US Consumer Is The Last Defense Against Strong Dollar Drag On The Economy

We continue to receive questions about the impact of the recent dollar strengthening on the US economy. The most immediate impact of course is on trade, which has created an immediate drag on the GDP growth.

Source: St Louis Fed, Goldman Sachs

We know that the impact on US industrial production in particular has been terrible.

On the other hand this currency appreciation, combined with weaker energy prices, is supposed to improve consumption as imports become cheaper.

The chart shows US import price index

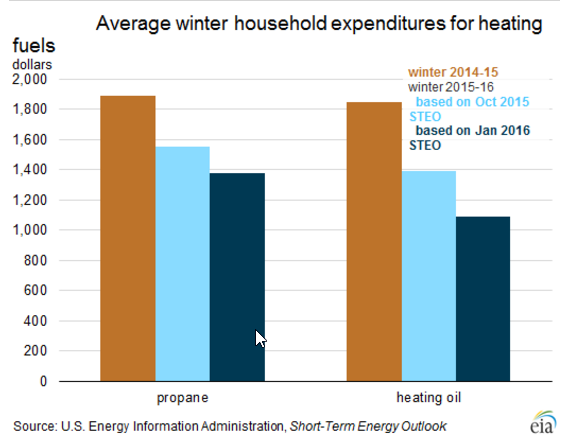

And of course all the cheap fuel (combined with a warmer winter) should be providing material support to US households.

US average gasoline price

Will that be enough to give US consumer spending a boost? Goldman outlines two potential scenarios, the second one of which leads to a contraction in US gross output.

Source: Goldman Sachs

The full impact of the US dollar rally thus depends very much on the behavior of the consumer in the months to come. From a balance sheet perspective US households certainly don't seem to be "stressed", as the Financial Obligations Ratio remains near multi-decade lows.

Source: @SoberLook, FRB

Moreover, high-frequency economic sentiment data, while showing some stock-market induced jitters, remains robust.

Source: Gallup

Whether this will translate into stable spending patterns remains a question. According to Gallup, at least through December, US consumer spending has been robust.

Source: Gallup

The equity markets however are now pricing in a much weaker discretionary spending pattern, while companies focused on staples seem to be doing much better. Note that much of the divergence has taken place this year. Is the market concerned about consumer retrenchment?

Source: Ycharts

The December GDP report (0.7% growth) showed that growth has already slowed as financial conditions tightened. Much of this tightening was driven by the US currency appreciation.

Source: @jbjakobsen

Consumer spending stability in the next few months is therefore critical. The strong US dollar has created a significant drag on economic activity in the US but economists are betting that the consumer tailwinds should support growth. If however the consumer (spooked by the sharp correction in the equity markets) retrenches, US growth could stall.

Sign up for Sober Look's daily newsletter called the Daily Shot. It's a quick graphical summary of topics covered ...

more