Forcerank Weekly Review (NFLX, AAPL, CBS, GRPN)

Monday marked the start of the fourth quarter and a new round of Forcerank contests. The market got off to a rocky start this week thanks to a number of surprising events in financial news. The earlier half of the week featured Theresa May’s first speech regarding Brexit, the VP Debate and increasing chatter around potential takeovers. Friday capped it off with a lackluster jobs report and a flash crash in the British pound that sent the market edging down. Major indices are now trading sideways for a second consecutive week as we head into the heart of earnings season. Nonetheless, the Forcerank consensus data kicked off Q4 correctly predicting numerous gains and losses.

Popular names including Netflix (NFLX) and Apple (AAPL) were two of the biggest gainers this week. Netflix’s shares jumped about 7.5% on news that Disney (DIS) and Apple were mulling an acquisition of the online streaming platform. Netflix has had its struggles in 2016 but a takeover could be just what they need to jump start membership growth domestically and worldwide. For Disney and Apple, a Netflix acquisition would provide them with an established brand that controls a great deal of the market with its popular original content.

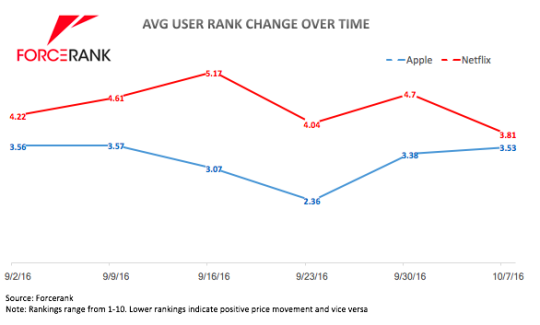

Netflix made the biggest jump in this week’s e-commerce contest, climbing to the second spot with an average user rank of 3.8. Apple, on the other hand, has firmly held down the top rank in the hardware game since the debut of the iPhone 7. The rave reviews the iPhone 7 has already received has revived Apple’s stock which had otherwise been struggling. Unfortunately, its average rank over the last 3 weeks has progressively declined to 3.53 this week from 2.36 the week ending 9/23. This is often a signal of a retracement as investors begin profit taking and shares start to slide.

We saw a number of other winners in the equities market including Bank of America (BAC), Citigroup (C) and CBS (CBS). Each of these stocks ranked in the top 3 positions of their respective games (Investment Banks, Media). Bank of America and Citigroup’s gains weren’t driven by any specific news but by a bullish reversal in their charts. The financial sector is expected to perform decently this earnings season that starts with reports from JPM, C and WFC next Friday. CBS, on the other hand, is still riding high on news that a potential merger with Viacom is on the horizon. Average user rank for the media company jumped to 3.43 from 6.39 and up almost 6 spots in the consensus rankings

Gains in the commodities market were largely driven by talks that OPEC would start to scale back oil production. Both oil and gasoline saw a significant boost following the news after struggling for the better part of the year. Natural gas also broke out this week to the tune of 10%. All three commodities (UNG, USO, UGA) were ranked highest in the commodities game and sending a strong buy signal to users.

The losers were less abundant than prior weeks. Groupon (GRPN) is consistently one of the worst ranked stocks in the e-commerce contest and rightfully so. Shares are down .5% this week and almost 8% in the past 30 days. There is a large gap at $4 that has yet to be filled, so it won’t be surprising if this remains one of the worst ranked stocks moving forward. On the forex front, the British pound took a beating . Late last night the currency took part in a rare flash crash that sent the GBP/USD to 1.22, reflecting an all time low. The British pound (FXB) is consistently one of the lowest ranked currencies in the forex game.

Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their respective games deliver the greatest positive price movement while the worst ranked companies post the biggest losses. To access this information earlier in the week, play next week’s contests and test your knowledge against hundreds of investment professionals.

Disclosure: Each week, Forcerank runs a variety of games covering different industries. What we have found, is that the highest ranked companies in their ...

more

Thanks for sharing