Weekly Gold Forecast - Monday, June 18

Gold prices settled at $1280.12 an ounce on Friday, falling 1.48% on the week, as a solid rebound in the U.S. dollar dented appetite for the yellow metal. The Federal Open Market Committee members signaled they could pick up the pace of interest-rate increases this year and next. The euro took a dive following the European Central Bank decision at a policy-setting meeting. The central bank made it clear that it intends to keep interest rates at present levels for at least one more year.

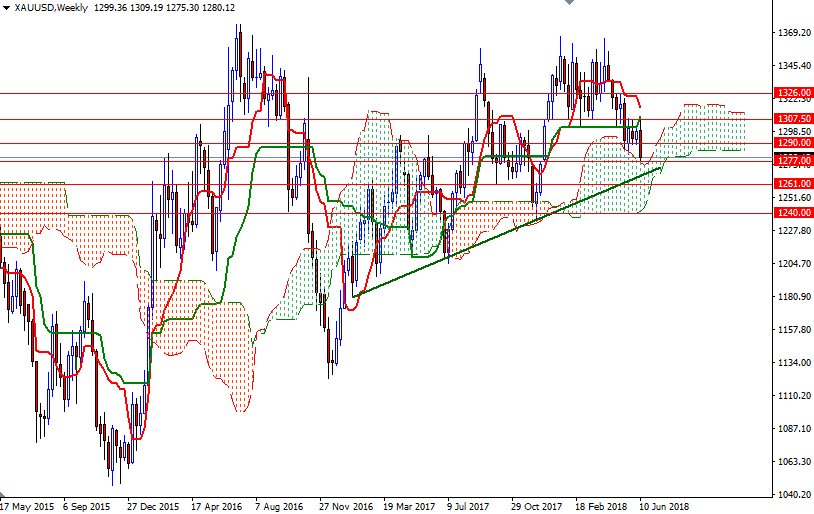

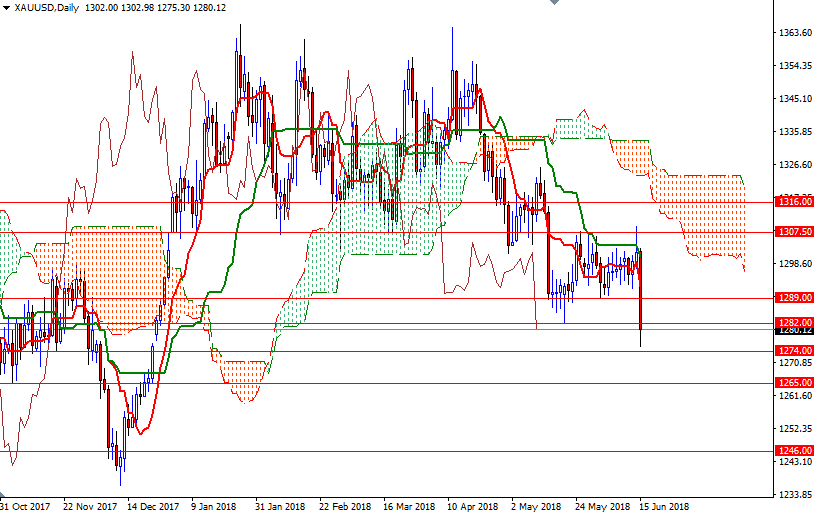

The support in the 1292.50-1289 area initially held and led to a bounce, but technical selling pressure increased after XAU/USD failed to sustain a push above in the 1307.50-1306 zone, a strategic resistance that I identified earlier as a key to higher prices. Although prices are above the weekly Ichimoku cloud, the near-term charts are still bearish, with the market trading below the clouds on the daily and the 4-hourly time frames. The daily Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-day moving average, green line) are negatively aligned on the daily chart. In addition to that, the daily Chikou-span (closing price plotted 26 periods behind, brown line) is also below prices.

The bears now have technical momentum on their side, but note that the top of the weekly cloud sits in the 1277/4 area and down below we have a technical support at 1270, the confluence of a horizontal support and an ascending trend line. If XAU/USD successfully breaks below 1270, look for further downside with 1265 and 1261/0 as targets. Further weakness below 1260 could trigger a drop to 1252. If the bulls defend their camp in the 1277/4 area and push prices higher, keep an eye on the 1292.50-1289 area. The bulls have to produce a daily close above 1292.50 to test 1296. Beyond there, the bears will be waiting in the 1303-1300.50 zone. A break through there paves the way for a test of 1307.50-1306.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more