Fed To Announce Unwind In September?

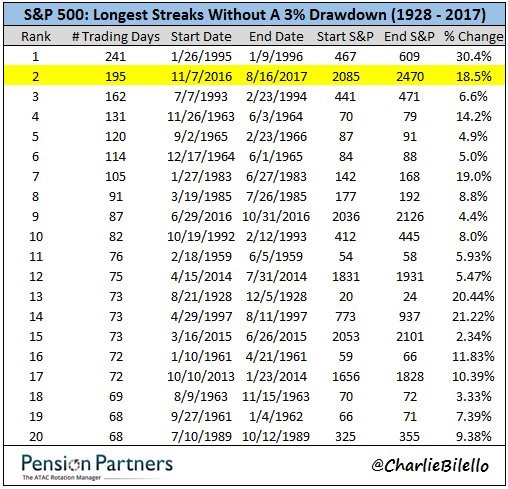

The North Korean fears are gone from the market completely as the stock market digests the great earnings reports and great economic reports. I can not think of a better scenario for stocks as we have a dovish Fed, U.S. growth accelerating, record corporate profits, regulation cuts, and emerging market growth. The stock market rallied slightly on Wednesday as the S&P 500 was up 0.14%. That means it’s only 0.38% off the record close. Not even the threat of a nuclear war could give us a 2% selloff. I’ve talked a lot about the lack of a 5% correction, but what’s even more impressive is the chart below.

As you can see, there has been 195 trading days without even a 3% correction. The chart below shows this is the second longest streak since 1928. The longest streak at the end of the 1920s bull market was 73 days where the S&P rose 20.44%. The longest streak in the 1990s bull market was 241 days where the market rose 30.4%. This lack of volatility is consistent with the valuations as we are near the 1929 Shiller PE and below the 1990s Shiller PE. I don’t think the market will hit a record because the debt ceiling and the Fed’s unwind might cause a 3% drop. Anyone who has been investing for longer than 8 years is probably flummoxed by this market as it feels like a dream. While the fundamentals in the intermediate term are sound, it’s still weird to see a market that doesn’t fall.

For the rest of this article, we will discuss the FOMC Minutes which were released on Wednesday from the July Fed meeting. There were two takeaways from the meeting. The first was the fact that the Fed will likely announce the timing of the start of the unwind in September. The minutes read: "Participants generally agreed that, in light of their current assessment of economic conditions and the outlook, it was appropriate to signal that implementation of the program likely would begin relatively soon, absent significant adverse developments in the economy or in financial markets. Many noted that the program was expected to contribute only modestly to the reduction in policy accommodation."

As you can tell, the base case expectation is for an announcement of a start date in September. The only way this will change is if the Fed makes a change in policy at the Jackson Hole summit next week. There would need to be a sharp change in the economy for that to happen. That’s almost impossible at this stage. The biggest question left outstanding is what the announcement will be. It’s possible the Fed could announce the unwind will start in September or October. My expectation has always been for an October start, but a few weeks earlier or later doesn’t really matter. It’s probably going to be soon because it’s not like this is the first ever discussion of an unwind.

The Fed has pre-announced the September announcement in every meeting for the past few months. It’s debatable the Fed needs to announce it at all now that the market is ready for it to occur in the fall. The other notable point was that the Fed said this is only a modest contribution to the reduction in monetary accommodation. This is correct because the halting of QE was a bigger deal. However, every action is big in a policy scenario where the Fed can’t even raise rates 75 basis points in a year where the labor market is as strong as it will ever be and the stock market is up over 10%.

The second takeaway was that there are contentions among Fed officials about the third rate hike this year. It used to be just Neel Kashkari who was against rate hikes, but now he has a few more officials on his side because of the disinflationary trend which has been going on for most of this year. On this concern about disinflation, the minutes stated: "Some participants" who counseled patience expressed "concern about the recent decline in inflation could afford to be patient under current circumstances." They "argued against additional adjustments" until the central bank was sure that inflation was on track.

Kashkari didn’t have anyone in his dovish camp because he was worried about wage growth. The reason his camp has expanded is because of changes to overall inflation. On the other side, the issue of potential wage inflation is what spooks the hawks and makes them want to raise rates. They are "worried about risks arising from a labor market that had already reached full employment and was projected to tighten further." They think the Fed can overshoot its unemployment target by keeping rates too low. That’s a misguided point, in my opinion. The risk isn’t that a few more people get jobs than expected. This risk is runaway wage inflation. The unemployment rate is implying we are getting more wage growth than we really are seeing. That means that an overshoot isn’t a big deal until it leads to inflation.

If I was a dove on the FOMC, I would tell the hawks to alter their models before coming up with policy prescriptions because they have been completely wrong on inflation this year. Currently, the chances of a rate hike are 50%. The data will guide the decision. I expect strong economic data this fall and a slight improvement in inflation. That would boost the odds of a rate hike.

Conclusion

Advocating for a rate hike in December is still dovish compared to the Taylor Rule. If you don’t advocate for 3 more rate hikes this year, as crazy as it sounds, you are a dove. The Fed is filled with doves, the economy is strong, and earnings are strong. That’s why the stock market hasn’t had a 3% correction in seemingly forever. I don’t this streak is a bad signal. It’s representative of the good situation we are in. The new saying on Wall Street is buy the micro dip because 5% corrections have become obsolete.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial adviser, ...

more