How To Get Your Tax Weekend Back

This weekend millions of Americans and/or their accountants are preparing to file income tax returns. Tax day is an annual event as significant as the Fourth of July – though far less fun.

Photo: Getty Images

My friends outside the US – and I have many – observe our ordeal with a combination of amusement and pity. They don’t like taxes either, and often pay far more than we do. But their governments, for the most part, don’t put people through such torture every year. They appear to have found better ways. Why can’t we?

Today we’re going to look at who wins and who loses under the new tax law. I think many of you will be surprised.

Bearing the Burden

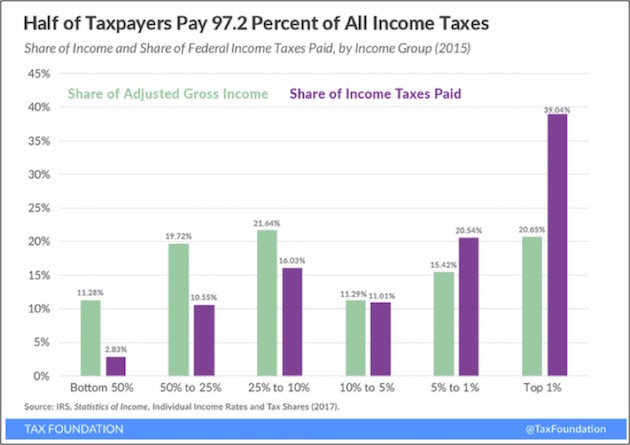

Each year the IRS releases aggregate data on individual income taxes, with a two-year delay. The Tax Foundation helpfully organizes the reports, and in January they released their summary of the data for 2015. We will look at estimates for this year in just a bit.

In 2015, 141.2 million taxpayers reported a total of $10.14 trillion in adjusted gross income (AGI). On this amount, they paid $1.45 trillion in taxes, or 14.3%. That’s our collective average tax rate, in other words. But we know averages can be deceiving, and this one certainly is. Most people paid well below that rate, and a small number paid a great deal more.

We’ll start at the bottom. The lower half of those 141.2 million tax filers had total AGI of $1.145 trillion, or about 11.3% of all income. On this, they paid $41.1 billion in taxes. Their average tax rate was 3.5%, and they paid 2.8% of all taxes.

Note, that’s the lower half of taxpayers – meaning they filed tax returns. There’s a large group below them who didn’t have to file because they had no taxable income. So well over half the population either paid no income tax at all or paid a very low percentage rate.

Jealous? You shouldn’t be. Do the math and you’ll see the average AGI for this bottom half of taxpayers was only $16,211. These are not wealthy people. Literally, housing and food and other basics are critical issues for them. Most were employed in some way for at least part of 2015, since they have income, but they didn’t make much. The system is designed to give them a break on taxes, and it worked.

At the same time, this income inequality has a frustrating consequence: the other half of taxpayers bear almost the entire burden. Note that the top 10% pay 70% of income taxes. The top 50% pay 97%.

The bottom 50% earn 11.3% of the adjusted gross income and pay 2.8% of the income taxes. The top 50% have 88.7% of the AGI and pay 97.2% of the taxes. That’s why we call the system “progressive.” By design, it gives those at the bottom a lower rate.

In fact, it favors more than just that bottom half. As the chart shows, everyone except the top 5% pays a lower share of the total income taxes than their share of total income. That’s not necessarily true of every taxpayer, since these are averages, but it’s certainly true for most. The top 1%, which we are often told gets wildly favorable treatment, doesn’t look so lucky by this measure. It only received 20.65% of the income but paid almost 40% of the taxes.

Let me point out again, this tax structure is not an accident. The tax system is designed to produce this result. The public wants the wealthiest Americans to pay a higher percentage of their income, and they do. Provisions that reduce taxes for the middle and lower classes mean those in the top brackets pay more.

Some caveats on this data: It omits payroll taxes, which for those on the lower end are often higher than the income tax. Wealthier people also have more ability to shift income into favorable categories. But in the aggregate, they still pay higher rates on more income than majority of the population does. We have a highly progressive income tax system by any fair definition. The share of tax paid by the top 20% of Americans also changes when social-insurance levies are included. It drops to about 67% of total federal income taxes paid from roughly 87%. (WSJ)

The “Tax Cut Act” Increased Taxes for the Rich

Changes in the recent tax bill will make the system even more progressive starting this year. You would never know that if you read the media, which seems to think that the tax bill was a panacea for the rich. Wealthy people in high-tax states will certainly have to pay more. But that’s the responsibility of those state governments, some of which seem intent on driving out their best revenue sources.

Laura Saunders, writing for the Wall Street Journal, uses analysis from the nonpartisan Tax Policy Center to demonstrate that the very top earners will now pay an even higher percentage of overall taxes. The top 1% go from paying 38% of total income taxes to a little over 43%.

According to Saunders,

The results show how steeply progressive the U.S. income tax remains. For 2018, households in the top 20% will have income of about $150,000 or more and 52% of total income, about the same as in 2017. But they will pay about 87% of income taxes, up from about 84% last year.

By contrast, the lower 60% of households, who have income up to about $86,000, receive about 27% of income. As a group, this tier will pay no net federal income tax in 2018 vs. 2% of it last year.

After the income tax, the most important revenue raisers are for social insurance, such as Social Security and Medicare. They will provide about 34% of the total tax take this year, according to the Joint Committee on Taxation. Corporate taxes will account for 7% of revenue, down from 9% in 2017. The rest of the total comes from excise taxes, estate and gift taxes, and other sources such as customs duties.

Roughly one million households in the top 1% will pay for 43% of income tax, up from 38% in 2017. These filers earn above about $730,000.

According to Roberton Williams, an income-tax specialist with the Tax Policy Center, the share of taxes paid by the top 5% will rise despite the fact that people in it were the largest beneficiaries of the overhaul’s tax cut, both in dollars and percentages.

Why are income taxes negative for the 77 million households in the bottom two tiers, which earn 13% of income? In recent decades Congress has chosen to funnel benefits for lower earners through the income tax rather than other channels such as federal programs. Some of these, such as the earned-income tax credit for the low-income workers, make cash payments to filers who don’t owe income tax.

The tax overhaul further lowered the share of income tax for people in these tiers, in part because it nearly doubled the standard deduction and expanded the tax credit for children under the age of 17.

People in the lower tiers do owe other federal taxes, such as for Social Security and Medicare. If these tax payments are included, their share of federal taxes paid turns positive.

Losing Your Deductions

In order to pay for the tax cuts on corporations and the lower income tiers of the country, the Republican Congress had to scramble to find additional sources of revenue in order for the new tax plan not to increase the deficit more than it did. And they found some of that revenue by taking away deductions. There are literally scores of smaller deductions that you were previously able to itemize that will not be available in 2018, or 2019 at the latest. Let’s look at just some of the bigger ones.

1. Everybody knows that state and local income taxes (SALT) will no longer be completely deductible. You will be allowed to deduct only up to $10,000. That is especially painful for people living in states with high income taxes and/or property taxes. And while Texas and other low-tax states don’t have an income tax, local governments are financed by property taxes that are typically higher than those of a lot of states. There are just six states that don’t have an income tax. The darker blue your state is in the following chart, the higher your total state income taxes are and the more pain you will feel.

2. Starting in 2018, homeowners can take a mortgage interest deduction on a loan of up to $750,000, down from the current limit of $1 million. When the median home in California is $480,000, a lot of homeowners are going to have mortgages in excess of $750,000.

3. I am not certain what Congress was thinking, but they took away the deduction for personal disaster losses. Now you can take deductions on personal losses if those losses amount to more than 10% of your income. In the future, you can deduct those losses only if the president declares their cause a national disaster. So you would more than likely be able to deduct losses from a hurricane or earthquake, but if your home were destroyed in a flood not associated with a larger disaster, you would not be able to take a deduction for your loss. The same thing goes for a fire. Or for vandalism. This provision makes me wants to throw the yellow flag for piling pain on top of more pain.

4. Today, if you move more than 50 miles for a new job, you can deduct reasonable moving costs. Starting this year you can’t.

5. Divorces are never fun or easy. They tend to cost a lot of money, on top of the emotional toll they take. Under current law, alimony is deductible by the former spouse making payments and is included as income to the recipient. In the new bill, however, these payments are no longer deductible by the payor. Nor are the payments included in the recipient’s gross income. Instead, the person getting the alimony has to pay taxes at the rate paid by the person paying the alimony. And since it’s usually the man who makes more money and pays the alimony, the woman will get taxed at the man’s tax rate. No matter what her actual income is. Ouch. This provision is effective for divorce and separation agreements signed after Dec. 31, 2018. (CNBC)

6. A Bloomberg article highlights the fact that business deductions for meals may be going away. Yes, corporations get a reduced tax rate, but essentially, the new law says that entertainment expenses are not deductible. Business lunches are entertainment and not deductible.

Ah, I remember the days when you could deduct 100% of your meals and entertainment. Yes, I know that during the Reagan years the top rate was 70%. But no one paid that. There were so many loopholes and deductions that my effective rate was much lower than it is today.

The problem is, there is a great deal of confusion over what might count as a deductible expense. If an expense is considered entertainment, it is not deductible. If you think that change is not going to make a difference in the revenues of high-end restaurants, you’re not paying attention. I don’t think the change affects Chipotle or McDonald’s much – they’re not exactly business-meal destinations. There are always consequences to tax rules, but I think some of the unintended consequences are going to be more painful than people currently think. Corporate accountants are going to strictly limit the ability of their employees to take their clients out to dinner.

7. The Republican Congress has spent a great deal of its time patting itself on the back over the 20% tax break on pass-through tax corporations. The thought was that they were helping small businesses to keep even with the big players who got most of the corporate tax cuts.

Well, not so much. It turns out that a lot of us with pass-through corporations don’t qualify, and if you are a modern business with lots of contract labor instead of actual W-2 employees, you don’t qualify either. Why do doctors not get a tax break but architects do? You would think a restaurant owner would qualify. Not necessarily. If you advertise the best pie or steak in your area, you may lose your tax exemption. Seriously. Who writes these rules? This cute infographic from Bloomberg illustrates part of the problem. No one really knows who qualifies for what.

8. Lots of “little” things (unless of course they are your deductions, and then they become big) are no longer deductible. Companies have been able to subsidize commuting and parking expenses and deduct them. No more. And that $20 a month subsidy you got for commuting to work on a bicycle goes away.

You can no longer deduct your cost for preparing taxes under the new tax plan, and if you do your own taxes, you can’t deduct the cost for the software.

No more deductions for the commissions you pay your agent or your manager or even for your union dues. Hollywood actors and professional athletes are not going to be happy about that first part. If you’re an actor, you no longer get to deduct your audition travel expenses or acting lessons, either.

And while the new tax law nearly doubles the standard deduction for married couples and singles, up to $24,000 and $12,000 respectively, you do lose your personal exemptions. Many families with multiple children will feel that loss of exemptions keenly. I can tell you from personal experience that having more than two kids is expensive. But then again, lower-income families get an enhanced child tax credit.

And my personal pet peeve: You can’t buy sporting tickets and give them to clients and claim them as a business expense. I don’t imagine that Mark Cuban and Jerry Jones here in Dallas or any other professional team owner will be happy. That change has got to leave a nasty mark on their corporate sales. And it’s not just professional sports. I have a number of friends who are college sports fanatics, and they had ways to make their ticket purchases a charitable deduction or a business expense. And they loved to use the tickets as a business perk. Now that’s gone, gone.

Some people were able to itemize their investment management and consulting fees, tax-preparation fees, unreimbursed employee expenses, and certain hobby expenses. Gone as well.

To be fair, there are a number of really good portions of this bill. As noted above, the increase in the personal deductions will mean that fewer people on the lower income scale will pay any taxes at all. Also, the lifetime state tax exemption doubled to $11.2 million for individuals and $22 million for married couples.

And with that I’m going to stop talking about taxes, even though I could easily write at least three or four times more than I have, and will probably get back to some of the other details later.

Disclaimer: The Mauldin Economics website, Yield Shark, Thoughts from the Frontline, Patrick Cox’s Tech Digest, Outside the Box, Over My Shoulder, World Money Analyst, Street Freak, Just One ...

more