3 Stocks You’ll Hear About On CNBC In 6 Months

Just having received great news about their products, these three companies are gearing up and in six months’ time, everyone is going to be talking about them. Luckily, you have the chance to invest in these companies before everyone else starts rushing in.

It is good to be back in Miami after spending a week out in Las Vegas for the MoneyShow where I was giving several presentations on how to properly optimize and manage a biotech portfolio. Some of the tenets of this strategy were posted last week right here on Investors Alley.

An investor can gain exposure to this highly volatile space that has outperformed the overall market significantly over the past five years in myriad ways. The easiest is just to buy a mutual fund focusing on this sector or an ETF like iShares Nasdaq Biotechnology ETF (NASDAQ: IBB) that focuses exclusively on the biotech sector.

One could also just concentrate on profitable large cap growth plays within this arena that are sporting attractive valuations like Gilead Sciences (NASDAQ: GILD). I have found though over two decades of investing in this area that in order to maximize your long term returns you must add some promising but speculative small cap biotech concerns to the mix. Besides diversifying extensively within this sub-sector of the biotech area with small stakes in numerous companies with potentially huge upside if things fall into place one must actively be aware of what catalysts are occurring in the stocks they hold or are thinking about purchasing.

This requires more active management than most investors want to devote to running a portfolio, but that devotion can lead to higher returns for those that are willing to dedicate the time. Here are a couple of promising small cap biotechs I currently hold that have had some fortunate news come their way over the last week or so which could be positive catalysts to stock price appreciation over the near and medium term.

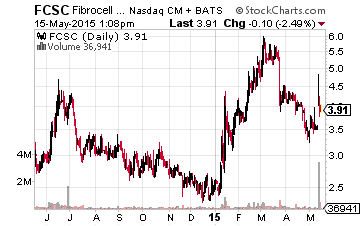

First up is Fibrocell Science (NASDAQ: FCSC), which is up some 15% since the last time I covered it in late January. Fibrocell extracts cells from the skin to create localized therapies that are compatible with the unique biology of each and every patient. The company uses this method to develop therapies to treat rare and serious skin and connective tissue disease. Fibrocell has one approved product on the market to treat “smile” lines but has several other trials progressing.

First up is Fibrocell Science (NASDAQ: FCSC), which is up some 15% since the last time I covered it in late January. Fibrocell extracts cells from the skin to create localized therapies that are compatible with the unique biology of each and every patient. The company uses this method to develop therapies to treat rare and serious skin and connective tissue disease. Fibrocell has one approved product on the market to treat “smile” lines but has several other trials progressing.

The company announced earlier in the week that the FDA added the Rare Pediatric Disease designation to Fibrocell’s Orphan Drug-tagged FCX-007 for the treatment of recessive dystrophic epidermolysis bullosa. If this product is cleared for sale, the company will receive a voucher that it can use to obtain Priority Review for a future NDA (New Drug Application). It can also sell or transfer the voucher if desired.

Obviously this is a positive development for this small firm with a market capitalization of under $200 million. The original reasons for holding the stock I outlined in January still apply and this latest announcement makes the longer term prospects for Fibrocell that much more attractive.

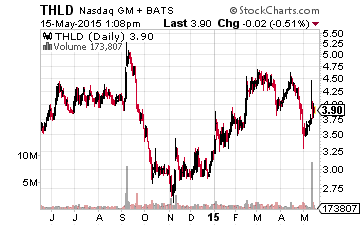

Next up is Threshold Pharmaceuticals (NASDAQ: THLD) which is also up since I last profiled this $280 million market capitalization biotech company. Last week Threshold announced that its compound evofosfamide (also known as TH-302), in combination with another drug received Fast Track review from the FDA for treatment-naive patients with metastatic or locally advanced unresectable pancreatic cancer. In November, TH-302 received the same FDA designation for use against advanced soft tissue sarcoma.

Next up is Threshold Pharmaceuticals (NASDAQ: THLD) which is also up since I last profiled this $280 million market capitalization biotech company. Last week Threshold announced that its compound evofosfamide (also known as TH-302), in combination with another drug received Fast Track review from the FDA for treatment-naive patients with metastatic or locally advanced unresectable pancreatic cancer. In November, TH-302 received the same FDA designation for use against advanced soft tissue sarcoma.

It is nice to see Fibrocell’s main pipeline candidate start to gain traction and have multiple target indications. Threshold has a global license and co-development agreement for TH-302 with Merck KGaA. If either of these focus areas see solid phase III trial results, the stock of Threshold could soar.

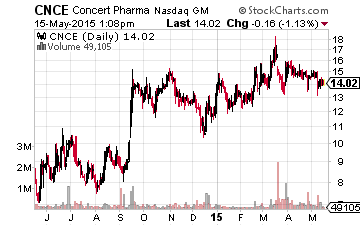

Our last selection is a small biotech concern I recently purchased called Concert Pharmaceuticals (NASDAQ: CNCE). The company uses a process called deuteration, where the hydrogen in carbon-hydrogen bonds is replaced with deuterium, a hydrogen isotope with an extra neutron in its atom to make existing drugs more effective. In theory, Deuteration helps the body breaks down a drug in the liver and gets it out of the system through the kidney. The process hopefully will give a targeted drug longer half-life, which means the compound will have more time to act against the targeted area. Although still an experimental process, a similar company called Auspex Pharmaceuticals (NASDAQ: ASPX) was recently bought out at a substantial premium by generic drug giant Teva Pharmaceuticals (NASDAQ: TEVA).

Our last selection is a small biotech concern I recently purchased called Concert Pharmaceuticals (NASDAQ: CNCE). The company uses a process called deuteration, where the hydrogen in carbon-hydrogen bonds is replaced with deuterium, a hydrogen isotope with an extra neutron in its atom to make existing drugs more effective. In theory, Deuteration helps the body breaks down a drug in the liver and gets it out of the system through the kidney. The process hopefully will give a targeted drug longer half-life, which means the compound will have more time to act against the targeted area. Although still an experimental process, a similar company called Auspex Pharmaceuticals (NASDAQ: ASPX) was recently bought out at a substantial premium by generic drug giant Teva Pharmaceuticals (NASDAQ: TEVA).

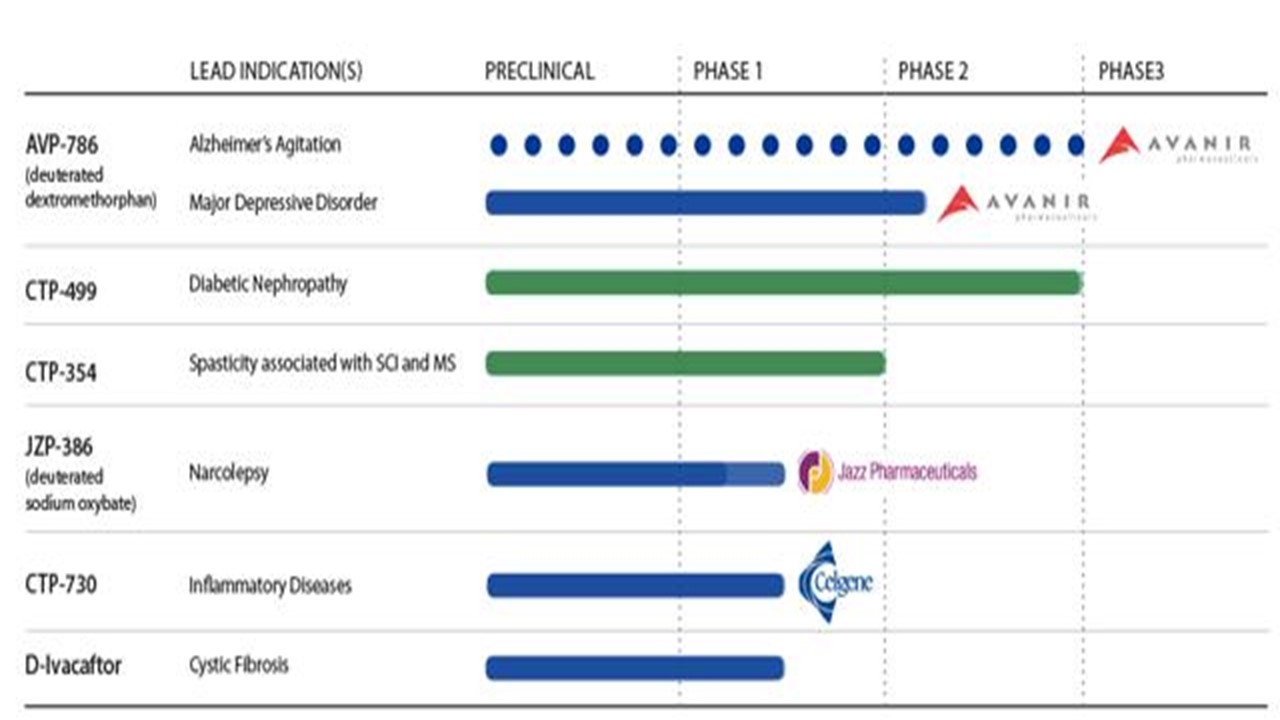

The company has a variety of compounds in development. More importantly, it has partnerships with some larger biotech firms such as Celgene (NASDAQ: CELG) and Jazz Pharmaceuticals (NASDAQ: JAZZ). It is also teaming up with Avanir Pharmaceuticals (NASDAQ: AVNR) for an upcoming Phase III trial on a compound to treat agitation within Alzheimers patients, which could be a significant catalyst if successful. Avanir was one of the inaugural selections in the Small Cap Gems portfolio when it launched in July of last year. Avanir provided a 215% return in five months and was bought out by a larger Japanese pharma concern in early December.

Concert goes for around $14.00 a share currently. Roth Capital reiterated its Buy rating and $22.00 a share price target on this $300 million market capitalization concern on May 8th. In addition, the company had a small stake in Auspex that is worth some $50 million after its recent buyout. The company also ended the first quarter with over $110 million in cash, cash equivalents and investments. Significant and progressing pipeline, numerous partnerships and a strong balance sheet: it is hard to not to like Concert’s prospects going forward. Concert presents at UBS Global Healthcare Conference on Tuesday and what analyst comments are forthcoming after the company’s presentation.

great ideas as usual..wonderful input..I am long many of your picks..we concur..the biotech landscape is fascinating..cheers Carol