Best Opportunities Outside Of North America

Investors tend to focus on investment opportunities that are well known and also those which have been headline news for several months. This allows the investor to become familiar with main stream news which eventually leads to a comfort level that makes them want to get involved with what is hot or not.

While there is nothing wrong with this process it’s widely known that self directed investors tend to get involved with these investments with their money on the wrong side of the market. Simply put, they buy at highs or sell at the lows.

By the time an opportunity becomes headline news most of the opportunities have already made the bulk of their move. Investors buy into good news and sell or short sell investments which are having negative news and this lag time between the investor receiving the news, processing it for a few weeks, then taking action makes for poor entry and exits for their investments.

As hard as it may seem, buying into investments that are getting a lot of negative news are likely going to be some of your best performing investments.

Recently I talked with Jim Goddard of HoweStreet about the best opportunities I see in the market and they all happened to be international investments. Feel free to listen to our thoughts about these opportunities (and/or see charts and discussion below).

Running length 00:10:55

Best International Opportunities Explained Visually

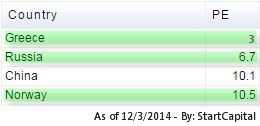

Finding low hanging fruit or stock markets that provide value is the key for investments you plan to hold for 1-3 years in length. The table below show the three countries with the lowest PE ratios and the best looking chart in terms of buying near long term support.

Looking at the charts you will how each of these markets has been under heavy selling along with negative headline news. Know what we know, it is very likely most investors holding equities within these countries that are scared by the news have already sold their positions. Those who have not will likely continue to hold long term for prices to rise eventually.

What Should You Invest In Next?

Investing is one part time, and one part timing. What I mean by that is if you have a long time 10+ years for an investment to mature you should be rewarded for holding and committing to that investment. But if you want real eye-popping performance year after year it is important to try to time your entry and exits.

Every year you should review the portfolio and rebalance. Shuffle funds out of mature markets and into ones which provide more value and have room to grow in excess of 30% or more. These ETFs I show are some of the investments I currently like.

Slowly averaging in, meaning buying a small portion ever week or every month is the best way to get involved in long term investments. I do feel these country ETFs could make minor new lows before going higher but we never really know what an investment will do and when, which is why we need to slowly build positions when you know a particular market is ripe for the picking.

Join My Free Newsletter at www.GoldAndOilGuy.com, and please ...

more