First Half Of 2018 To See Weak Economic Growth

Stocks Decline Over Trade War Fears

The Dow had the worst day of the major indexes as it fell 1%. It underperformed because Boeing fell 2.5%. Boeing is a high priced stock which matters in the price weighted Dow. The S&P 500 was down 0.57% as it makes its way back to the mid point of the recent range. Boeing fell because investors were worried that China would target the company in retaliation to the American tariffs. If you are a long term investor who doesn’t believe the hype about a trade war, you are getting a gift to buy Boeing at these levels.

It’s very interesting that consumer staples were down 1.27% and consumer discretionary was down only 0.2%. I would expect consumer discretionary stocks to fall more because of the weak retail sales results. Utilities were up 0.97% and real estate was up 0.10%. This trade is occurring because yields are falling. The financials fell 1.2% as the yield curve flattened and the economy looks weak. The VIX was up 5.38% to 17.23. When the VIX is at 16, it implies a 1% move in the S&P 500 every day. I expect volatility to decline in the next few days. The biggest risk is tariffs. This is a headline driven market for the near term as news from the White House comes fast and furious. The latest news is that Larry Kudlow was picked as Trump’s Chief Economic adviser. Kudlow is a free trader; it will be interesting to see if he has any sway with lowering the tariffs. It’s important to recognize that the U.S. has very low tariffs. The countries threatening retaliation already have high tariffs. It’s possible that there aren’t retaliatory measures when the dust settles.

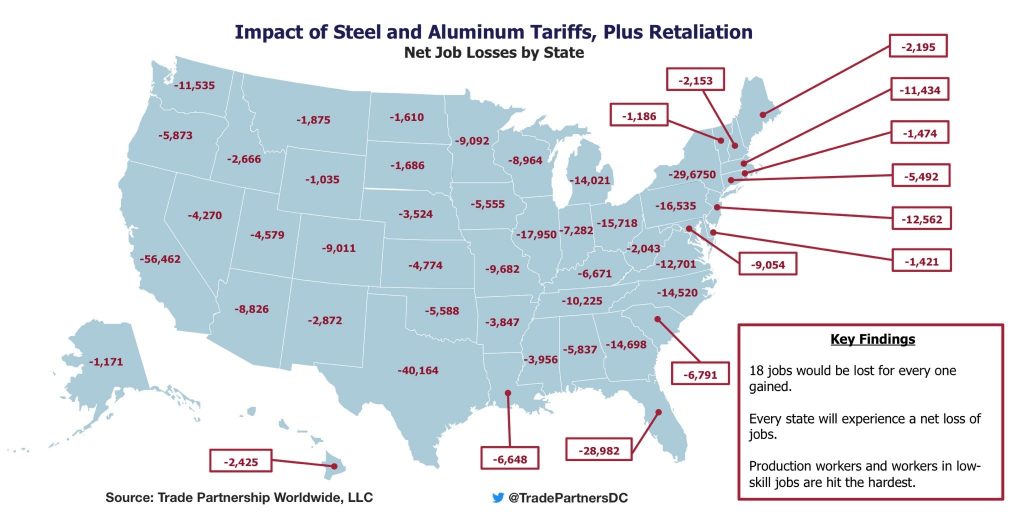

The chart below shows one analysis done on the effects of the steel and aluminum tariffs with Australia, Mexico, and Canada excluded. As you can see, 18 jobs are lost for every one gained. Clearly, this tariff is bad for employment, costs, and the consumer. Every state will lose jobs. In total, the net job losses will be 470,000. In the current economy, that doesn’t seem like something that could cause a recession, but it’s certainly worth monitoring. A trade war with China would cause a recession.

(Click on image to enlarge)

Cyclical Downturn Coming

The economy will slow in the first half of 2018 as the the hurricane rebuilding will no longer provide demand. The ECRI report did a great job of forecasting this recent slowdown. As you can see from the chart below, the leading index fell from March 2017 to September 2017. That decline is working through the economy now. The good news is the economy won’t get as weak as it was in 2016. A rebound similar to the 2nd half of 2017 will occur in Q3 if this is right. As you can see, it has been falling for the past few weeks. My worry is that this downtrend may be the one which signals a recession. At this pace, the growth rate could fall to negative in a few months, signaling a recession in 2019. I’m getting ahead of myself with this example, but the recent month of results certainly are disconcerting.

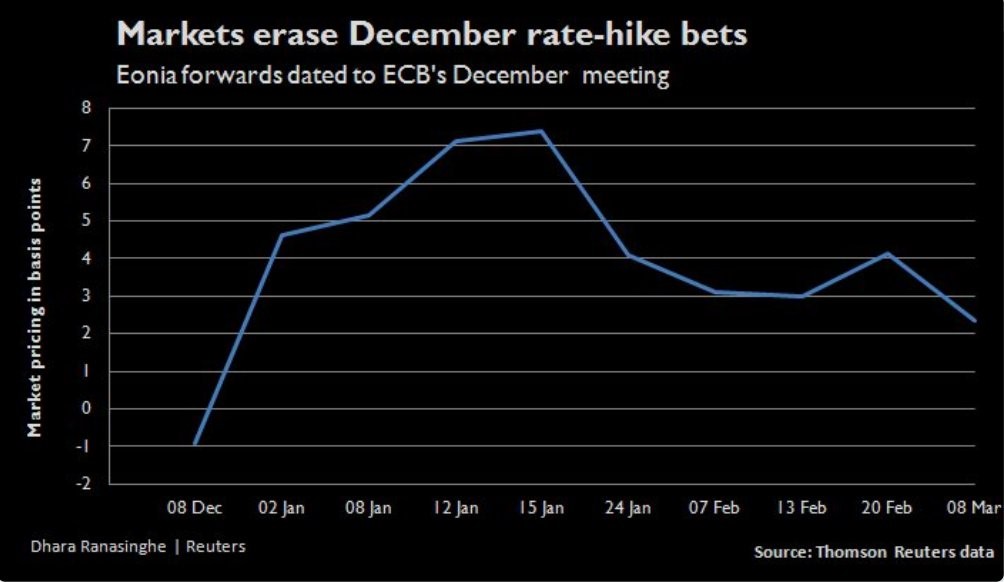

ECB Rate Hike In 2018 Is Gone

Earlier in the year investors were optimistic on inflation in Europe, but that has quickly faded like in the U.S. The ECB’s recent dovish tone led the market to remove the chance of a 10 basis point hike in December of this year. As you can see from the chart below, the chance of a 10 basis point hike was about 75% in mid-January. Now it has fallen to about 25%. Instead, the ECB is now expected to hike rates in March 2019 as the odds for that hike are 80%. Economists expect the ECB to hike rates 15 basis points in Q2 of 2019 and 25 basis points by the end of the year, taking the deposit rate from -0.40% to 0%. Clearly, the ECB isn’t concerned about what it will do in the next recession. The Fed is getting hawkish because it is afraid of getting to the point where it can barely cut rates in the next recession.

Based on precedent alone, the ECB has more flexibility than the Fed because it can buy corporate bonds and cut rates below zero. However, there is a limit to the bond buying and the level rates can be cut below zero. It’s not obvious where that level is, but it seems impossible to imagine rates getting to -4%, for example. Draghi is worried about the current low inflation rate as he expects inflation to be at 1.5% this year and only get to 1.7% in 2020. The ECB is caught because if it hikes rates too quickly, inflation will fall further below the target. The ECB is trying to create an environment where the small inflation flame can grow into a camp fire. Rate hikes would be like putting water on the fire. However, it’s disconcerting that the ECB is going to have a 0% deposit rate heading into 2020 because that’s the year I expect a recession in America. It’s amazing that central bank policy still hasn’t normalized after such a long expansion.

(Click on image to enlarge)

Conclusion

With the latest weak economic results, it looks like the first half of the year won’t have great GDP growth. Add in the potential for tariffs to slow down the economy and a potential trade war and you have a range bound market rather than a market in an uptrend. If the Fed gets too aggressive, we could see a bear market. I don’t think those negatives are all going to happen; economic growth may pick up later in the year. Even with the tax cut boosting earnings growth, a 20% return in the S&P 500 like last year is highly improbable.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more