Annaly Capital Management: Attractive 9.5% Dividend Yield, But Interest Rates Are A Major Risk

Annaly Capital Management (NLY) appears to be a tale of two stocks. On one hand, shares have soared 26% year-to-date. The company’s earnings-per-share rose significantly in 2016. Annaly followed this up, by turning a loss in the first quarter in 2016, into a profit in the first quarter this year. Investors cheered its first-quarter earnings report, in which a key metric—interest income—came in better than expected. However, Annaly’s dividends are going in the wrong direction. As a mortgage REIT, Annaly is being squeezed by rising interest rates. Annaly stock offers a sky-high dividend yield, of 9.5%. It is one of 416 stocks with a 5%+ dividend yield. You can see the full list of established 5%+ yielding stocks by clicking here.

While Annaly’s stock price performance and current dividend yield are certainly impressive, the company is facing a difficult fundamental outlook moving forward. As a result, this may not be the best time to buy Annaly shares. Investors who greatly desire high dividend yields, should also consider the risks before investing.

Business Overview

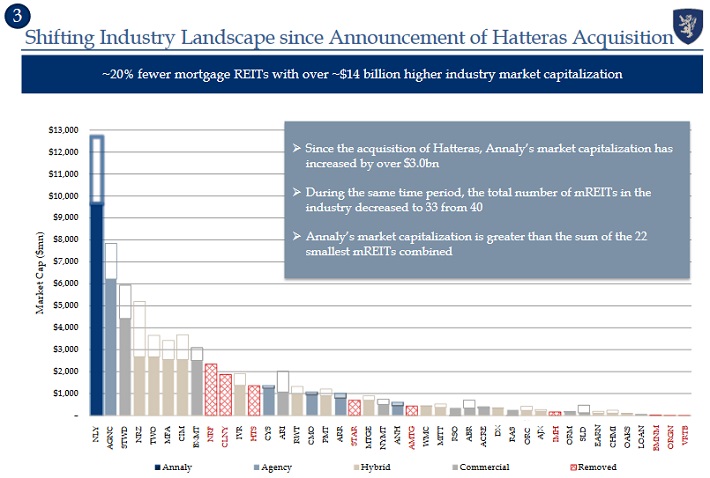

Most investors probably associate REITs with investing in real estate properties, but Annaly has a much different business model. It is known as a mortgage REIT—meaning it invests in mortgage securities. Annaly is the giant in the mortgage REIT industry. After its $1.5 billion acquisition of Hatteras Financial in 2016, Annaly now has a larger market capitalization than the 22 smallest mortgage REITs combined.

Source: JPM Securities Financial Services & Real Estate Conference, page 16

The company has approximately $90 billion in assets, and its portfolio includes securities, loans, and equity investments. It invests in both the residential and commercial real estate markets. Agency mortgage-backed securities represent the vast majority of Annaly’s assets:

- Agency Mortgage-Backed Securities (94% of assets)

- Residential Credit (3% of assets)

- Commercial Real Estate (2% of assets)

- Middle-Market Lending (1% of assets)

Essentially, Annaly makes money by borrowing to purchase mortgage securities, and pocketing the difference between the interest it receives, less interest paid and hedging costs. As a result, the company suffers when short-term interest rates rise, since this can compress its profitability, as the company invests in long-term mortgage securities. It can also report gains (or losses) from changing values of its mortgage investments. The current environment is difficult for Annaly. Rising rates have caused spreads to contract. However, Annaly’s financial performance was resilient last year. In 2016, the company reported earnings-per-share of $1.39, up significantly from earnings-per-share of $0.42 in 2015. The key contributor to this growth was much better performance from the company’s interest rate swaps. However, net interest income declined 8.6% for the year, which is a lingering concern for investors. Continued interest rate hikes could cause Annaly’s growth to deteriorate moving forward.

Growth Prospects

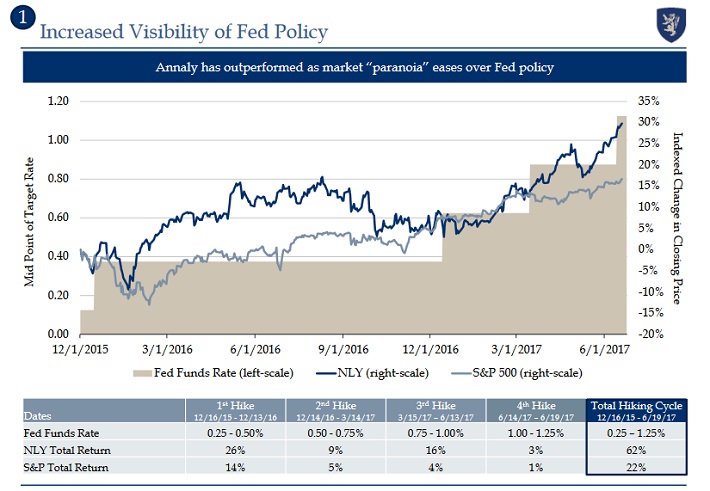

Annaly’s strong performance continued in the first quarter of 2017. Earnings-per-share of $0.41 were a huge improvement over the first quarter of 2016, when Annaly reported a net loss of $0.96 per share. Annaly stock has roared to start 2017, possibly because investors have become more comfortable with the pace of the Federal Reserve’s intended rate increases. This increased visibility is a growth catalyst.

Source: JPM Securities Financial Services & Real Estate Conference, page 13

A delay in the Fed’s plan to raise interest rates could be a continued catalyst for Annaly going forward. There have been a few data points that suggest the U.S. economy may not be strong enough to support the Fed’s aggressive rate hike plans. For example, inflation remains muted, and the U.S. economy expanded by just 1.2% in the first quarter. Separately, consumer spending—which constitutes two-thirds of U.S. gross domestic product, rose at its slowest pace since the fourth quarter of 2009. In light of some soft economic data, Annaly investors may be pricing in a slower-than-expected pace of rate hikes over the remainder of the year.

Dividend Analysis

With a 9.5% dividend yield, Annaly looks like a very attractive dividend stock, considering the S&P 500 Index on average, has just a 2% dividend yield. The problem is, Annaly’s dividend declined considerably over the past several years, as the Fed embarked on a path of monetary tightening and interest rate increases since the Great Recession ended. For example, after Annaly’s quarterly dividend reached a high of $0.75 per share for the fourth quarter 2009 payment, it has been steadily reduced, to its current level of $0.30 per share. The good news is, Annaly earned enough profit last year to cover its dividend. Based on 2016 earnings-per-share of $1.39, Annaly maintained a payout ratio of approximately 86%. This held true in the first quarter as well.

The bad news is, Annaly’s core fundamental metric—net interest income—declined in 2016. The company’s rising earnings were due to its aggressive hedging. Fortunately, conditions improved in the first quarter. Net interest income jumped 62%, but if the Fed continues to raise interest rates, Annaly’s growth could be in jeopardy. Annaly also raises red flags, because its business model relies heavily on debt. The company ended last quarter with a leverage ratio of 6.1.

While Annaly has worked to reduce its leverage ratio over the past three years, it still holds a high level of leverage, which investors should monitor moving forward. Annaly has held its dividend unchanged for 14 quarters. While this could be disappointing for investors, considering the dividend has been halved since 2009, it’s at least promising that the dividend has not been reduced in that time. As a result, when it comes to Annaly’s dividend, beauty is in the eye of the beholder.

Final Thoughts

With Annaly’s share price rally since the start of the year, the stock no longer appears to be undervalued. For example, Annaly stock trades for a price-to-book ratio of 1.12. This is not a high ratio, but it’s difficult to view Annaly as cheap, given its share price increase, combined with its difficult growth trajectory ahead. It is not uncommon for mortgage REITs to trade at a discount to book value, particularly if operating conditions are deteriorating. As a result, while Annaly’s high dividend yield is attractive, investors may want to wait until a better entry point, to compensate for the uncertainty surrounding its dividend sustainability.

Disclosure: Sure Dividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities.

However, the publishers of Sure ...

more