Fed Remains On Track To Raise Rates Again In September

The recent turmoil in emerging markets hasn’t deterred the Federal Reserve from lifting interest rates at next month’s monetary policy meeting, according to analysts, Fed funds futures, and the recent trend in inflation-adjusted base money supply.

A handful pundits still wonder whether the escalating financial crisis in Turkey, which has weighed on stocks and bonds in emerging markets generally, could be a factor in delaying and perhaps even derailing the Fed’s plans for squeezing monetary policy. A possible trigger: a further deterioration in economic conditions in emerging markets in the wake of Turkey’s recent troubles.

“The risk of contagion is pretty high,” warns Robert Subbaraman, an emerging market economist at Nomura in Singapore.

But by one analyst’s reckoning, Turkey’s problems are a minor issue at most for US policy, at least for now.

“If you look at how Turkey is affecting US financial conditions, at the moment you barely see it,” observed Roberto Perli, a partner at Cornerstone Macro and a former Fed Board economist, earlier this week.

The futures markets for Fed funds agrees. As of this morning, the crowd’s pricing in a 96% probability that the central bank will raise its target rate 25 basis points to a 2.0%-to-2.25% range, based on CME data.

Raghuram Rajan, former governor of the Reserve Bank of India and a widely followed monetary analyst, told CNBC yesterday that the Fed isn’t likely to cease and desist with policy tightening. “In 2013, when we had the last bout of volatility, the Fed stayed off raising interest rate for some time. It is not clear it can do that right now because we have inflation numbers in the U.S. gaining strength.”

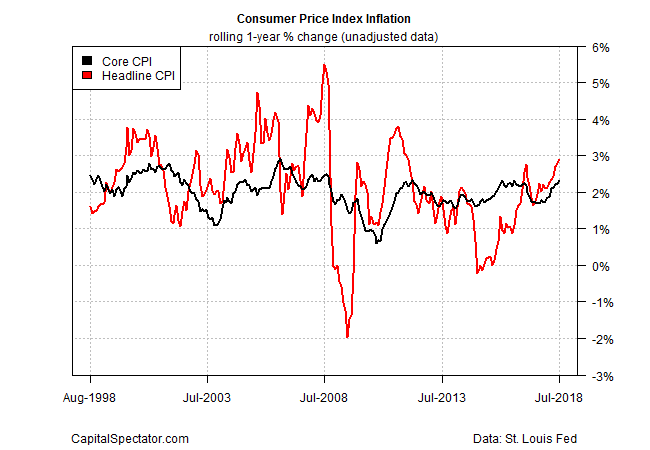

Headline consumer inflation ticked up to a 2.95% year-over-year pace in July, the strongest rise since 2011, based on unadjusted numbers for the consumer price index (CPI). Core CPI (less food and energy) is trending higher, too, increasing 2.35% last month vs. the year-ago level – the biggest jump since 2008.

Meanwhile, the negative trend in real M0 rolls on. Last month marked the fifth straight month of negative year-over-year comparisons, signaling that the Fed’s policy stance continues to favor tightening. (Recall that the real annual trend for the Fed’s narrowest gauge of money supply — also known as base money or high-powered money — offered an early sign in 2015 that the Fed was moving toward hiking interest rates for the first time in nearly a decade. Later that year, in December, the central bank announced that it was raising the target range for the federal funds rate. The central bank has increased rates several times since then.)

The upbeat economic profile for the US is another factor. Recession risk has remained low recently and expectations for more of the same prevail. Consider yesterday’s update of the Atlanta Fed’s GDPNow model, for instance: the outlook for growth in the third quarter ticked up to a strong 4.3% pace (seasonally adjusted annual rate), building on Q2’s solid 4.1% gain.

Softer growth and weaker inflation could change the calculus, of course. The escalating trade war with China may be a headwind that convinces the central bank to reconsider its policy path at some point.

“If you have a situation where tariffs have a significant enough knock-on effect and real growth is impacted in a sustainable way, it’s a prescription for them to [follow a] shallower path for the funds rate,” advises Jacob Oubina, senior US economist at RBC Capital Markets.

In fact, yesterday’s survey of economists via CNBC and Moody’s Analytics reveals that human analysts are lowering expectations with a 3.3% nowcast for Q3. That’s still a healthy pace, but it marks a sizable deceleration from Q2.

Even if the survey data is right still leaves plenty of room for the Fed to lift rates again. The potential for trouble can’t be dismissed, of course. But short of a run of worrisome incoming numbers in the days ahead – or a further deterioration in Turkey’s crisis that infects other countries — the Fed still appears committed to its slow-but-steady tightening path.

Disclosure: None.