Oil Update: OPEC And Non-OPEC Cuts Mean Higher Oil Prices

Oil prices may rise from 15% to 35% over the course of the next 12 months. The initial cut by OPEC caused a 15% increase in the price of oil. $52 proved to be a significant resistance level, as producer hedging has the benefit of contango. Contango is a bearish situation that occurs when oil prices are higher in the future. Backwardation is bullish as front month prices are higher. Since oil prices are now higher by $3 to $4/bbl over 12 months, operators can hedge production for better forward prices. Operators hedge to guarantee a price for production. Operators in the Permian, SCOOP/STACK, core Eagle Ford, and core Bakken see decent returns at $54/bbl or $55/bbl. Producer hedging is creating difficulties breaking to the upside. This could decrease quickly, as contango is moving to a more normal backwardated market. We are starting to see this in futures markets in 2018. 2017 is also starting to tighten, but balance seems pegged closer to July or August of this year.

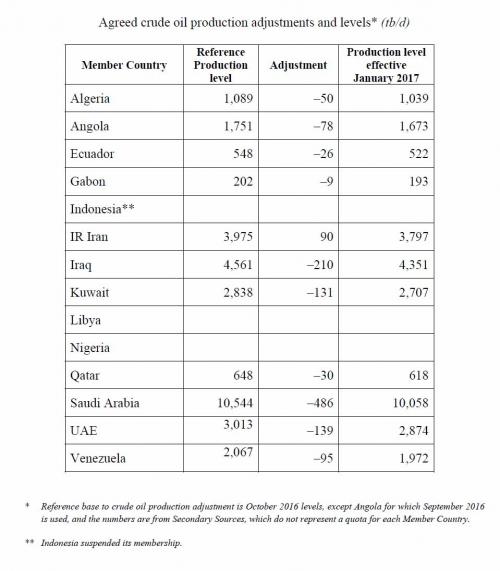

(Source: OPEC)

The above chart shows the 1.2 million bpd OPEC cut. It shows an upward production revision for Iran. Other outlets have reported this, but Iran isn't being allowed to raise production. Although the adjustment looks positive, the 1/17 production level is below current output. Iran was allowed to leave the meeting stating it was allowed to raise production, but this was political. The Iranians and Saudis have been in the middle of a Sunni/Shia competition. When oil prices were high, the Iranians had garnered more support in OPEC. The Saudis have regained the majority. Countries like Venezuela are willing to do anything to get prices up. The suspension of Indonesia was a message to both Iran and Iraq that OPEC was willing to expel or suspend nations to get this deal done. Iraq folded relatively quickly. Iran was louder about its unwillingness to cut, but also gave in. To suspend or remove a member of OPEC there needs to be a unanimous vote. The Saudis don't just have the majority, it has them all.

OPEC needs the cooperation of other nations to control the world oil market. Its production as a percentage of world demand, has decreased. OPEC now represents approximately one-third of world demand. 25 nations were represented at Saturday's meeting. It initially reported a cut of 558,000 bpd. Russia was by far the largest contributor at 300,000 bpd.

1. Russia to cut 300,000 barrels a day

2. Mexico to cut 100,000 barrels a day

3. Kazakhstan to cut 50,000 barrels a day

4. Oman to cut 45,000 barrels a day

5. Azerbaijan to cut 35,000 barrels a day

6. Malaysia to cut 35,000 barrels a day

7. Bahrain to cut 12,000 barrels a day

8. Equatorial Guinea to cut 12,000 barrels a day

9. South Sudan to cut 8,000 barrels a day

10. Brunei to cut 7,000 barrels a day

11. Bolivia to cut 4,000 barrels a day

12. Sudan to cut 4,000 barrels a day

Although many media outlets have reported a 558,000 bpd cut, the 12 nations reporting totaled 612,000 bpd. The OPEC/Non-OPEC cut represents 2% of world production. The size and scope of cooperation is significant, and could move trading ranges higher. Kazakhstan was a surprise with it's 50,000 bpd cut. It had planned to bring a new field online next year. Significant pressure must have been placed on the country, as the IEA had estimated it would increase production in 2017 by 160,000 bpd. Russian production is also a mystery. It self-reports at 11.2 million bpd. Analysts have noted Russian production closer to 10.7 or 10.8 million bpd. It is possible Russia isn't cutting. OPEC has stated it would accept natural declines as cuts. It is possible these cuts may come into effect over time, and not on January 1st.

The key issue associated with any OPEC cut is cheating. This type of a maneuver is not just difficult from a production perspective. The 1986 glut is an example of stolen customers. In the early 80's oil demand decreased. This was due to a low to negative growth environment, and new fuel efficient automobile engines. When demand decreased, OPEC cut. The majority was done by the Saudis. Saudi Arabia decreased production from 9 million bbls/d in 1981 to 3.1 million bbls/d in 1985. Other members had stated it would cut with SA, but instead increased production. This allowed countries like Iran to steal customers. The Saudis increased production in response, but could not get customers back. Some believe the lowest breakevens provide the advantage selling crude. This would be true if it weren't for contracts. Without crude to sell the Saudis hoped that prices would increase, but it didn't. Members competed with one another to sell to refiners. The result wasn't a higher oil price. Oil prices dropped to $10/bbl in March of 1986 from a peak of $32/bbl in November of 1985. The Saudi economy plummeted into recession. More importantly, it looked like a fool. The Saudis decided to discontinue its swing producer role. History does repeat itself, and many believe some OPEC members will not hold up it's end of the deal. A five-country panel was appointed to oversee production. This includes Venezuela, Algeria, Kuwait, Russia and one other non-OPEC nation to be named later (notice Iran and Iraq weren't appointed, that's a surprise). The most important comment made was after the deal."I can tell you with absolute certainty that effective Jan. 1 we're going to cut and cut substantially to be below the level that we have committed to on Nov. 30," said Khalid al-Falih. The Saudi oil minister seemed to be stating his country would cut more than its original 486,000 bpd. A more important fact could be taken from his comment. We could mean OPEC with multiple countries getting involved. It provided a "the suspense is killing me moment", which could help to propel oil prices higher. So why the shock and awe? Producer hedges are the answer. The same reason we couldn't get through resistance at $52, may provide a significant support level going forward.

After the OPEC deal, speculative short covering and long hedging pushed oil prices higher. Spec shorts covered 66 million barrels. Some hung on and we have a net short position of 80 million barrels. This could mean that oil prices could push higher, as we will likely continue to see short covering. That is only if OPEC sticks to the deal, and much of Non-OPEC will see half of its cuts from natural decline. The shorts aren't done and one would think that it will add more shorts in the coming days. E&Ps are also doing its part, by selling barrels at higher prices. This continues to provide significant resistance levels. The only way hedging will decrease is if operators buy into higher oil prices. If OPEC does cut, and in a big way, E&Ps may hold off. Many operators already hedged at much lower levels and each barrel hedged now will bring up that expected price. It sold 43 million barrels after the deal. Total operator hedges are now over 650 million barrels. The number will just get bigger. Net positions from buyers and sellers were up over 80 million barrels. Shorts will continue to push oil down. OPEC will counter with positive noise every time oil heads lower and push prices back up. This will cause significant volatility in the coming weeks, but it also provides a relatively nice range to trade.

In summary, the OPEC deal is historic. If the cuts do happen, and we think it will, there could be a drastic drop in world oil inventories. To get back to a more normal average, 340 million barrels need to be worked off of world inventories. It is almost impossible to calculate world supply and demand. Some believe before the cuts that supply was 1 million bpd more than demand. Others think the markets were already in balance. Using those estimates the market could see somewhere between 200 thousand bpd and 1.2 million bpd removed. The first month probably will not see much from Non-OPEC, but there is the possibility OPEC will cut more. Over the first 6 months of the deal, the inventory decreases would be between 36 million and 216 million. If we use another 400 thousand bpd as the non-OPEC average, the range becomes 108 million to 288,000.000. This does not include possible production increases from Nigeria and Libya, but provides an idea as to why this deal could be so important. Without the deal, the market would balance on its own, but the Saudis needed this done long before its IPO of Saudi Aramco. It does provide an opportunity, as US E&Ps have upside. There are a large number of reasons the oil markets could head higher, and the technicals point to $62 or $63.

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more

Thanks for sharing