Breadth And Taxes

TRUMP’S “PHENOMENAL” TAX REFORM DRIVES MARKETS HIGHER

Donald Trump made headlines last week with his suggestion that a proposal for tax-reform is on the immediate horizon, and that it would be nothing short of “phenomenal.” What that means exactly remains to be seen, but the statement added fuel to the markets--powering indices to new highs despite what many deem nosebleed valuations. Trump’s tax plan to this point has lacked specificity, so it will be interesting to see his proposal--likely rolled-out in March. Trump has, in the past, spurned the current Republican proposal for a Border Adjusted Tax, labeling it “too complicated,” however, recent anecdotal evidence points to a gradual warming to the idea. Some in his inner-circle, most notably Steve Bannon, like the proposal. Still, even if the Border Adjusted Tax is adopted by President Trump, it will still have numerous hurdles to clear: retailers and many Republican Senators are opposed to the idea, and, in its current form, it may violate World Trade Organization rules.

WHAT IS EXACTLY IS THE BORDER ADJUSTED TAX?

The Border Adjusted Tax (BAT) is a tax overhaul plan that would tax American corporations at a lower rate (20%) and change the methodology of calculating income from the current system that is based on production to one that is destination-based. Currently, domestic companies are taxed on their gross-receipts both domestically and abroad. The new proposal would levy a 20% tax on domestic net income (domestic sales – domestic costs). Thus, exporters will not be taxed on revenues generated from selling their goods overseas. Meanwhile, those companies that import products to be sold in the United States will not be able to deduct them as COGS against their domestic revenue. It is easy to see why retailers like Walmart that import a substantial amount of their products from overseas are vehemently opposed to the idea, and exporters like General Electric and Boeing are staunch advocates.

On the surface, the BAT will accomplish much of Trump’s core objectives. It will incentivize companies to stock their shelves with American-made products and invest domestically. It will raise wages for the domestic worker, which is in short supply. And the border adjustment will make the overall cohesive bill more revenue neutral. If enacted, a repatriation holiday and the immediate expensing of capital investment should soften the near-term blow for importers. Perhaps most important to Trump, the tax overhaul will eliminate the motivation for corporate tax inversions.

But the BAT is not without risks. Domestic prices are likely to increase markedly. Production of domestic goods will not be able to increase immediately, and this inelasticity means core inflation will increase. Industries that cannot replace imported goods with domestic substitutes will try to pass costs on to the consumer. The domestic production spike will take time, and until that happens, price levels are likely to increase – perhaps significantly. It is for this reason that many have dubbed the tax-proposal a regressive tax since price increases on consumer staples disproportionally affect lower-income families. Will domestic wage-gains offset price increases? I don’t know. But what it will likely do is elevate business investment in the United States, something that has been inauspiciously absent post-recession.

There is a lot of confusion in the press regarding the border adjustment. There shouldn’t be. Many advocates for the plan claim that there are many countries around the world that have enacted such a tax regime. This is wrong. The countries to which they refer have a value-added tax (VAT) which is a consumption tax assessed at each level of the supply chain. It is not a corporate income tax like the current Republican proposal. VAT’s are condoned by the World Trade Organization because they treat all consumption equally, regardless of product origination. A good sold in Germany is levied the same consumption tax whether it originated domestically or in the United States. Thus, VAT’s are not protectionist nor do they constitute an export This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. It contains opinions of the author which are subject to change without notice. Forward looking statements, estimates, and other information contained herein are based upon proprietary and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. subsidy. So, is Paul Ryan right when he claims that goods produced in the United States are taxed twice, and foreign goods once? Yes, he is. Because the United States has a corporate income tax, export revenues are taxed and those same goods are subject to foreign VAT’s. This makes U.S. companies less competitive on the global market. But the problem does not originate with unfair practices by our trading partners. It is rooted in the fact that our current corporate income tax is bad policy and the reason why most countries have opted out of such an archaic system in favor of a VAT. But rather than transitioning from a corporate income-tax to a VAT, the Republican proposal has taken the border adjustment and overlaid it with an income tax, which arguably is protectionist and subsidizes exports.

BAT ADOPTION WOULD EXPOSE THE IMPOTENCE OF THE WTO

Donald Trump has made his disdain for the World Trade Organization (WTO) abundantly clear. Trump has an “us versus them” mentality when it comes to International relations. It is this approach that ultimately won the election. Through the “Make America Great Again” campaign he forged a growing base and resonated with a large portion of the electorate. Because of this approach, it is highly unlikely that Trump will shy away from protectionist trade policy because of WTO objections. After all, Trump has already threatened to leave the WTO during his campaign. Furthermore, the enforcement of a WTO decision will take years. A complaint must be filed by foreign governments. That complaint must be heard by the WTO, deliberated on, and a decision rendered. If they rule that a Border Adjustment tax is protectionist the United States will then have to pay reparations only to those countries that filed suit. If payment is refused, the WTO then authorizes those governments to pursue retaliatory trade practices. It is doubtful that such a process would be completed before the next election, and Trump is not one to shy away from a legal battle, or undermine an entity (WTO) that he deems ineffective and unfair—especially if it interferes with his election mandate. If the BAT is implemented, the lack of WTO enforcement power will be blatantly obvious, and it remains to be seen if foreign governments would wait for a decision before pursuing protectionist policies of their own.

THE BAT IS PLAYING CHICKEN

The EU and other U.S. trading partners are already laying the groundwork for a WTO legal challenge to the border tax proposal. The question the administration should be asking themselves is, “will the rest of the world roll-over and accept a U.S. tax policy that is inherently one-sided?” If the answer is “yes,” the BAT will be a boon for U.S. business. Or, if Trump believes he can individually reach bilateral agreements with all of U.S. trading partners like he has intimated, then it might be a good strategy. The more likely end-game is that, in some form, trade relationships deteriorate and global trade with the United States plummets. In this scenario, any initial benefit stemming from elevated domestic investment, wage gains, and corporate earnings, would certainly be wiped out. This is the biggest risk of the BAT, not the immediate dislocation for importing retailers. They will find a way to adjust. The BAT may very will die in the next month, so this is all conjecture. There is considerable opposition in the Senate and it remains to be seen if Trump will adopt it. However, there is no other comprehensive tax plan on the table. Whatever tax-reform proposal surfaces the market will rally on the following initiatives: repatriation holiday, lower taxrates, and front-loaded capex deductibility. The market will likely spurn any mention of border tariffs. If the border adjustment is adopted, equity returns will be bifurcated— importers will be punished and exporters rewarded. A potential scenario is that Trump adopts the Republican plan without the border adjustment. This would likely send markets much higher in the near-term, however, is not revenue neutral and would send fiscal deficits and treasury yields sky-rocketing. It would also not directly subsidize exports and punish imports--two initiatives that appeal to Trump and were central campaign promises. Whatever the Trump proposal is, the market will be hanging on every word.

WHAT IS THE CURRENT MARKET PRICING IN?

It is difficult to discern what markets are pricing in regarding potential tax reform. Importers have not underperformed enough to indicate that the market is taking the BAT seriously. The most likely scenario is that the market is in a wait-and-see approach with regard to tax reform, and has rallied on an improving economic backdrop. Global PMI’s are expanding. Business and consumer sentiment have all improved. The job market is still robust. And the S&P 500 emerged from an earnings recession in the third quarter of 2016. Given the powerful upside momentum at breakout levels, short-sellers are being forced to cover, regardless of their fundamental views.

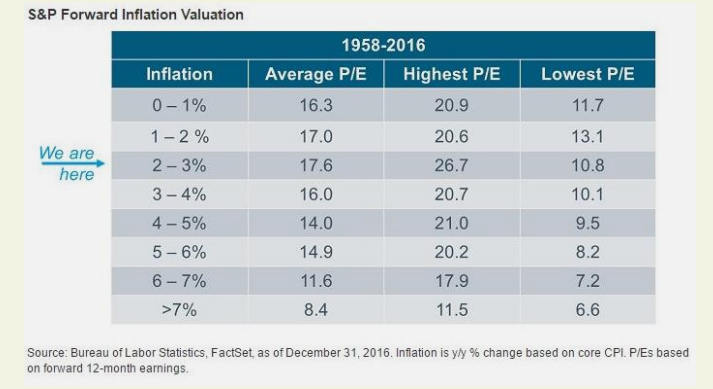

By some measures overall valuation is stretched. From a price-to-sales perspective the S&P 500 is at its highest valuation ever. Schiller’s CAPE ratio is almost 30x—the highest reading since the dot-com bubble. But other valuations remain more reasonable. The trailing PE is over 21x, a bit elevated, but not unreasonable given that the U.S. is emerging from an earnings recession. Forward PE’s are 18x, which given the current inflationary environment, is the historical average. The recent uptick in CPI (2.5%) merits attention since nothing drives multiple compression in equities like inflation.

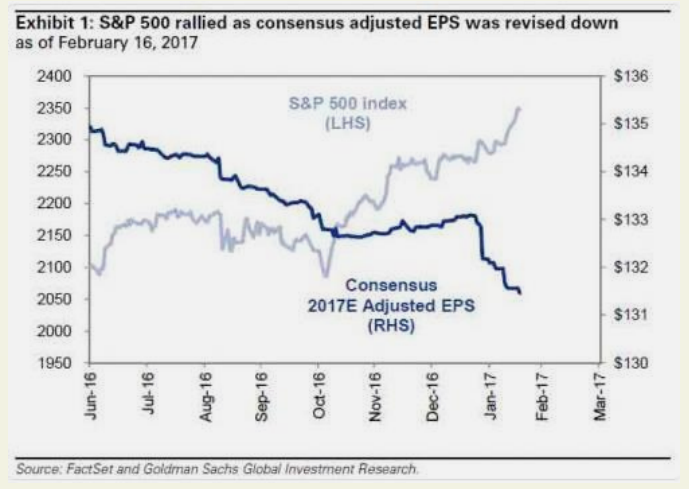

A bit concerning is the fact that the Trump rally has coincided with earnings estimates for 2017 being adjusted lower. All of the recent market advance can be explained by multiple expansion.

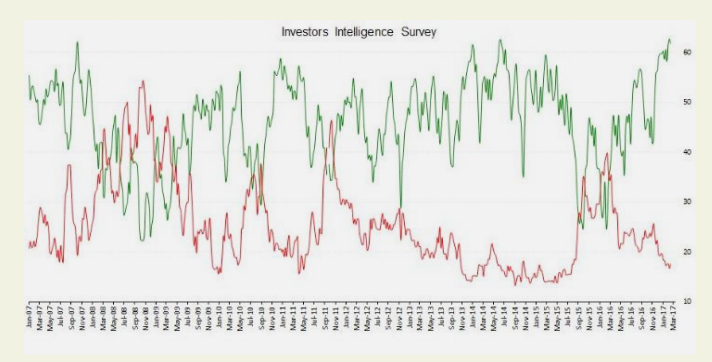

Multiple expansion is a function of sentiment. And investor sentiment has certainly improved as reflected in the Investor’s Intelligence Survey. Bullish sentiment is tracked in green, and bearish sentiment in red.

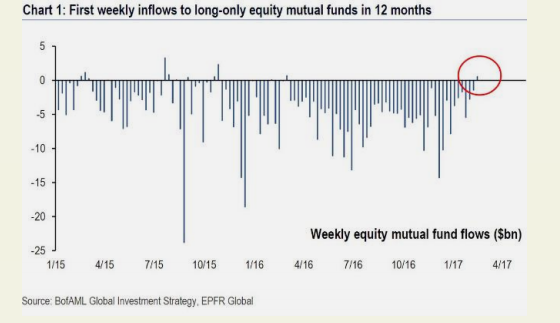

Much of our 2016 investment thesis was based on the premise that market participants were overly-pessimistic and underinvested in risk-assets. The spike in investor sentiment post-election has removed that margin of safety. Even in a world of low-cost ETF fanaticism, actively managed equity funds recently had net inflows!

Sarcasm aside, we stated in our 2017 Outlook that “as investor sentiment improves, asset prices are driven by underlying fundamentals. Volatility increases as excess cash can no longer absorb selling pressure. Pullbacks are deeper to entice sidelined cash back into the markets. And finally, market returns become more dependent on long-term organic earnings growth, limiting upside.” Holbrook believes that the economy will continue to gather steam in 2017, but that the market has increased a bit too far too fast. There is ample room for policy error and delay. After all, despite a Republican sweep, this is still politics. And this is still the U.S. government. In this context, any delay and opposition to comprehensive tax reform would likely result in a spike in volatility and an equity pullback. Going into year-end, front-end index volatility was low, but back-month protection was expensive indicating that market participants were hedging against that policy risk. As you can see in the chart below, even the expectation that volatility will pick-up from current subdued levels has subsided. This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. It contains opinions of the author which are subject to change without notice. Forward looking statements, estimates, and other information contained herein are based upon proprietary and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Tactical traders might want to take advantage of this and buy some portfolio insurance—it’s cheap!

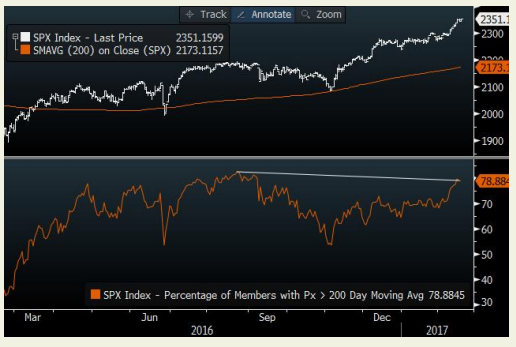

If there is one indicator that might signify an impending correction in equities, it is that breadth has not confirmed the daily “melt-up.” The percentage of S&P 500 companies that are trading above their 200 Day moving averages hasn’t surpassed 2016 highs suggesting that this breakout is not as strong as it seems.

Regarding the fixed income market, our 2016 thesis was also predicated on the over-exuberance for safe assets. This has also reversed course as evidenced by the sizeable short positions outstanding in treasury futures. The net noncommercial position (green) is plotted against the inverted ten-year yield (orange). In the near-term, this positioning is likely to keep a lid on rates, and an unwind could send tenyear yields to 2%.

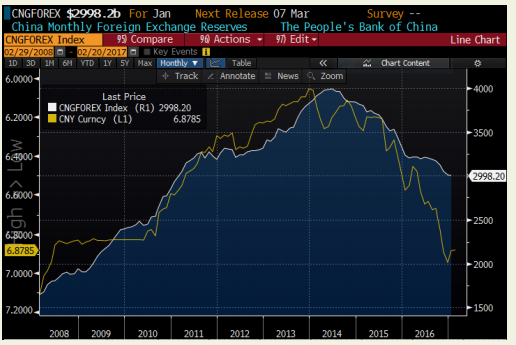

However, it is important to keep in mind who the real money buyers in the treasury market are—namely the three Central Banks of China, Japan, and the United States. With QE behind us (and the potential for balance sheet contraction), and China selling off treasuries to support their currency to stem capital outflows, there could be significant selling pressure in U.S. treasuries. The following chart shows how Chinese Reserves have followed the Yuan lower. If this relationship holds, yuan weakness is likely to exacerbate the move higher in treasury yields. Meanwhile, if inflation continues to accelerate, potentially intensified by tax-reform, it will also put upward pressure on rates. Any near-term bid for treasuries driven by short covering should be used to trim duration in investor portfolios.

CONCLUSION

Trump’s tax reform proposal, and the ease of implementation will have much to do with the direction of markets in the near-term. A lack of clarity or significant opposition could derail a market that has forged ahead despite falling earnings estimates. Meanwhile, the breadth of the recent rally has yet to confirm. Breadth and taxes are the two biggest risks to this rally.

Disclosure: This article is distributed for informational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy or investment product. ...

more