Norges Bank Keeps Policy Unchanged As Expected

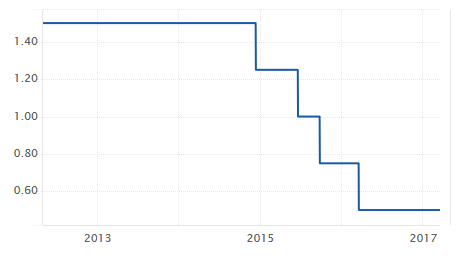

The Norwegian krone weakened significantly last week against the common currency following the Norges Bank decision to keep interest rates unchanged at 0.50%.

The decision by the Norges Bank was widely expected, but the NOK fell after the central bank sounded more dovish than expected as the central bank said in its statement that it would keep interest rates lower for longer than initially expected.

Norges Bank Interest Rates: 0.50% (March 2017)

"Persistently low-interest rates may lead to financial system vulnerabilities. Monetary policy remains expansive and supports the restructuring of the Norwegian economy," Governor Olsen said after conveying the bank's interest rate decision.

The governor said that the economic forecasts imply a higher probability for a decrease in interest rates than an increase as the CPI forecasts were downgraded. For 2017, inflation is forecast to rise just 1.7%, compared to previous forecasts of 2.4% and in 2018, inflation is expected to rise 1.5% down from 1.8% that it projected previously.

"But inflation expectations seem firmly anchored and also as we see the picture now looking forward, inflation will pick up after some time," the governor said during the press conference.

The Norges Bank has an inflation targeting mandate and is targeting core inflation level of 2.5%. But inflation data in Norway released just a week before showed that the annual inflation rate in Norway fell more than expected to 2.5% while core inflation was lower at 1.6% for the month of February.

The dovish remarks came as a surprise for the markets which hit the NOK strongly. The Norwegian krone was already trading weaker tracking oil prices lower, thus the gains in EURNOK was sharper than expected.

For its part, the euro jumped on about of positivity as the exit polls from the Dutch elections put the incumbent PM Mark Rutte in the lead. Many feared that given the rise in populism and anti-EU rhetoric, the anti-establishment, right-wing leader Geert Wilders could upset the status quo.

Reacting to the Norges Bank decision, some analysts doubted the strategy wondering for how long that the Norges bank could keep rates lower. The questions come as Norway's housing prices have been steadily rising, fuelled in part by lower interest rates.

However, others view the remarks from the central bank as a kind of easing without having to resort to further expansion in QE or further cuts to interest rates.

But there is a significant debate if the Norges bank can stoke inflation from where it stands. Many draw a parallel to the Swedish Riksbank which was caught with interest rates zero-bound and had to embark on a massive bond purchase program in order to push inflation higher.

"If inflation continues to surprise to the downside, we wonder for how much longer Norges Bank can stick with this strategy," asked analysts from Svenska Handelsbanken cautioning that if inflation expectations start to slip, the central bank would abandon its current strategy and potentially dig deeper into bond purchases.

The slower pace of inflation is concern among policy makers in Norway as the economy was seen recovering after the sudden drop in oil prices over the past three years. The Governor of Norges Bank also made it quite clear that he was reluctant to cut rates lower on account of the rising house prices.

Speaking after the monetary policy decision, the Norges bank governor said that the central bank would tolerate inflation of one or two percent.

Analysts at Nordea Bank, however, expect that 40% chance of a rate cut from the Norges Bank at the June meeting. "Today’s message signals that Norges Bank is more concerned over low inflation than we had expected," analysts said noting that "we keep our view for unchanged rates. But we see some more downside risk."

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission ...

more