Opportunities In A Wrecked Shipping Industry: LPG Tankers

<< Read More: Opportunities In A Wrecked Shipping Industry: LNG Carriers - Part 2

<< Read More: Opportunities In A Wrecked Shipping Industry: Overview - Part 1

This is Part 3 in a 3 Part series about the investment opportunities in shipping

As 2018 continues one thing has become clear, markets are far more volatile than they have been in 2017 or in recent memory. As the economy moves into the late stages of the economic cycle and with asset prices at record highs, investors have to be careful about where they put their money. Shipping stocks, trading at the most attractive valuations in 20 years, present an interesting opportunity. More specifically, shipping companies involved in the transportation of certain energy products such as Liquefied Natural Gas (LNG) and Liquefied Petroleum Gas (LPG) present even better opportunities as supply and demand for these products soars at the same time as fleet growth slows down. In part 2 in this 3 part series on shipping I wrote about the opportunities in LNG carriers, this article describes the opportunity in an even more niche and possibly lucrative area of the shipping business, LPG Tankers.

To understand the opportunity in LPG Tankers it is first necessary to understand the market for liquefied petroleum products. LPG is the liquefied form of hydrocarbon gases such as propane and butane, which are byproducts of natural gas processing and oil refining. The uses for LPG are immense, its used throughout the world as a cooking and auto fuel, it is used in refrigerants and as a petrochemical feedstock (which used to make plastic or synthetic rubber), you use if you want to barbeque, you can use it to heat your home, the uses go on and on. It also has the benefit of being clean burning and easy to transport, requiring little or no infrastructure. LPG’s versatility has made it prime choice of energy for developing countries and demand has been expanding rapidly. At the same time shale drilling in North America has turned the U.S into one of the largest energy producers in the world and consequently the largest producer of LPG, production of which is only expected to increase through 2026. By that time the global LPG market is expected to reach $150 billion. The new rapidly growing market in LPG has in turn created a new highly profitable segment within the shipping industry and led to the rise of a new type of commercial vessel, the VLGC (very large gas carrier).

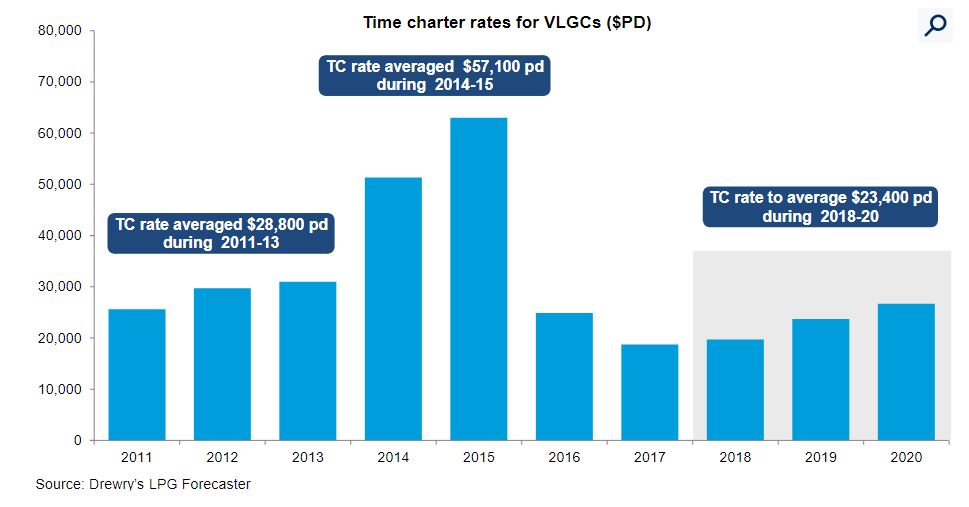

These vessels are about 230 meters in length and could carry up to 43,000 tons of LPG across the world’s oceans. As the market for LPG began to expand charter rates for VLGC’s soared, going from an average $28,800 a day during 2011-13 to an eye watering $57,100 during 2014-15 on some routes charter rates were over $100,000 a day. The increase was largely due to a sudden spike in propane demand from China caused by the opening of several PDH (propane dehydrogenation) plants, which are used to create propylene (a superior alternative to propane). The combination of increased demand for LPG, especially from China, and small number of VLGC’s able to carry it led to an amazing boom in this shipping sector. Unfortunately it was not to last, like any commodity business when prices get to high more supply and more players inevitably enter the market, dropping prices back down.

(Click on image to enlarge)

Average charter rate for VLGC’s from 2011-2017 and projected charter rate from 2018-2020. Charter rates are expected to begin recovering over next 3 years.

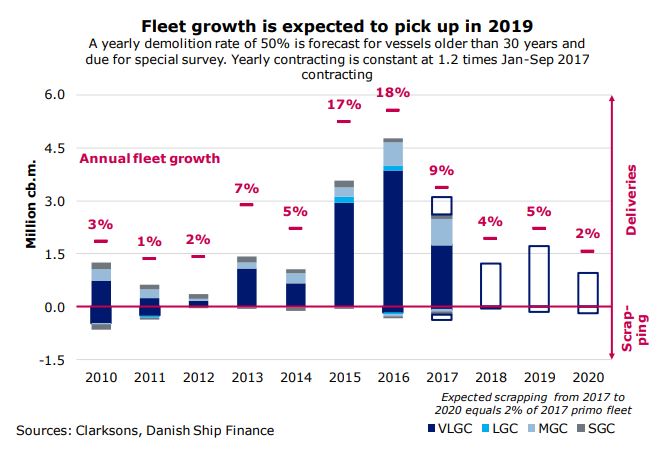

Shipping firms anxious to take advantage of sky high rates for VLGC’s began to order new ships on mass. In 2015 and 2016 the LPG Tanker fleet’s carrying capacity increased 17% and 18% respectfully. At the same time LPG production decreased as oil prices plunged, suddenly there were more ships then cargo causing the booming industry to crash. The recession in the LPG Tanker market continued through 2017, which was one of the toughest years in the history of the VLGC market. Charter rates for VLGC’s along the benchmark Arabian Gulf to Japan route averaged $12,500 a day, well below the breakeven price of $21,000. Even worse supply continued to squeeze the market with new ships ordered during the boom years hitting the market in 2017. Overall LPG shipping capacity increased about 9% in 2017 even as demand for seaborne LPG increased only 5%. New players entering the market also made the situation worse. Increased fragmentation and saturation reduces bargaining power for individual shippers and charterers. At the end of 2017 there were 62 companies in the VLGC sector, 17% more than at the end of 2013. Overall the market for LPG Tankers and VLGC’s has been depressed for several years, but that is the best time to look for opportunity.

Due to the excess supply of ships in the LPG Tanker market VLGC operators have seen their stock prices collapse over the last 2 years. Many of these firms such as Dorian (LPG) and Navigator Holdings (NVGS) trade below book value, which makes sense given the poor fundamentals for LPG shippers. However, there are signs that the market for VLGC’s is set to recover and given the cheap valuations in the sector this gives investors an interesting opportunity.

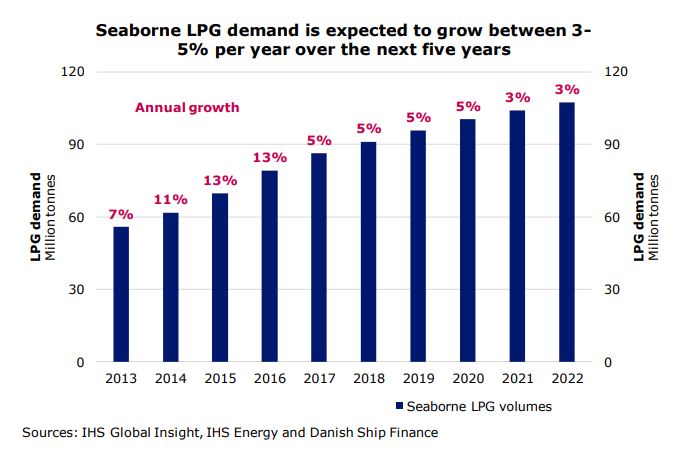

The first sign of a recovery could be seen when examining the global market for LPG itself. As was stated before demand and consumption of LPG is surging around the world especially from developing countries that are in need of cheap, clean burning and easy to transport energy products. In 2015 the global market demand for LPG was about 278 million tons, it is forecasted to exceed 380 million tons by 2024, that is a 36% increase. Much of this increase in demand is expected to come from Asian countries like China, India and Indonesia. This is mostly due the rapid population growth in these countries and government initiatives trying to promote cleaner energy. In China alone LPG imports are expected to surge 40% by 2019 to 25.3 million tons as the country plans to open two new PDH plants. Each of these plants could consume as much a 1 million tons of LPG a year and almost all of this LPG will be imported from abroad. These plants alone mean China will need 3.5 more VLGC imports every month. Although that does not sound like much when considering the fact that the global VLGC fleet consists of barely 260 ships, such an increase in demand from China will have a significant effect on the market. China is also not the only Asian country increasing its LPG imports, Indonesia, South Korea, India and even Japan are all thirsty for more LPG as those countries continue switching from traditional fuel sources like coal to cleaner cheaper LPG.

Chart showing annual growth of seaborne LPG demand from 2013-2017 and projected growth from 2018-2022. Demand is expected to grow between 3-5% over the next 5 years.

As the same time as demand is increasing, production and exports of LPG is also increasing. This increase is being driven by large oil production in North America and the United States’ shale fields in particular. According to oil and gas shipping consultancy, Poten & Partners, in 2019 total U.S LPG production is expected to be about 65.6 million tons, that is 7.7 million ton increase from 2017. Almost 5.5 million tons of that increased production is expected to be exported. This increase in LPG exports is being driven by strong demand from abroad and no significant increase in domestic demand. The strong outlook for U.S LPG exports is a very positive development for the struggling VLGC and LPG Tanker market. Shipping LPG from the U.S to customers in Asia leads to longer charters for ships, which leads to higher fleet utilization, which in turn leads to higher charter prices and greater profits. The U.S is also not the only country increasing its LPG exports. New LNG projects starting up in Australia in 2018 are set to boost that country’s LPG exports as well, from 1.6 million tons in 2017 to 2.5 million tons by 2019. Some estimates from shipping consultants and energy analysts say the total LPG exports could increase 41% between 2017 and 2019. Overall strong demand from Asian countries and increased exports from the United States and Australia create a favorable environment for LPG trading, which provides a strong market for LPG Tankers.

Although global demand for LPG might be slowing it remains healthy and positive which is a strong benefit for LPG Tankers. However, the depression in the LPG Tanker market was not caused by turbulence in the LPG market but rather by an oversupply of LPG Tankers and VLGC’s. Therefore it’s the slowdown in fleet growth that truly signals the possible turnaround in this specific shipping sector. Fleet growth in 2018 and 2019 is expected to average between 4% and 5%, a much more manageable level then the last 3 years. In fact, according to global shipping consultancy Drewry, a slowdown in fleet growth should begin a recovery cycle in the LPG Tanker market beginning in the latter half of 2018.

High fleet growth in 2017 put significant pressure of ship values and freight rates, in the first 10 months of the year 54 new LPG Tankers entered the market, 21 of which were VLGC’s. This sent second-hand prices for VLGC’s falling by 8% and freight rates to record lows. However, demand for LPG Tankers is expected to start outpacing supply of ships in 2018 and this trend is predicted to continue until at least 2020. This will shrink overcapacity and increase freight rates across the industry. According to LNG and LPG shipper BW LPG, charter rates for VLGC’s will average above $20,000 a day in 2018. Analysts at Grand View Research predict that over the next 3 years charter rates for VLGC’s will average $23,400 a day, such prices would make VLGC’s and LPG shipping firms profitable again. However, current oversupply still hangs over the industry and orderbook for new vessels still stands at 11%. In 2017, 14 new orders for LPG tankers were placed, 7 of which were for VLGC’s. Overall 30 new VLGC’s are expected to hit the market between April of 2018 and 2020. This increase in ships will be balanced somewhat by an increase in scrapping. Due the young age profile of the LPG Tanker fleet scrapping of vessels has been limited, but according to the C.E.O of major VLGC operator Dorian LPG, 35 LPG Tankers are set to be scrapped over the next 2 years. Such an increase in scrapping would go a long way toward balancing the market.

Chart showing annual fleet growth for LPG Tankers from 2010-2016 and projected fleet growth from 2018-2020. Fleet growth is expected to fall off heavily starting in 2018.

Despite the current oversupply and still relatively large number of ships set to hit the market, strong U.S LPG exports driven by rising oil and gas production, coupled with the expansion of LPG import and export capacity will strengthen the market for VLGC’s. Even though the supply and demand picture will remain fragile, overcapacity is expected the start shrinking over the next 12-18 months and the market is expected to be completely balanced by 2020. With stocks in the industry trading at below book value such a modest recovery would lead to outsized returns for investors.

Of course, there are significant risks involved in investing in LPG Tankers, the primary one is the brewing trade tension between the U.S and China. As was stated before Asia’s and China’s importance to the LPG trade is enormous. China is the world’s largest buyer of LPG and alone was responsible for 20% of the LPG market in 2017, up from just 6% in 2012. Much of China’s LPG demand had been met with imports from the U.S and the rapid growth of the U.S – China LPG trade has been very beneficial for VLGC operators. Unfortunately, this trade is under threat from the current tensions. In response to tariff threats from the U.S, China has retaliated by proposing its own series of tariffs on a variety of U.S imports. One of these proposed trade barriers is a 25% duty on LPG imports from the U.S. Such an action would be sharp blow to the LPG trade and to the LPG Tanker market in particular.

So far the tariff threat remains just that, a threat. No firm action has yet been taken and no date has been set on the application of the proposed tariff on U.S LPG. The announcement has had little impact of the VLGC market as of yet, since many in the industry believe China’s threat is a shallow one, meant to scare the United States to the negotiating table. In fact current trade negotiations could end up benefitting the VLGC market. President Trump has made it clear that he wants a steep reduction in the U.S trade deficit with China. The one way to accomplish this is through China agreeing to purchase more goods from the U.S, if this is the case the obvious goods for China to purchase are energy products such as LNG and LPG. China’s ever-growing appetite for cheap clean energy corresponds perfectly with the increased production and export capacity of such energy products in the U.S. China already has a deal with Cheniere Energy (LNG) to import 1 million tons of U.S LNG a year, a new trade deal with the U.S could lead to similar arrangements for LPG. Such a deal would be a boon for the LPG shipping sector.

With all that being said, the LPG Tanker industry much like the rest of the shipping industry is volatile, prone to sharp boom-bust cycles. For investors willing to take on the risk the best way to invest in LPG Tankers is through the stocks of VLGC operators and LPG shipping firms. Such firms include U.S based Dorian LPG (LPG), which operates 22 VLGC’s with a total aggregate capacity of 1.8 million cbm (cubic meters). Another option for investors is London based Navigator Holdings (NVGS) whose 38 ship fleet consists of 33 handy sized LPG carriers (ships that are smaller than VLGC’s and have a carrying capacity of 15,000-25,000 cbm). Yet another option for investors interested in LPG shipping is Bermuda based Avance Gas Holding (AVACF) which operates 14 VLGC’s and is traded on the Oslo stock exchange in Norway. These are not the only companies involved in LPG shipping but for investors who want to gain exposure to the recovering sector, these companies are good options.

Overall the fundamentals in the LPG Tanker market are improving. With stocks in the sector trading at wildly cheap valuations, investors who are willing to take on the additional risk now are likely to see remarkable profits down the road when the market becomes balanced and the industry returns to profitability.

Disclaimer: This material has been distributed for informational purposes only and is the opinion of the author, it should not be considered as investment advice.

Been waiting for your next article...