USD/JPY Initiates Bearish Sequence Amid Failed Run At August-High

Fundamental Forecast for Japanese Yen: Bullish

JAPANESE YEN TALKING POINTS

The recent rebound in USD/JPY unravels following the failed attempt to test the monthly-high (112.15), but fresh data prints coming out of the U.S. economy may prop up the exchange rate as Non-Farm Payrolls (NFP) are projected to increase another 191K in August.

Signs of a more robust labor market should keep the Federal Open Market Committee (FOMC) on track to further normalize monetary policy as the central bank largely achieves its dual mandate for full-employment and price stability, and Fed officials may ultimately prepare U.S. households and businesses for four rate-hikes in 2018 as the updates are also anticipated to show Average Hourly Earnings climbing to 2.8% from 2.7% in July.

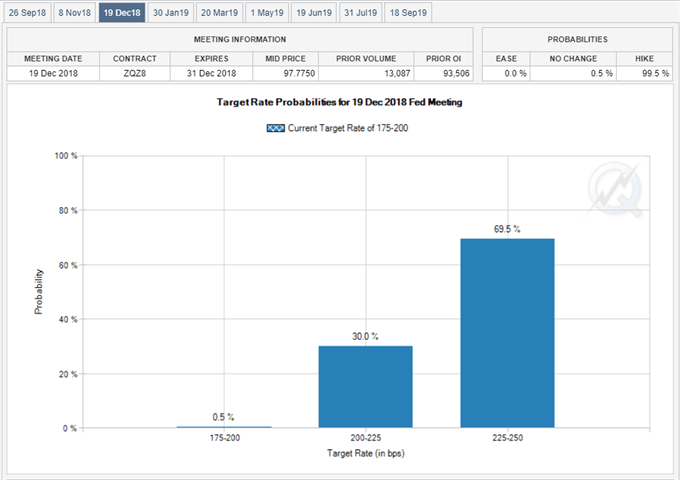

Keep in mind, Fed Fund Futures continue to reflect expectations for higher borrowing-costs, with market participants gearing up for a move in September and December, and a batch of positive developments may heighten the appeal of the U.S. dollar as it puts pressure on the FOMC to extend the hiking-cycle.

However, a set of lackluster data prints may drag on the greenback as Chairman Jerome Powell talks down the risk for above-target inflation, and central bank officials may continue to project a longer-run Fed Funds rate of 2.75% to 3.00% as ‘‘there does not seem to be an elevated risk of overheating.’ Until then, USD/JPY may continue to give back the advance from the August-low (109.77) following the failed attempt to test the monthly-high (112.15), with the exchange rate at risk of exhibiting a more bearish behavior over the coming days as it starts to carve a series of lower highs & lows.

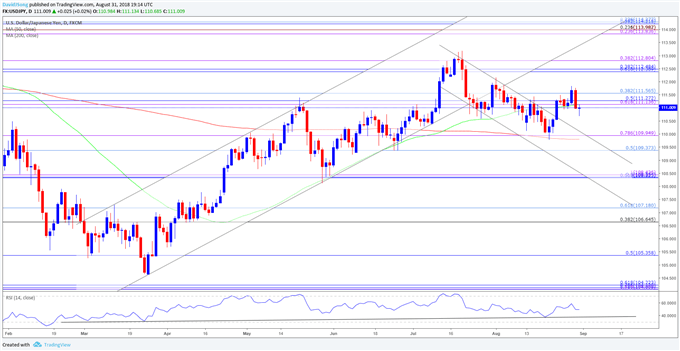

USD/JPY DAILY CHART

Failure to break the August opening range may produce range-bound conditions in USD/JPY, with the fresh series of lower highs & lows raising the risk for a move back towards the 109.40 (50% retracement) to 110.00 (78.6% expansion) region, which largely lines up with the monthly-low (109.77). Need a break below the stated region to open up the downside targets, with the next region of interest coming in around 108.30 (61.8% retracement) to 108.40 (100% expansion), which sits just above the May-low (108.11).

Disclosure: Do you want to see how retail traders are currently trading the US Dollar? Check out our IG Client Sentiment ...

more