Despite Continuing Low Inflation, The U.S. Has Begun To Normalize Its Monetary Policy

“A decade after the onset of the global financial crisis, it seems more than appropriate for central bankers to move the levers of policy off their emergency settings. A world in recovery – no matter how anemic it may be – does not require a crisis-like approach to monetary policy.”

(Stephen S. Roach, The Courage To Normalize Monetary Policy, Project Syndicate, Sept. 26, 2017)

In the wake of the severe 2008-09 economic downturn there was widespread fear that an international financial collapse was imminent, and that the ordinary policy tools (fiscal support and bail outs) would be incapable of stopping the hemorrhage.

Confidence in the financial markets had to be restored and the major central banks, led by the U.S. Fed, implemented a series of unconventional monetary policy measures. The new measures included zero interest rates, massive purchases of financial assets including private sector debt, and the introduction of formal quantitative easing (QE) policies.

The large central banks (the Federal Reserve, the Bank of England, the European Central Bank and the Bank of Japan) all quickly lowered their interest rates to zero which also resulted in massive balance sheet expansions.

Now the major central banks are starting to normalize conditions, or at least plan to start the normalization process,

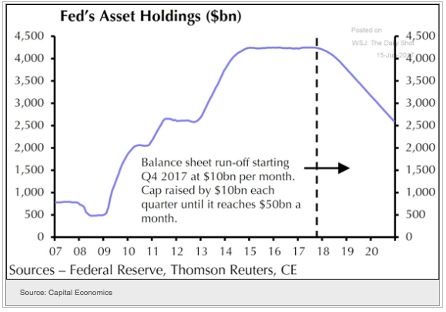

The US Fed has already raised interest rates twice and has scheduled a slow process of shrinking its balance sheet.

The Bank of England and the European Central Bank (ECB) are both hinting at this new direction.

The Bank of Canada has also begun to tighten monetary policy, and has raised its policy rates 50 basis points over the last couple of months. Ironically, the Canadian tightening has coincided with an actual easing of financial conditions.

The U.S. Fed stopped expanding its balance sheet in October 2014, and more or less left it at $4.5 trillion until recently. According to recent data, the Fed balance sheet consists of $2.5 trillion in treasuries and $1.8 trillion in mortgage-backed securities.

The FOMC (the policy committee of the Fed) decided to begin reducing its $4.5 trillion balance sheet as of October of 2017. The Fed’s approach will be very cautious and will simply take place by allowing some of the maturing assets not to be repurchased.

At the Fed’s June policy meeting, the committee indicated that once the balance sheet tapering begins, it would start by letting $6 billion a month of maturing Treasuries run off, which would slowly increase to $30 billion over the coming months. With regards to agency debt and Mortgage-Backed Securities (MBS), the Fed laid out a similar approach where it will begin the tapering at $4 billion a month until it reaches a total of $20 billion.

Thus, the tapering (i.e. or overall shrinkage) will amount to $30 billion in assets in Q4 of 2017 gradually increasing to $50 billion as of the fourth quarter of 2018.

Assuming tapering holds at $50 billion per quarter into 2019, the Fed’s balance sheet would drop below $3 trillion in 2020 at which point the next discussion will be how big should the Fed's balance sheet remain once tapering is over.

It is rather unlikely that even with further shrinking of its assets, that the Fed would ever return to its pre-crisis balance sheet level of less than a trillion dollars.

Clearly, unwinding the $4.5 trillion-dollar balance sheet is a delicate task. Only time will tell how this all turns out.

Disclosure: None.