Foreign Stocks In Developed Markets Rise For 6th Week

Equities in foreign developed markets delivered the strongest gain last week for the major asset classes, based on a set of exchange-traded products. The modest advance marked the sixth increase in as many weeks for these markets.

Vanguard FTSE Developed Markets (VEA) edged up 0.5% for the five trading days through Sep. 22, posting the strongest gain for the major asset classes. The advance lifted the fund to its highest close since 2008.

Supporting the bullish trend in foreign equities is the ongoing decline in the US dollar. All else equal, the depreciation of the greenback relative to foreign currencies lifts the value of offshore assets after converting prices into dollars. Although the US Dollar Index edged higher last week, its second weekly gain, this benchmark has fallen 10% this year through Sep. 22.

US real estate investment trusts (REITs) posted the biggest loss for the major asset classes last week. Vanguard REIT (VNQ) fell a hefty 2.3%, the fund’s first weekly loss since early August.

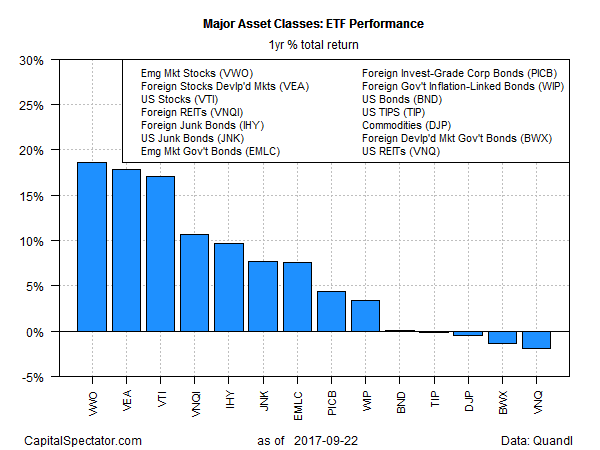

For one-year results, stocks in emerging markets continue to hold the top spot. Although Vanguard FTSE Emerging Markets (VWO) edged lower last week, the ETF’s 18.6% total return for the past 12 months reflects the strongest gain among the major asset classes for year-over-year changes.

Meanwhile, US REITs are still the bottom performer for trailing one-year returns. At last week’s close, VNQ was off 1.9% vs. its year-earlier price.

Disclosure: None.