Best And Worst Mid Cap Stocks Into Q1 + Seasonality

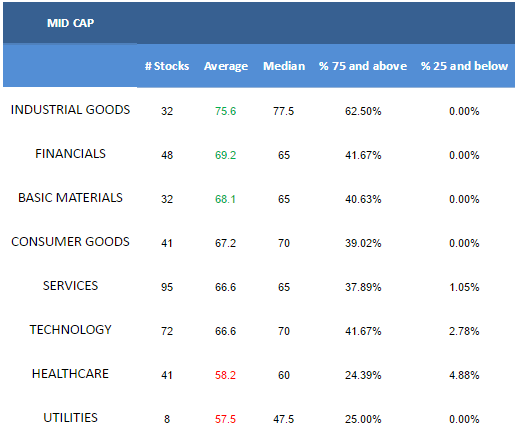

The best mid cap sector is industrial goods.

The highest scoring mid cap industry is trucking.

**Important** Scores have shifted to reflect first quarter seasonality.

The average score for mid cap stocks in our universe is 66.85. For comparison, the moving average score over the past four weeks is 69.30. The typical mid cap stock in our coverage is trading -13.61% below its 52 week high, 5.82% above its 200 dma, has 5.64 days to cover short, and is expected to see EPS grow 13.96% in the coming year.

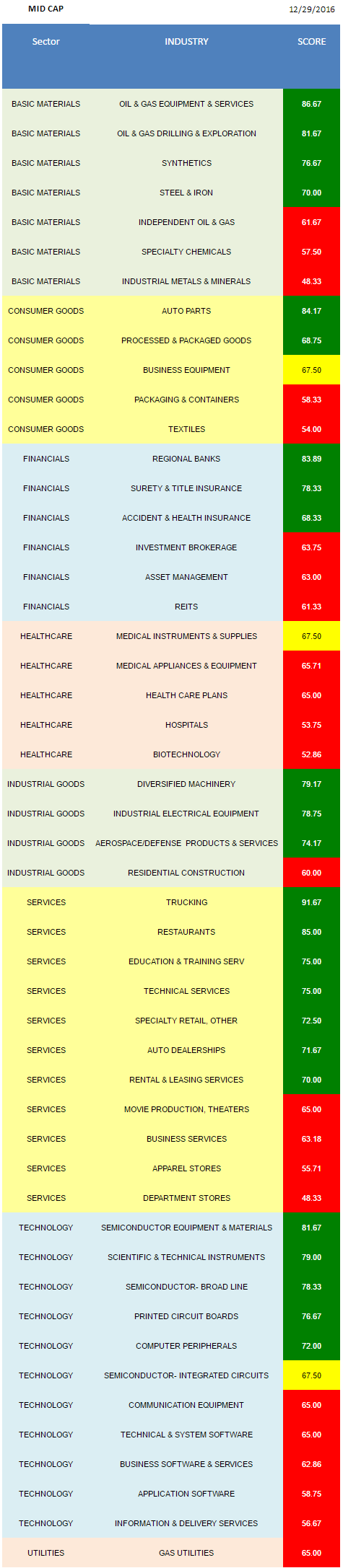

Industrial goods, financials, and basics are top scoring. Consumer, services, and technology score in line and are industry specific. Healthcare and utilities score below average and are stock specific.

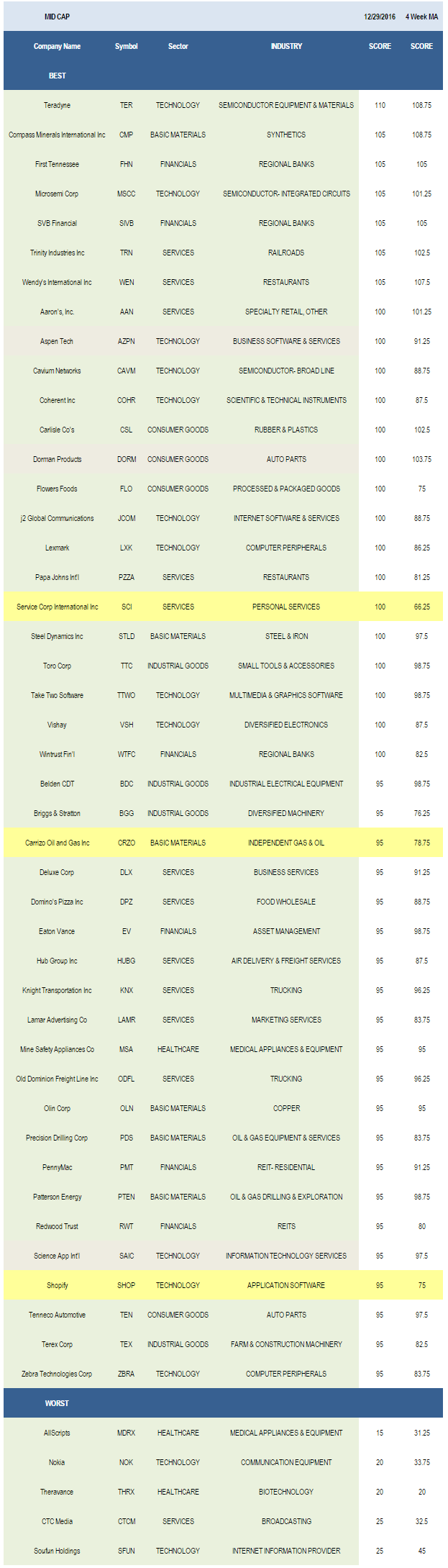

The following are the top and bottom scoring mid cap stocks.

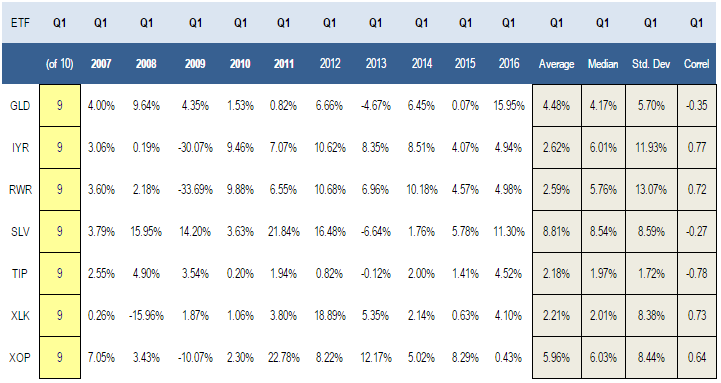

There are the top baskets for first quarter seasonality over the past 10 years.

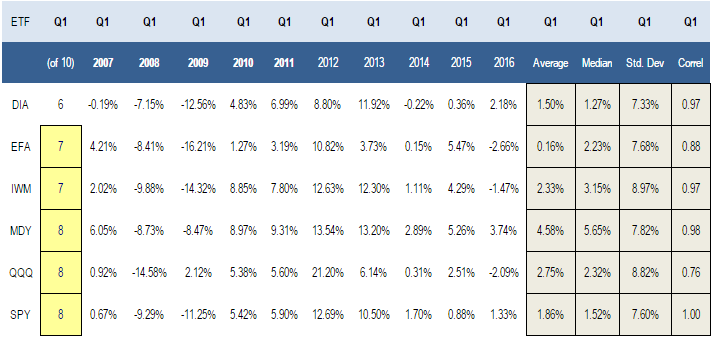

Here's the first quarter seasonal track record for major market ETFs.

The best scoring mid cap industry is trucking (ODFL, KNX, HTLD). Oil & gas equipment & services (PDS, HLX), restaurants (WEN, PZZA, TXRH, CAKE), auto parts (DORM, TEN, GNTX, FDML), and regional banks (SIVB, FHN, WTFC, OZRK) are also high scoring.

The best scoring industries in basics are oil & gas equipment & services, oil & gas drilling & exploration (PTEN, ATW), and synthetics (CMP, MTX). In consumer, buy auto parts and processed & packaged goods (FLO). The top financials industries include regional banks, surety & title insurance (AGO, RDN), and accident & health insurance (CNO). No healthcare industries score above average this week. Diversified machinery (BGG, MIDD, NDSN), industrial electrical (BDC, LFUS), and aerospace/defense (CW, TDY, ESL) can be bought in industrial goods. The strongest services baskets are trucking, restaurants, and education & training (DV, LOPE).Semi equipment & materials (TER, ENTG), scientific & technical instruments (COHR, CGNX), and broadline semi (CAVM) offer upside in technology.

Disclosure: None.

What goes into the score? Relative strength? Valuation? Quality? Some combination of the three?

What goes into the score? Relative strength? Valuation? Quality? Some combination of the three?