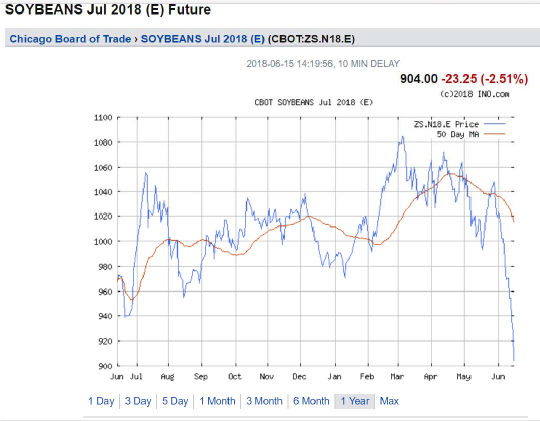

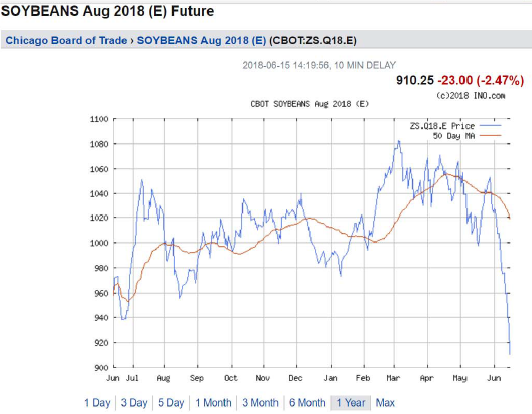

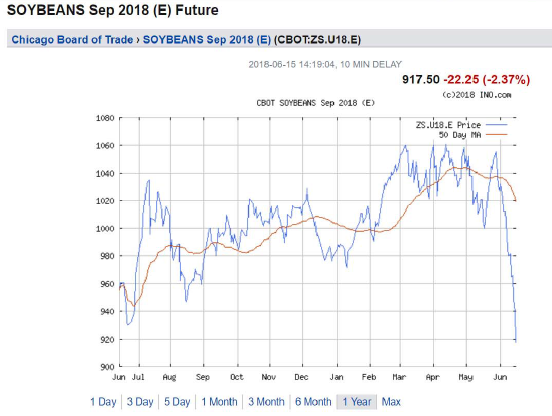

Soybean Futures In Free Fall: Front And Back Months

Reader Ed Hanson asks if it makes a difference to look at front month or back month futures in discerning the impact of news on soybean prices. The answer is no.

Below, I present graphs of soybean futures over the past year for contracts expiring in July, August, September, November, and January 2019 (all accessed on 6/15, from ino.com):

Those who are familiar with finance, and futures in particular, will recognize this pattern for any semi-storable commodity, as in soybeans.

Storable agricultural commodity future prices act like typical asset prices, to a first approximation, so that they respond to news, pretty much impounding new information rapidly. This is not to say futures prices (or even spot soybean prices) behave like a random walk. Theory doesn’t predict that stock prices should follow a random walk — just an approximate one. Similarly for futures.

In Chinn and Coibion (2014), we document the fact that at the three and 12 month horizons, futures outperform a random walk and ARIMA. Moreover, futures are an unbiased predictor of future spot prices. (I keep on coming back to this as I’m inordinately proud of this paper, which took 13 years from CEA memo to publication; you can see the intermediate NBER WP version here.)

By the way, you should not extrapolate this message of unbiasedness to other commodities, particularly precious metals. And not to currencies.

Disclosure: None.