Sophisticated Investors Love Call Options - Here's Why

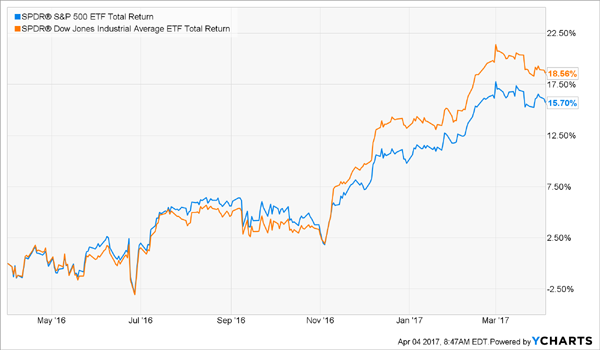

The past year has been good for the S&P 500: it’s up about 15.7%, including dividends so if you’re simply tracking the index through an exchange traded fund, congrats. That’s a decent gain but I’ve got one simple trick—and a far superior fund buy—that can help you do even better … and grab a big chunk of your gain in cash, too. That trick? Covered calls.

Written by Michael Foster (ContrarianOutlook.com)

Covered what? Covered calls are a strategy in which investors buy stocks and sell call options against those stocks.

Think of call options as a kind of insurance; investors buy them if they are short the market and want to protect themselves from blowing up in case the market rallies. If you sell those options to investors, you’re essentially becoming an insurer, giving these gamblers the protection they crave to cover their risky bets...

Selling call options doesn’t always produce a higher return than just betting on the stock market but it does work at times when volatility is high and investors are growing more and more twitchy. Times like, say, when Washington threatens high trade barriers, and a much-promised overhaul of the nation’s tax system looks like it’s on thin ice.

This is precisely why the Nuveen S&P 500 Dynamic Overwrite Total Return Fund (NYSE: SPXX) has delivered a much higher total return than the S&P 500 SPDR ETF (NYSE: SPY), the benchmark for the index as a whole, since November:

Selling Insurance Is Good Business

Notice how the two funds rose in lockstep before the election, with SPXX slightly outperforming SPY. That’s because SPXX is long the S&P 500, just like SPY, but it gets extra income by selling call options against its holdings.

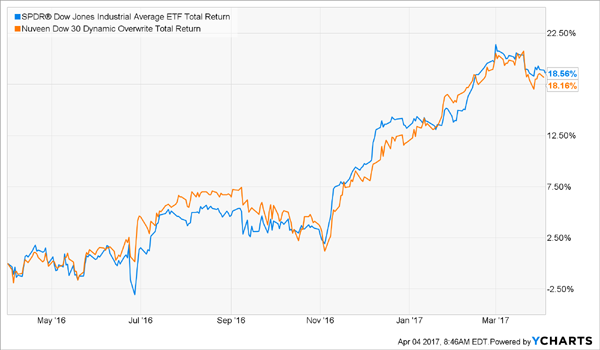

Interestingly, we don’t see the same thing happening when it comes to the biggest of the big-cap stocks. The SPDR Dow Jones Industrial Average ETF (NYSE: DIA) has pretty much had the same performance as its call option–selling peer, the Nuveen Dow 30 Dynamic Overwrite Total Return Fund (NYSE: DIAX), in the last 12 months:

No Call-Option Boost for the Big Names

So why did SPXX outperform while DIAX matched its benchmark index’s return? The answer is simple: the need for insurance.

While the overall market has been cautious for a while, large cap stocks have seen a lot less selling pressure than smaller companies during particularly volatile times. Meantime, investors’ ongoing nervousness about the Trump bump has helped the Dow Jones Industrial Average—which contains 30 of the biggest names on the market—outperform the broader-based S&P 500:

The Bigger the Company, the Bigger the Gain

That doesn’t mean now is the time to jump into Dow stocks, however. Some Dow constituents are strong and some are weak, and the need to be careful with big-cap stocks grows the longer they outperform the market, since these periods of outperformance don’t tend to last long.

So what’s an investor to do? Besides simply being choosy, you might want to consider opting for DIAX instead of DIA. I say this for three reasons.

No. 1: More Cash in Hand

Investors who buy DIAX will get a dividend yield of 6.6%, based on the fund’s last payout, while DIA offers a measly 2.2%. The reason for that higher dividend is the cash that call-option buyers are paying DIAX for the options the fund sells. Those cash payments—called option premiums—are then returned to investors as cash dividends on top of dividends from the companies DIAX owns.

The difference in yield is dramatic. DIAX will pay $1,100 per month to anyone holding $200,000 worth of DIAX shares, while that same investment yields just $368 per month from DIA. If you really love large cap stocks and really want to own DIA, you can just invest those cash dividends into DIA every quarter when you get your payments from DIAX.

The important point here is that you’re getting that cash from the fund without the fund having to sell a single stock, because the cash from its option-selling strategy and the dividends from the companies it owns are enough to fund its 6.6% payout.

No. 2: Less Downside Risk

Remember that call options are insurance. When DIAX sells that insurance, the fund is effectively hedging its position in the market. The cash it gets from those options is cash, and it’s credited to the fund pretty much immediately. DIA doesn’t get regular cash payments in the same way.

If the Dow Jones falls by 4% this year, the value of DIA will also fall by 4%, and your return for the year will be negative 4%, excluding dividends. However, since DIAX got a 4.4% cash payment for selling those call options, your return for the year would be actually slightly positive, again excluding dividends.

This is the power of hedging your bets, and it’s why sophisticated investors love call options: more cash in hand now, less downside risk later.

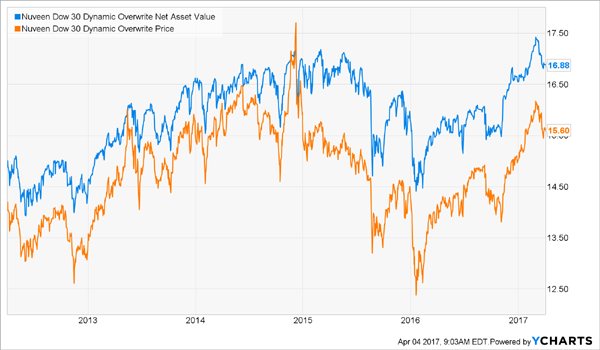

No. 3: A Terrific Discount, to Boot

The final reason to consider DIAX is the most compelling. The fund is trading at a pretty big discount to its net asset value, or the value of the stocks it holds, even though it’s traded at a premium to its NAV more than once in the last five years:

Buying the Dow on the Cheap

What this means is that anyone who buys DIAX now is getting exposure to the entire Dow Jones index and paying less than market value for those stocks. In fact, you’re getting the Dow Jones Industrial Average for 7.5% off, while also getting the fund’s consistent high yield and exposure to the safest group of stocks on earth: US large caps.

This article may have been edited ([ ]), abridged (...) and reformatted (structure, title/subtitles, font) by the editorial team of munKNEE.com (Your Key to Making Money!) to provide a ...

more