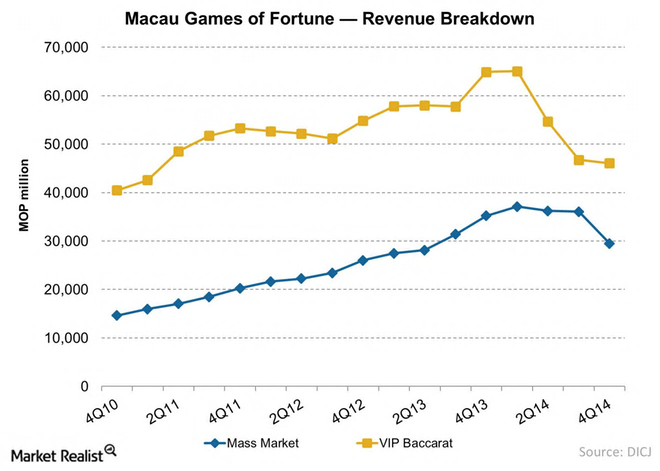

Macau has been the recipient of this economic rise as tourism has increased rapidly and as more casinos have opened on the island. This growth was unabated for over ten years until the second quarter of 2014 as a result of initiatives from the new Chinese leadership to crack down on corruption as it cements its hold on power and puts in place its economic growth plans for the next five years. As can be seen from the graph below, this was triggered a significant decline in gambling revenues especially from the well-heeled or “VIP” gambling population.

As one might ascertain this has not been good for the stocks of casino operators that depend on Macau for a large percentage of their revenue and earnings growth. The major players on the enclave have seen their shares give back 30% to 45% from their highs last spring.

This is a good entry point for some of these casino equities as this corruption “purge” is likely to fade by the end of 2015 as it has many times before once new leadership in the Middle Kingdom is firmly in place. In addition, the gambling enclave is likely to return to growth by 2016 as the tourism from Chinese consumers with more and more discretionary income continues to increase and take more trips out of the country.

Monthly revenue comparisons should get easier as we enter the second half of the year, buoying sentiment on the sector. Finally, some of the shares are attractive on a long term valuation basis and also pay high yields. This should appeal to income investors and also pays an investor to wait for a turn in the fundamentals in the industry. Here are my current two favorite Macau plays at the current moment.

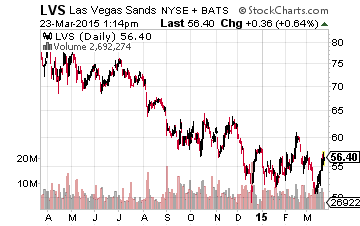

Las Vegas Sands (NYSE: LVS) is my top pick in Macau and also one of the five inaugural picks in the recently launched Blue Chip Gems portfolio. The company currently is one of the top two market share leaders in Macau – with just under 25% of the total gambling revenues on the enclave. The company has its 3,000 room Parisian Macao hotel and casino opening in early 2016 which should cement its #1 status as Macau’s leading gaming concern.

Las Vegas Sands (NYSE: LVS) is my top pick in Macau and also one of the five inaugural picks in the recently launched Blue Chip Gems portfolio. The company currently is one of the top two market share leaders in Macau – with just under 25% of the total gambling revenues on the enclave. The company has its 3,000 room Parisian Macao hotel and casino opening in early 2016 which should cement its #1 status as Macau’s leading gaming concern.

It’s important to note, the completion of the Parisian Macao will greatly reduce the company’s capital expenditures budget over the next few years. This should result in expanding free cash flow, the majority of which should find its way to increasing dividend payouts and stock buy backs. The stock already pays an almost five percent yield (4.9%) after increasing its payout by some 160% over the past three years.

In addition, over 80% of Las Vegas Sands revenues from Macau comes from the mass market lessening its exposure to the currently crippled VIP segment of the market. The company’s Singapore facilities are showing strong performance and Vegas operations are slowly improving.

Finally, the company has an outstanding collection of luxury retail properties within its casino hotels. These stores are seeing solid revenue growth and have very high per square sales. Spun off in a real estate investment trust structure they would be worth around $10 billion according to several analysts and would unlock significant shareholder value. With the stock down approximately 30% from its highs in the second quarter, the shares are offering a solid entry point for long-term investors.

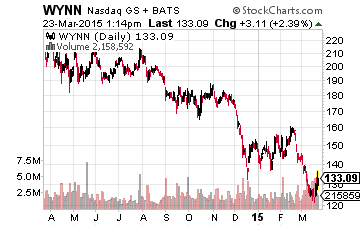

My next stock in the sector is Wynn Resorts (NASDAQ: WYNN). The stock has been harder hit than Las Vegas Sands as it counts more on the VIP sector in Macau and gets 70% of its overall revenues from the former Portuguese colony. The stock has given up some $100 a share over the past nine months and now goes for approximately $130 a share.

My next stock in the sector is Wynn Resorts (NASDAQ: WYNN). The stock has been harder hit than Las Vegas Sands as it counts more on the VIP sector in Macau and gets 70% of its overall revenues from the former Portuguese colony. The stock has given up some $100 a share over the past nine months and now goes for approximately $130 a share.

Also like my top selection, WYNN pays nearly a five percent dividend yield (4.8%) thanks to its recent decline. Wynn Resorts has positioned itself as the high-end, premier and luxury brand in Macau. Its customers pay the highest room rates and bet the most per hand in the industry. This may be a detriment now but once things start to get back to normal, this strategy should pay off again as it has for years.

The huge Wynn Palace project on the Cotai strip in Macau is expected to begin operations by mid-2016. The effort will have cost more than $4 billion when it is complete. Its arrival will signal a lessening of its capital expenditure needs in Macau and increased revenues. The company should also have a huge complex opening in Boston by 2017 provided it can get around some opposition to its recently received license.

Revenues for the company overall should be in the high single digits in FY2015 due to the decline of revenues in Macau. However, analysts project Wynn should see 25% sales increases in FY2016 as its new complex opens in 2016 in Macau and the environment on the enclave improves for the better.

Both Wynn and Las Vegas Sands are two of six companies with concessions to operate in Macau. Both stocks are long term bargains for patient investors, pay high dividends and are already seeing some benefit from increasing traffic and revenue in Las Vegas thanks to an improving economy and low gasoline prices. For investors who want exposure to what is and will remain the largest gambling mecca in the world and should continue to benefit from the economic growth from China, now is the time to start building a stake in these two well-run casino operators.

Disclosure: Long LVS.

For more on how I find these winners and how you can too, more