It's A Good Thing That Trump Is Asking About Strong Or Weak Dollar

Despite press coverage to the contrary, it is actually a good thing that Donald Trump asked national security adviser Mike Flynn about the benefits of a weak dollar versus a strong dollar for the US economy. He asked the wrong guy, but at least his question is extremely relevant because of economic stands he has taken or may take in the future.

Trump wants the American worker to rebound, economically. So the question is an important one. I believe there is a specific reason Donald Trump asked the question and I share it at the end of this article.

The question is important is because Trump wants our exports to succeed. That would require a somewhat weak dollar compared to other currencies. But he wants a strong dollar to strengthen the buying power of the American worker. This of course is an economic conundrum, like wanting high and low interest rates at the same time.

Key adviser Steve Mnuchin is on record saying in January that he favors a weak dollar, at least until currency manipulation by everyone else is somehow stopped, assuming China and Germany acknowledge the practice, which they don't.

Donald Trump, by asking the question, is wrestling with pragmatic solutions to the ills of our nation. Of course a weak dollar is crucial to exports, but it erodes the buying power of Americans. If they don't spend, who buys all the extra goods produced? And now we hear that gasoline demand plunged by a recessionary amount.

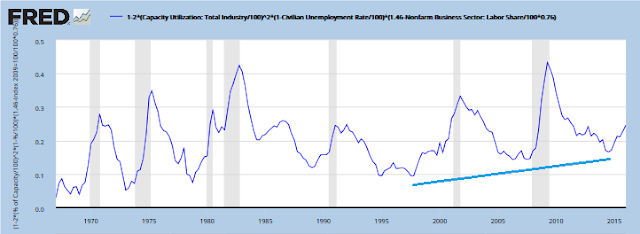

Consider that we have gasoline demand declining, we have a fairly unhealthy capital formation and we have labor's share of capacity utilization below historic norms. The charts show this:

|

Labor's Share of Capacity Utilization Up Trend Shows Decline -h/t Edward Lambert |

It is obvious now that credit card usage spiked so we could (barely) grow Christmas sales. Paying that debt off is reflected in declining gasoline sales. No one says we are in recession, but we are certainly toying with it.

The United States is clearly between a rock and a hard place. House prices and rents are a problem. The Economist says that the asset class, American real estate, is both the largest and most dangerous asset class on the face of the earth.

The dangers of a nationalised system are more insidious (see article). The size, design and availability of mortgages is now decided by official fiat. Partly because the state charges too little for the guarantees it offers, taxpayers are subsidising housing borrowers to the tune of up to $150 billion a year, or 1% of GDP. Since the government mortgage machine need not make a profit or have safety buffers, well-run private firms cannot compete, so many banks have withdrawn from making mortgages. If there is another crisis the taxpayer will still have to foot the bill, which could be 2-4% of GDP, not far off the cost of the 2008-09 bank bail-out...

Got that? The state charges too little for the guarantees it offers. That is exactly what happened in the real estate bubble, the mispricing of risk. The bonds, MBSes, that undid the housing bubble and allowed the Fed to liquidate the economy in the Great Recession were not priced based on the true risk of those bonds.

We are doing it all over again. This is, in my opinion, why Trump is having trouble with a weak dollar. Eventually, a dollar made weaker and weaker will keep the people from home ownership. Investors and foreigners will own all the housing. But a strong dollar will curb exports. Of course Donald Trump is worried about all this. Everyone should be concerned.

Trump is a real estate guy. He knows people can be priced out, by speculation, of both the housing and rental markets. He wants exports to grow and house prices to appreciate. Something has to give. If we are going to be competitive in the world markets with our exports, house prices must come down and stay down. But does Trump have other plans?

We just will have to wait and see if POTUS will solve the dollar issue and the potential recession issue by just having an old fashioned housing bubble. A housing bubble would create a higher percentage of home ownership, maybe pushing it up to the bubble high of 69 percent in the last decade. But if it crashed, the Fed would have to act differently, not transferring the wealth and houses back to the elite like it did in the Great Recession. The Fed would have to act as the Bank of England did, reaching out to small and medium sized businesses to prevent a housing crash from turning into another Great Recession or worse.

But the Fed has a history of liquidation of small and medium businesses and jobs after easy money bubbles. That behavior must be modified or the working folks will just not trust anymore. And that is exactly what Donald Trump doesn't want.

A housing crash usually crashes the dollar until people flee to the dollar. The Fed liquidated the S&L bubble in 1986 and the dollar was crushed. The Fed liquidated many of the S&Ls, slowing lending. The dollar appreciated towards the 1990s. Then, the dollar was showing signs of life in 2005, but the housing bubble peaked in early 2006, causing the dollar to crater. It had been declining since the dot com crash in late 2001, but it attempted to strengthen during the housing bubble, only to crash after house prices reached the peak. The Fed strengthened the dollar in 2008 as the economy cratered and people fled to the dollar:

In the Great Recession, specifically in 2008, the BOE held up the UK economy as the dollar strengthened against the pound because the Fed liquidated the US economy and the BOE did not liquidate the UK economy. Dollars were hoarded because the Fed did not come to the aid of the rest of the economy, in my opinion:

If Trump could get a guarantee from the Fed that it won't liquidate so drastically in the next housing bubble, he could feel more confident that wealth would stay in the hands of the people once a downturn in prices began, as the rest of the economy would be saved and exports would continue with a dollar that would not explode in value. Without that guarantee, POTUS's options are limited. An easy money housing bubble surely would result in a crash, a strong dollar, and a certain decline in exports unless the Fed turns over a new leaf.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.