Gold Prices Edge Up As Dollar, Stocks Ease

Gold prices are higher in Asia trade, trading up 0.35% at $1282.98 an ounce, as escalating trade tensions between the U.S. and China triggered some safe-haven buying that helped underpin gold. U.S. President Donald Trump threatened to impose a 10% tariff on $200 billion of Chinese goods. Mounting fears over a potential trade war weighed on investors’ appetite for risk and sent global stock markets lower. The key U.S. economic highlights of the day will be building permits and housing starts.

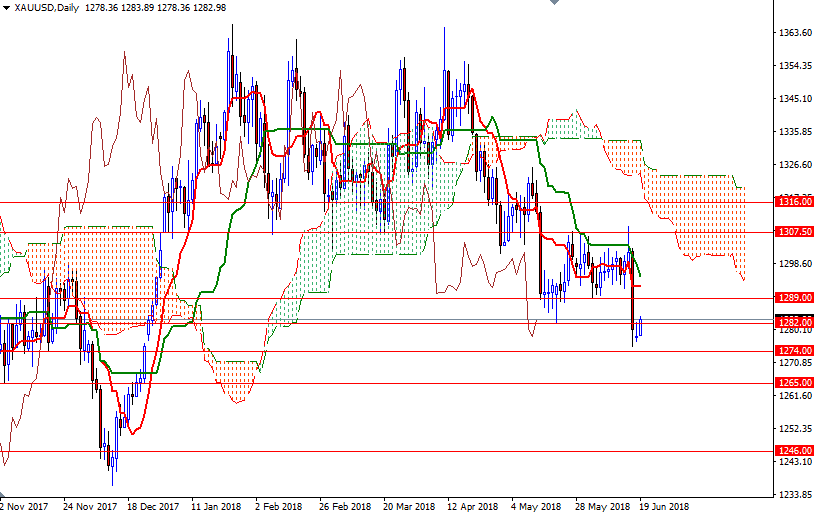

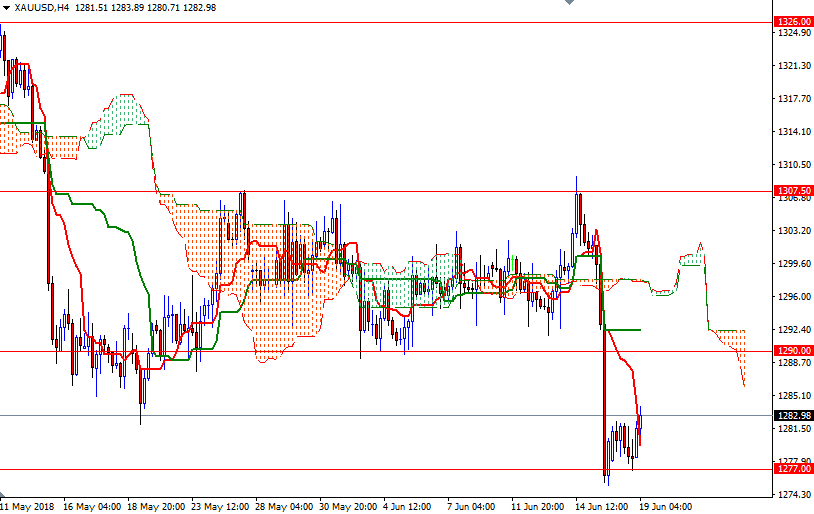

On the technical side, the first upside barrier comes in around 1286. That is followed by the former support in the 1292.50-1289 area, while the top of the weekly Ichimoku cloud in 1277/4 remains as a strategic support. XAU/USD continues to trade below the daily and the 4-hourly clouds. We also have negatively aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line), suggesting that the upside potential will be limited.

The bulls have to produce a daily close above 1292.50, the daily Kijun-Sen, to challenge 1296 and 1303-1300.50. Beyond there the 1307.50-1306 zone stands out as a solid technical resistance. If XAU/USD fails to hold above 1282/0, then keep an eye on the aforementioned support in the 1277/4 area. A break below there could foreshadow a drop to 1270. The bears have to drag prices below 1270 to gain momentum for a test of 1265.

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more