The Gritty Potential Of Fire Ice – Savior Or Scourge?

On June 6, Japan’s Ministry of Economy, Trade and Industry (METI) announced the Resumption of the Gas Production Test under the Second Offshore Methane Hydrate Production Test This is what they said:

Concerning the second offshore methane hydrate production test, since May 4, 2017, ANRE has been advancing a gas production test in the offshore sea area along Atsumi Peninsula to Shima Peninsula (Daini Atsumi Knoll) using the Deep Sea Drilling Vessel “Chikyu.” However, on May 15, 2017, it decided to suspend the test due to a significant amount of sand entering a gas production well.

In response, ANRE advanced an operation for switching the gas production wells from the first one to the second one for which a different preventive measure against sand entry is in place. Following this effort, on May 31, 2017, it began a depressurization operation and, on June 5, 2017, confirmed the production of gas.

Sand flowing into the well samples has been a gritty problem for the Agency for Natural Resources and Energy (ANRE) since 2013. They continue to invest because Japan relies on imports for the majority of its energy needs, especially since the reduction in nuclear capacity after the Tōhoku earthquake and tsunami in 2011. It has been in the vanguard of research into the commercial extraction of Methane Hydrate or ‘Fire Ice’ as it is more prosaically known.

Methane hydrates are solid ice-like crystals formed from a mixture of methane and water at specific pressure in the deep ocean or at low temperature closer to the surface in permafrost. For a primer on Methane Hydrate and its potential, this November 2012 article from the EIA - Potential of gas hydrates is great, but practical development is far off – may be instructive but a picture is worth a thousand words:-

Source: US Department of Energy

During the last two months there have been some important developments. Firstly the successful extraction of gas by the Japanese, albeit, they have run into the problem of sand getting into the pipes again, which poses an environmental risk. Secondly China has successfully extracted gas from Methane Hydrate deposits in the South China Sea. This article from the BBC - China claims breakthrough in mining 'flammable ice' provides more detail. The Chinese began investment in Fire Ice back in 2006, committing $100mln, not far behind the investment commitments of Japan.

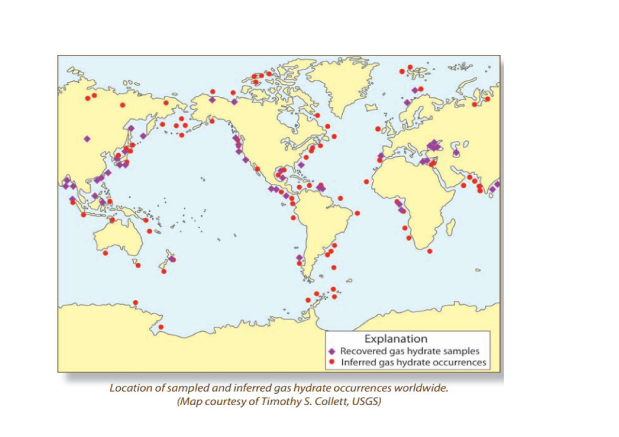

Japan and China are not alone in possessing Methane Hydrate deposits. The map below, which was produced by the US Geological Survey, shows the global distribution of deposits:-

Source: US Geological Survey

For countries such as Japan, South Korea and India, Methane Hydrate could transform their circumstances, especially in terms of energy security.

Estimates of global reserves of Methane Hydrate range from 10,000 to 100,000trln cubic feet (TCF). In 2015 the global demand for natural gas was 124bln cubic feet. Even at the lower estimate that is 80 years of global supply at current rates of consumption. This could be a game changer for the energy industry.

The challenge is to extract Methane Hydrate efficiently and competitively. Oceanic deposits are normally found at depths of around 1500 metres. Even estimating the size of deposits is difficult in these locations. Alaskan and Siberian permafrost reserves are more easily assessed.

Japan has spent $179mln on research and development but last week METI announced that they would now work in partnership with the US and India. The Nikkei - Japan joining with US, India to tap undersea 'fire ice' described it in these terms, the emphasis is mine:-

Under the new plan, Japan will end its lone efforts and pursue cooperation with others. The country has been spending tens of millions of yen per day on its tests. By working with other nations, it seeks to reduce the cost.

A joint trial with the U.S. to produce methane hydrate on land in the state of Alaska is expected to begin as early as next year. Test production with India off that country's east coast may also kick off in 2018.

The new blueprint will define methane hydrate as an alternative to liquefied natural gas. Based on the assumption that Japan will be paying $11 to $12 per 1 million British thermal units of LNG in the 2030s to 2050s, the plan will set the target production cost for methane hydrate over the period at $6 to $7.

In the shorter term METI hope to increase daily production from around 20,000 cubic metres/day to around 56,000 cubic metres/day which they believe will bring the cost of extraction down to $16/mln BTUs. That is still three times the price of liquid natural gas (LNG).

Here is the latest FERC estimate of landed LNG prices/mln BTUs:-

Source: Waterborne Energy, Inc, FERC

You might be forgiven for wondering why the Japanese, despite being the world’s largest importer of LNG, are bothering with Methane Hydrate, but this chart from BP shows the evolution of Natural Gas prices over the last two decades:-

Source: BP

Japan was squeezed by rising fuel costs between 2009 and 2012 only to be confronted by the Yen weakening from USDJPY 80 to USDJPY 120 from 2012 to 2014. If Abenomics succeeds and the Yen embarks upon a structural decline, domestically extracted Methane Hydrate may be a saviour.

Cooperating internationally also makes sense for Japan. The US launched a national research and development programme in 1982. They have deep water pilot projects off the coast of South Carolina and in the Gulf of Mexico as well as in the permafrost of the Alaska North Slope.

Technical challenges

As deep sea drilling technology advances the cost of extraction should start to decline but as this 2014 BBC article - Methane hydrate: Dirty fuel or energy saviour? explains, there are a number of risks:-

Quite apart from reaching them at the bottom of deep ocean shelves, not to mention operating at low temperatures and extremely high pressure, there is the potentially serious issue of destabilising the seabed, which can lead to submarine landslides.

A greater potential threat is methane escape. Extracting the gas from a localised area of hydrates does not present too many difficulties, but preventing the breakdown of hydrates and subsequent release of methane in surrounding structures is more difficult.

And escaping methane has serious consequences for global warming - recent studies suggest the gas is 30 times more damaging than CO2.

Given the long term scale of the potential reward, it may seem surprising that the Japanese have only invested $179mln to date, however these projects have been entirely government funded. Commercial operators are waiting for clarification of the cost of extraction and size of viable reserves before entering the fray. Most analysts suggest commercial production is unlikely before 2025. With the price of Natural Gas depressed, development may be delayed further but in the longer term Methane Hydrate will become a major global source of energy. Like the fracking revolution of the past decade, it is only a matter of when.

The history of fracking can be traced back to 1862 and the first patent was filed in 1865. In the case of Fire Ice, I do not believe we will have to wait that long. Deep sea mining and drilling technologies are advancing quickly in several different arenas. The currently depressed price of LNG is only one factor holding back the development process.

Conclusions and investment opportunities

Predicting the timing of technological breakthroughs is futile, however, the US energy sector is currently witnessing a resurgence in profitability. In their June 16th bulletin, FactSet Research estimated that Q2 profits for the S&P500 will rise 6.5%. They go on to highlight the sector which has led the field, Energy, the emphasis is mine:-

At the sector level, nine sectors are projected to report year-over-year growth in earnings for the quarter. However, the Energy sector is projected to report the highest earnings growth of all eleven sectors at 401%.

This sector is also expected to be the largest contributor to earnings growth for the S&P 500 for Q2 2017. If the Energy sector is excluded, the estimated earnings growth rate for the index for Q2 2017 would fall to 3.6% from 6.5%.

The price of Brent Crude Oil has been falling but the previous investment in technology combined with some aggressive cost cutting in the recent past has been the driving force behind this spectacular increase in Energy Sector profitability. Between 2014 and 2016 Energy Sector capital expenditure fell nearly 40%. I expect a rebound in capex over the next couple of years. It may be too soon for this to spill over to commercial investment in Methane Hydrate, but developments in Japan and China during the past two months suggest a breakthrough may be imminent. The next phase of investment may be about to begin.

Disclosure: None.