The Simple Math Behind Greece’s Complicated Situation

The Simple Math Behind Greece’s Complicated Situation

"Life is really simple, but we insist on making it complicated." - Confucius

Occam’s Razor is a frequently quoted principle which states that when one is faced with a multitude of seemingly complex possibilities, the simplest approach or explanation is best. As the ECB and Greece fight over terms of yet another bailout we employ this principle to help better grasp Greece’s dire situation.

The ratio of debt to GDP is one of the most basic and popular measures used to determine the ultimate ability of a sovereign nation to service its debt. Consider a country which has a debt to GDP ratio of 100%, and a balanced budget (excluding interest payments). In this country, it can be said that the interest rate on its debt and the growth rate of its GDP must be equal for the ratio to stay unchanged. In this example a 2% interest rate with a 1% GDP growth rate would result in an increase from 100% to 101% in the debt to GDP ratio. As the ratio rises above 100%, the interest rate must be lower than the GDP growth rate or the ratio will continue to rise. At a debt to GDP ratio of 150%, a 2% interest rate would require a 3% growth rate to remain stable at 150%.

Greece has a current debt to GDP ratio of 170%, and based on current bailout terms, it will likely grow to well over 200%. So applying the logic from above, Greece’s GDP growth rate prior to the current bailout needed to be 1.70 times greater than the rate of interest Greece pays on its debt just to keep its ratio constant. Following are some facts which will allow us make judgments on Greece’s ability to improve or at least sustain its debt to GDP ratio:

Since 1970 Greece’s best 5-year annualized GDP growth rate was +1.50% with an average of +.46%. Over the past 10 years growth has averaged -0.50%.

Since 1997 Greece’s lowest 5-year average interest rate on 10 year bonds was 3.41% with an average of 7.50%. Over the past 10 years the average annual 10 year interest rate was 8.16%

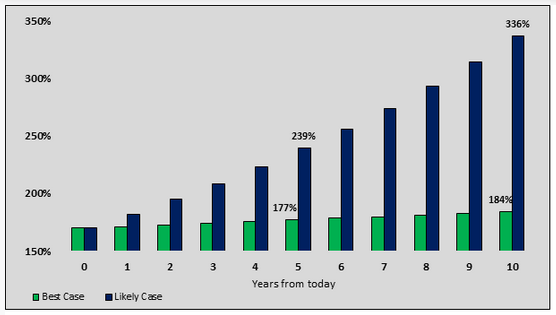

Using Greece’s current debt to GDP ratio as summarized above, we present a best case forecast and a likely forecast for debt to GDP over the ensuing 10 years. For the best case we assumed Greece’s highest 1 year GDP growth rate (+2.74%) and lowest interest rate (3.58%). The likely case uses Greece’s average 1 year GDP growth rate (+0.45%) and average interest rate (7.55%). In both examples we make the very bold assumption that Greece will run a balanced budget excluding interest expense. The results, as plotted below, are not encouraging.

Debt to GDP Scenarios

Data Courtesy: St. Louis Federal Reserve (FRED) and Bloomberg

Greek credit default swaps (CDS) and bonds have rallied sharply on hopes that a bailout will help Greece avoid default. We believe the current terms simply delay the inevitable. In the scenarios above we were very generous with the assumption that Greece will run a balanced budget. Consider that since 1990, Greece has averaged a total budget deficit equal to 8.17% of GDP and has never run a surplus going back to at least 1990.

One of the goals of the current round of negotiations are structural reforms designed to help Greece reverse its troubling debt to GDP ratio. Reforms are imperative if Greece is to ever become economically viable. That said, reforms are widely unpopular, take time to enact and take even longer to show results. We believe default, or the politically correct term “debt forgiveness”, is the most likely outcome. When combined with reforms, Default is the only option which leaves Greece with a fighting chance to avoid being in the same situation a few years from now. The CDS and bond markets are likely over-reacting today as they did with the prior bailouts of 2011 and 2012.

Disclosure: None.

720 Global is an investment consultant, specializing in macroeconomic research, valuations, asset allocation, and risk management. Our objective is to provide ...

more

Sorry for my mistake as to the date of the treaties of Rome in a previous message. They were signed in Rome in 1957, not as in the previous message.

relax and cool down dear fellows,

Here in Greece it's still summer the sun shines and there is nothing to worry about debt since it's inevitable. Stop trying to model and forecast it's evolution as if Greece is a single country who decides for it's destiny, because in fact this is a part of the European Union and the degrees of freedom are much greater than simple maths given here...

Instead and before doing any maths you have to make decision in what context you define your problem. Just compare the greek debt to the EU GDP and you will recognize why this is a political problem that one way (United States of Europe) or the other (bye bye lazy Greeks, PIGS, etc.) will be solve.

i like hearing the word greece.

Reminds me of constantin demiris and noelle page and catherine alexander.

And michael douglas and the athens court where noelle page was tried.

These guys should talk to sydney sheldon to to bail them out.

Guy must have made millions with their rich nice greek history

i am sorry. Still not clear why greece is in debt.

Loading comments, please wait...