USD/JPY At All Time Low

US to impose 50 billion worth of tariffs on China may cause investors to bail out of greenback, short USD/JPY?

Fed Chairman Jerome Powell raised rates last week and cited a stronger outlook for the economy. However, he was cautious to not send signals about the path of policy. FOMC repeatedly mentioned they anticipate “further gradual adjustments in the stance of monetary policy.” The fear of a pending trade war between US and China overshadowed all the economic data last week.

President Trump has signed the presidential memorandum last week which will target up to 60 billion worth of tariffs on Chinese imports as recompense for alleged intellectual property abuses. China retaliates with levies on $3 billion of US imports of pork, recycled aluminum, steel pipes, fruit, and wine. Although China are negotiating in Washington for US to withdraw the tariffs, chances are low as Treasury Secretary Steve Mnuchin on Sunday said President Trump had no intention of backing down and was not worried about a trade war.

In a trade war, certain currencies outperform others. This is especially true as we saw a huge inflow of funds going into safe havens such as Yen and Gold. The strengthening of the yen has caused USD/JPY to hit all-time lows since November 2016. Gold, on the other hand, has risen 400 pips to re-test the 1350 price ceiling once again.

The last prominent trade war of the 20th century was started by the Smoot-Hawley Tariffs act of 1930 led by Canada which imposed heavy tariffs on close to 20,000 imported goods. America’s trading partner retaliated with tariffs on US exports which plunged 61% from 1929 to 1933. It was almost certain that no country “won” the trade war. The only country that can possibly win are countries that are not part of it.

Another unintended victim of this trade war is the Australian currency. As China is still Australia’s biggest trading partner, they are very much affected by China’s implications. Furthermore, China’s growth might be affected which might decrease their demand of exports from Australia.

Moving forward, political headlines and the updates on the trade war between China and US will be the primary focus for this week. There may be more to come from China’s retaliation given that China has considerable leverage over US as they hold sizeable amounts of US Treasuries.

Lastly, the white house has seen one of the highest turnover rate than the five previous presidents. This definitely caused uncertainties as Trump seemed to fire those who opposed his decisions in policy making which will create diversion in the economy. The latest resignation was by H.R McMaster and was replaced by former US ambassador and Fox News Analyst John Bolton as the new National Security Adviser. John Bolton could wreak havoc in the market given his hard-line stance against Iran.

This week is a quiet week and how the currencies move will be very much based on updates on the trade war and other political headlines.

Our Picks

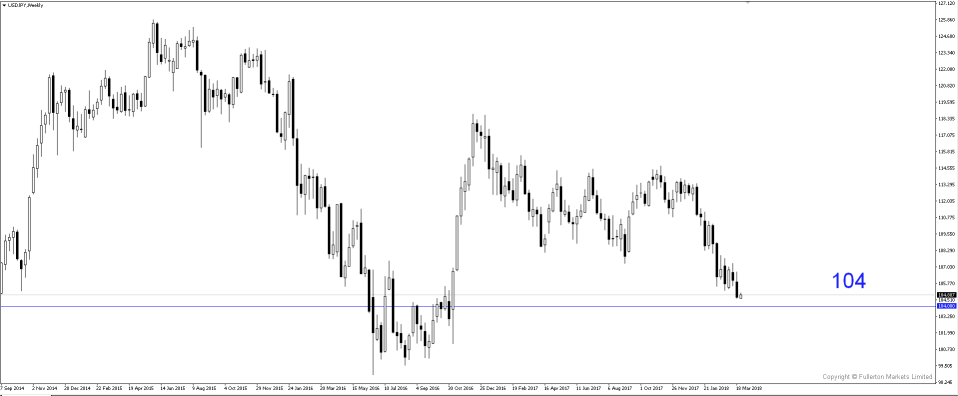

USD/JPY – Bearish.

Fears of a trade war has overshadowed any economic data and even FOMC last week. We expect more retaliation from China which will pressure dollar even lower. Yen, on the other hand, will strengthen due to risk aversion by the market.

(Click on image to enlarge)

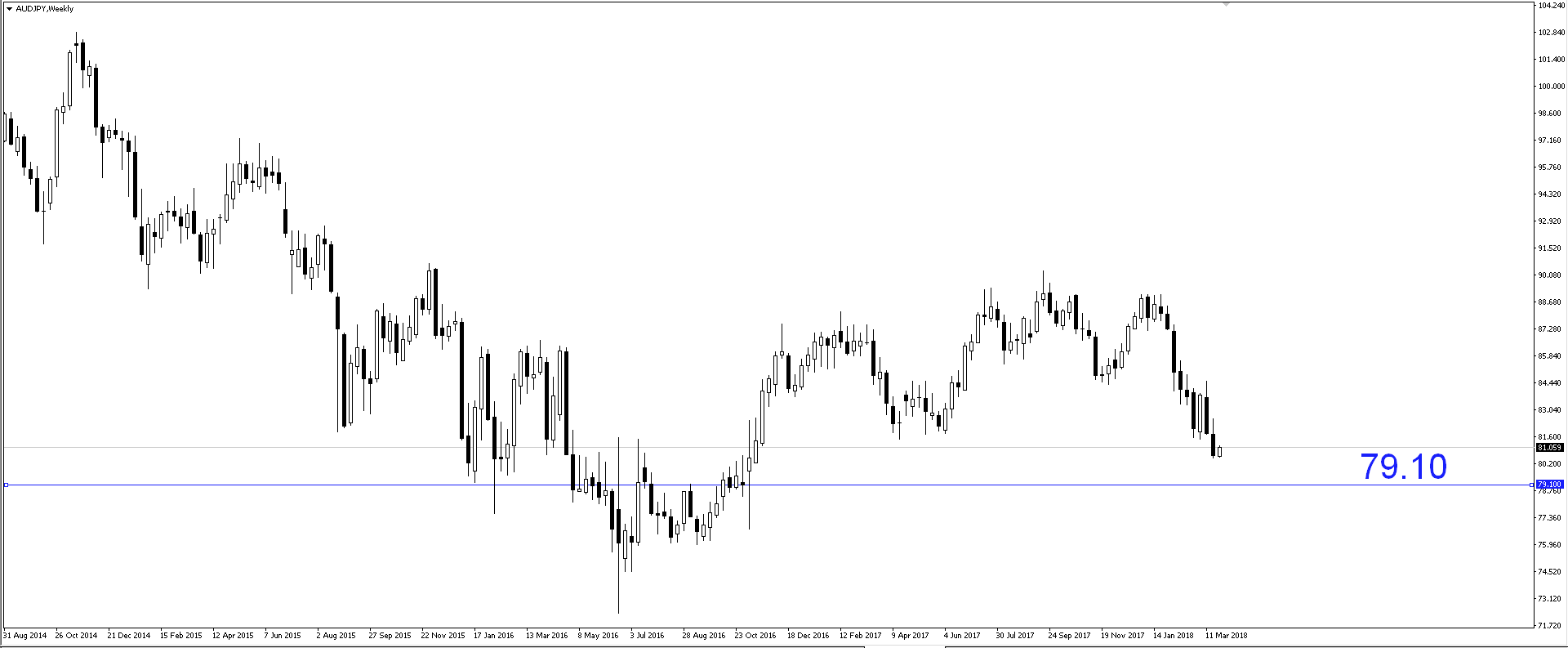

AUD/JPY – Slightly Bearish.

This pair has broken its low of 81.4 since late 2016. The trade war may continue to pressure Australian dollar and strengthen yen.

(Click on image to enlarge)

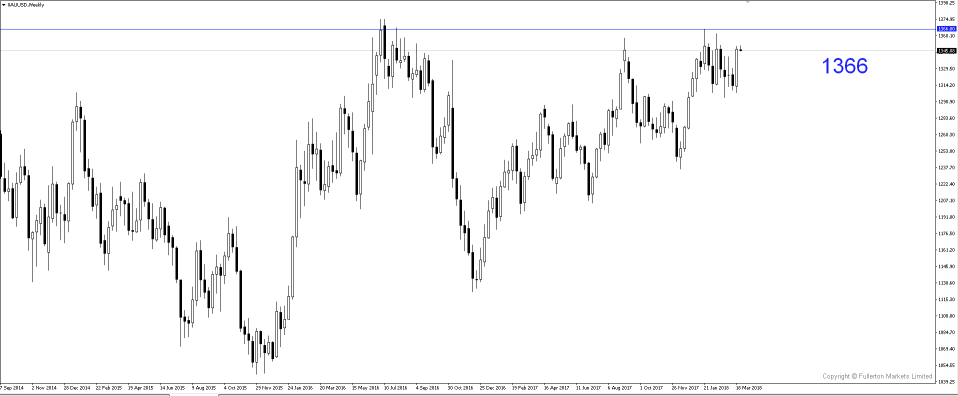

XAU/USD (Gold) – Slightly Bullish.

The uncertainties in the market due to the trade war has cause funds to flow into safe havens. We do expect more retaliation from China which could boost gold further to 1366 price level.

(Click on image to enlarge)

Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. ...

more