‘Tis The Season To Be Oily

My kids groan whenever I try to regale them with tales of the past. The grumbling begins as soon as I say “You know, back in my day …”

Groan alert: I’m about to regale you.

I come from the commodities world — a place where real goods like gold, soybeans and crude oil are traded. And back in my day (cue the grumbling) we traders speculated on the profitability of oil refining by keeping a close eye on the “crack spread.” The spread’s earned for cracking input crude oil into distillates such as gasoline and heating oil.

If you want to emulate the refining and merchandising cycle now, you’d buy three December light crude contracts and simultaneously sell short two January RBOB gasoline contracts together with one January ULSD fuel oil contract. At current prices, that would lock in a crack spread of nearly $14 a barrel.

That’s not bad, considering spot crude oil’s selling for $50 a barrel. In fact, that translates into a gross refining margin (GRM) of better than 27 percent. Still, the margin’s been fatter. A lot fatter. Back in February, when crude oil prices tumbled below the $30 level, the crack spread was worth $20 a barrel as the GRM spiked above 77 percent.

February, in fact, tends to be a peak time for GRMs. You can see this in the chart below which plots the GRM — based on a 3-2-1 crack spread – against the spot oil price.

(Click on image to enlarge)

You can see that refining margins tend to be inversely related to oil prices. Crude prices drive the cost of gasoline and gasoline, in turn, makes up the bulk of the crack spread’s sales side.

There’s a confluence of forces at work on the petroleum complex in the first quarter of each year. In February, the petroleum industry begins its switchover to summer blend fuels. Domestic gasoline demand is lowest then, so that’s when refinery maintenance is typically scheduled. These turnarounds require the shutdown of refinery process units for anywhere between one to four weeks. On average, refineries schedule turnarounds every four years, so about one-quarter of the country’s refining capacity can be offline sometime in the year’s first quarter.

Now, just because the crack spread favors selling distillates doesn’t mean that refiners will actually be able to capture the margin on every barrel of crude in inventory. But crack spreaders in the futures pits (remember them?) can.

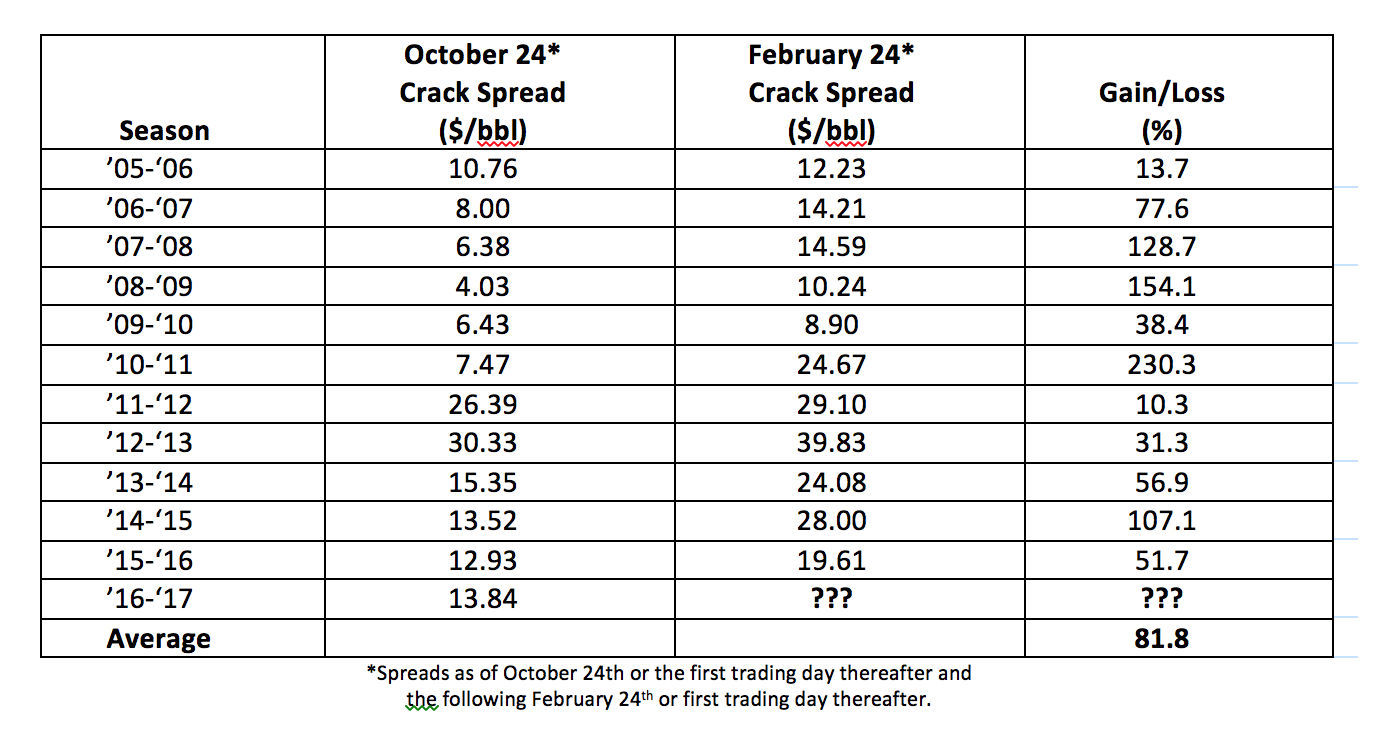

Now is a particularly good time for traders to sell the crack spread. Why? Because the 3-2-1 crack spread has, on average, risen by 82 percent over the past 11 seasons (October through February). And that’s before leverage.

(Click on image to enlarge)

So there’s a definite seasonality to the crack spread, but you can see its size varies significantly from one period to the next. That’s due, in part, to supply and demand dynamics as well as exogenous economic influences. Weakness in the currency markets and slowdowns in economic growth, in particular, tend to slow the spread’s ascent.

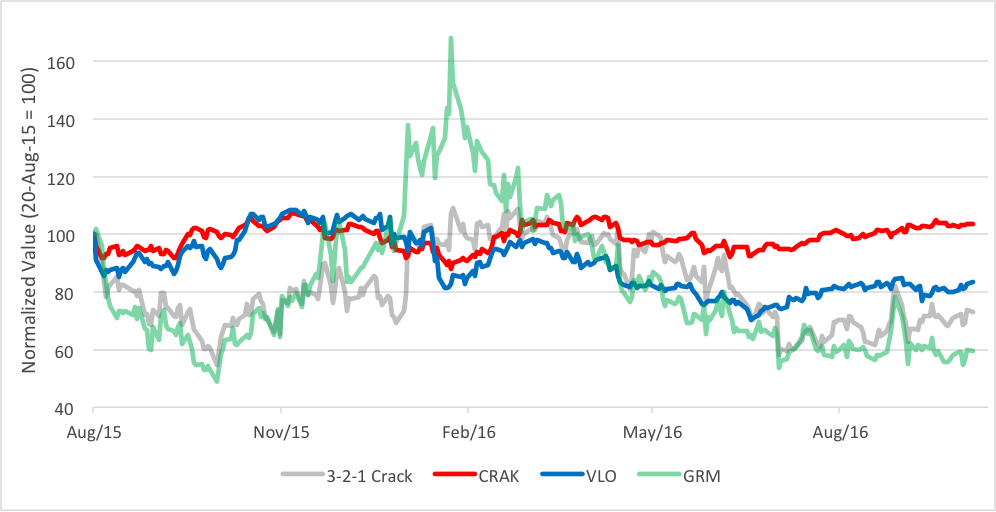

Now, if you don’t want to trade futures, you can trade the crack spread indirectly through a pure refiner like Valero Energy Corp. (NYSE: VLO). Generally speaking, VLO’s price is positively correlated to GRMs. VLO’s a stock, of course, so there’s an additional layer of risk in this alternative play. GRMs are after all, gross refining margins. There are a lot of corporate expense deducted as this profit ratchets down to the bottom line.

(Click on image to enlarge)

Last week, VLO staged an upside breakout that puts a $71 price objective insight on the long-term chart. That’s a 20 percent lift from today’s price.

If you don’t want to take on the risk of a singleton, the VanEck Vectors Oil Refiners ETF (NYSE Arca: CRAK ) lets you take a stake in the aggregate performance of more than two dozen global refiners. CRAK’s upside objective is $22-$23, some 10 to 15 percent higher than its current level. Why so low? Well, mostly because CRAK is a young ETF and trades by appointment. The fund was launched last August.

(Click on image to enlarge)

If you go the VLO or CRAK route, though, look to exit before the February refinery turnover when revenues typically slump.

You done groaning?

Disclosure: Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) ...

more