Consumer Confidence Soaring But Spending Growth Is Modest

Consumer Confidence Irrelevant

Many bearish investors have used the heightened consumer confidence reports to justify their negativity. They want to fade the optimism because when euphoria occurs, it’s usually followed by despair. I certainly agree with this mindset when it comes to the consumer’s opinion on the stock market over the next year. We saw stocks rally in record breaking fashion. That simply confirmed the euphoria consumers felt. It was easy to see why you should fade the consumer in that instance. However, when it comes to consumer confidence the bearish argument may be wrong.

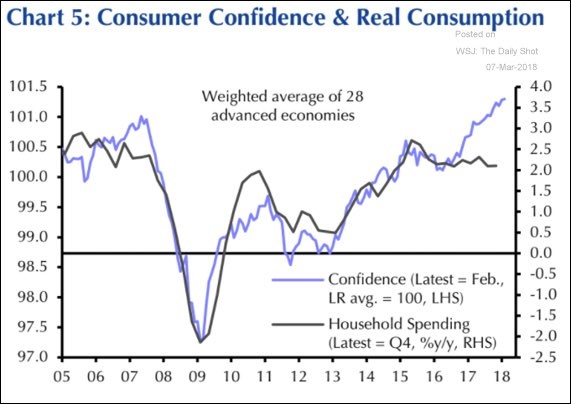

As you can see from the chart below, the consumer confidence has increased dramatically while consumer spending growth has stagnated. The consumer confidence numbers have become politicized as there has been a record number of consumers, who when they are being polled, give unprovoked positive stats on the economy. Therefore, it makes sense to ignore the consumer confidence figure rather than fade it. If consumers aren’t accurately telling pollsters about their spending, then this data is useless.

The chart is enlightening because the divergence only started in the past 12 months. This is an example of an indicator losing its influence over time. There will never be a perfect indicator which will always tell you where stocks and the economy will go. It’s best to always be vigilant. We’re lucky to see this information because we now know not to be bearish on the medium term. We also shouldn’t expect consumer spending to perk up in the next few months based on the optimism. Obviously, the tax cut could help consumer spending, but just make sure not to cite confidence as justification for this thesis.

An Indicator Which Uses Consumer Confidence

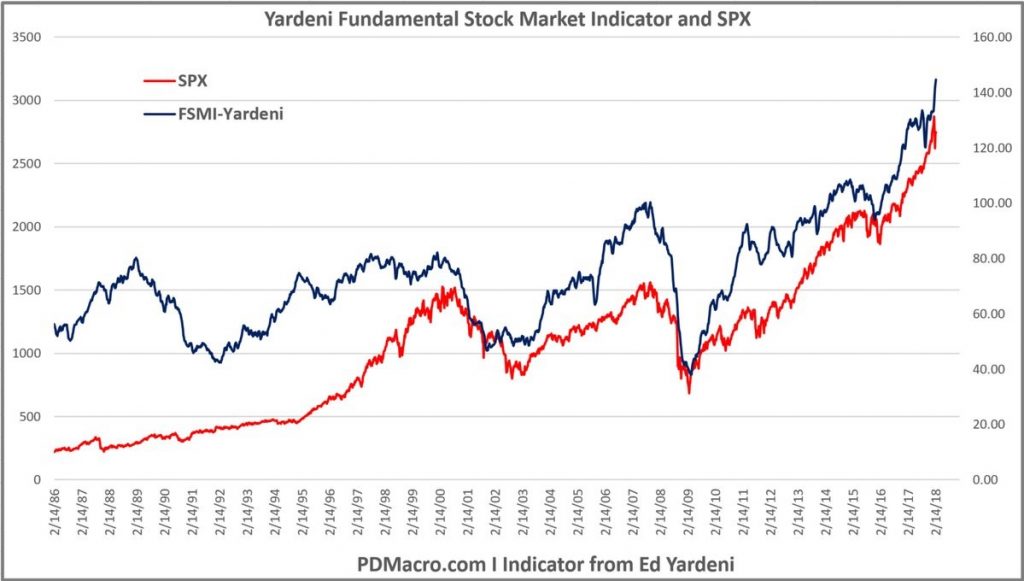

It’s obvious that the data is skewed when you look at the consumer confidence polls. However, many economic metrics also use this indicator which means it’s hidden. The chart below shows Yardeni’s fundamental stock market indicator compared with the S&P 500. The indicator includes consumer sentiment. It also includes the jobless claims report which has become less useful than the past because it is at a record low on a population adjusted basis even though the labor market isn’t at full employment. To be clear, I’m not saying that the stock market shouldn’t go higher. I’m saying that this indicator is using flawed data. I actually agree with its prediction; I just disagree with its method.

(Click on image to enlarge)

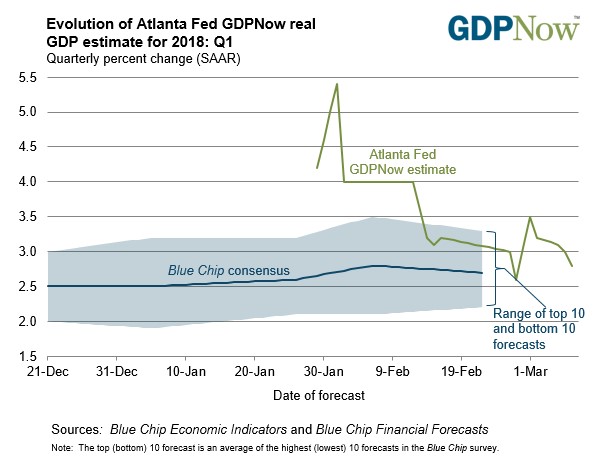

GDP Now Is At 2.8% Growth

This consumer spending discussion is important because the Atlanta Fed GDP Now forecast for real GDP growth in Q1 recently fell from 3.5% to 2.8% because it lowered its consumer spending and real non-residential equipment investment growth estimates from 2.9% and 10.1% to 2.6% and 6.9% respectively. The decline is the result of the weak lightweight vehicle sales report. The latest sales report for February was 16.961 million units which is down from the previous month’s sales of 17.067 million units. The sales peaked at 18.485 million units in September after the hurricanes. Since then, it has gone down every month, but December. I think it’s reasonable to suggest that the sales reach the August 2017 trough which was 16.020 million. Sales had been in a downtrend before the hurricanes which were a temporary boon to results. I don’t think auto sales can drag the economy into a recession, but they will hurt GDP growth this year. With sales so weak, it makes you question the overall strength of the economy.

Consumer Credit Weakening

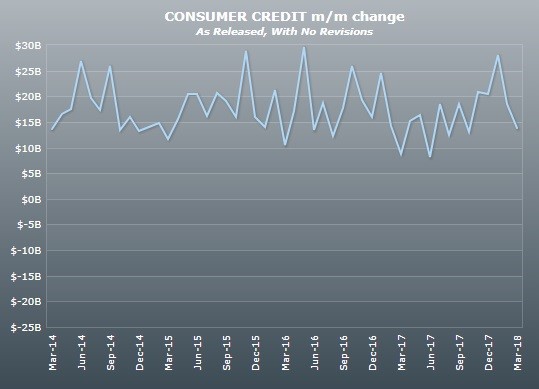

The key theme here is the consumer isn’t in an amazing position. The consumer is somewhere in between a good position and an ok one. The chart below provides more support for that thesis. It shows the non-seasonally adjusted month over month change in consumer credit. The increase was $13.9 billion in March which was below the prior month’s $19.2 billion and the consensus for $17.4 billion. The bright side is March 2017 saw an increase of $8.8 billion which missed estimates for $18.3 billion.

Latest Rumblings On The Tariffs

The stock market had a volatile day on Wednesday as investors digested the resignation of President Trump’s chief economic adviser, Gary Cohn. The S&P 500 was down about 1% early in the day, but ended only down 0.05%. The Nasdaq actually closed up 0.4%. Part of the reason stocks rebounded was simply the realization that Gary Cohn resigning isn’t a reason to sell stocks. This feeds into the other reason stocks rallied which is that the White House stated Mexico and Canada could be exempt from the tariffs. It appears last week was an emotional one where traders sold first and asked questions later. Now we’re seeing that the details are better than some feared.

The details will be revealed later this week, but based on Trump’s trade adviser's interview on Fox Business, it appears that the tariffs will be phased in over 15-30 days. The tariffs on Canada and Mexico will be delayed. If a new NAFTA deal is struck, the tariffs won’t go through. Hopefully, something is done to avoid them. As I have mentioned, Canada is the largest exporter of aluminum and steel to America. Trump also wants China to come up with a way to reduce its trade deficit with America by $1 billion and to stop infringing on American firms’ intellectual property rights.

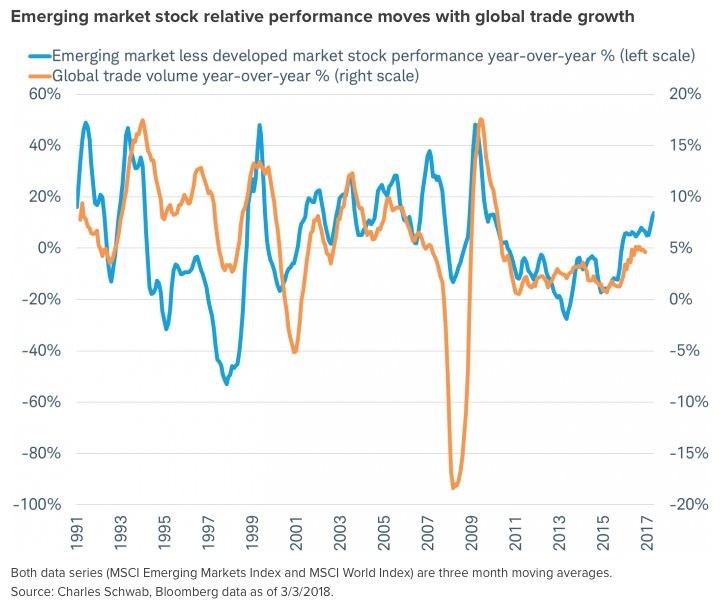

The chart below shows emerging market stocks have a high correlation to global trade growth. I don’t think this metals tariff will slow trade, so it doesn’t stop me from being bullish on emerging markets. The worry is about further policy changes such as ones which target China. That worry might be overzealous because of the push-back Trump has seen on this small tariff. 107 House Republicans sent President Trump a letter urging him to not go through with the tariffs. If Trump were to try further action, I think the Congress would step in. I think the main driver of trade growth, which is the maturation of the expansion in advanced economies, will continue for at least the next 12 months.

Disclaimer: Neither TheoTrade or any of its officers, directors, employees, other personnel, representatives, agents or independent contractors is, in such capacities, a licensed financial ...

more