Broadly Defined Commodities Rise For Fifth Straight Week

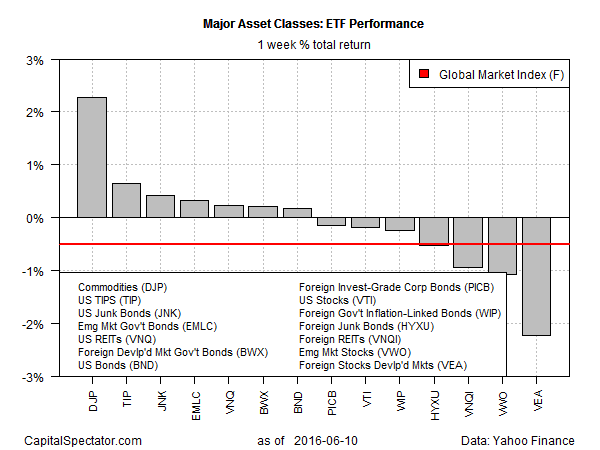

The rebound in commodities rolled on last week, delivering the biggest return for the five trading days through June 10 among the major asset classes, based on a set of exchanged-traded products. For the fifth consecutive week, the iPath Bloomberg Commodity ETN (DJP) posted a gain, rising 2.3%.

The biggest loser last week among the major asset classes: foreign equities in developed markets. The Vanguard FTSE Developed Markets ETF (VEA) lost 2.2% in total-return terms.

Despite the impressive rally in commodities and several other corners, there was a negative bias overall in markets last week. An ETF-based version of the Global Markets Index (GMI.F) — an investable, unmanaged benchmark that holds all the major asset classes in market-value weights — fell 0.5% last week. The setback marks the first weekly loss for the index in three weeks.

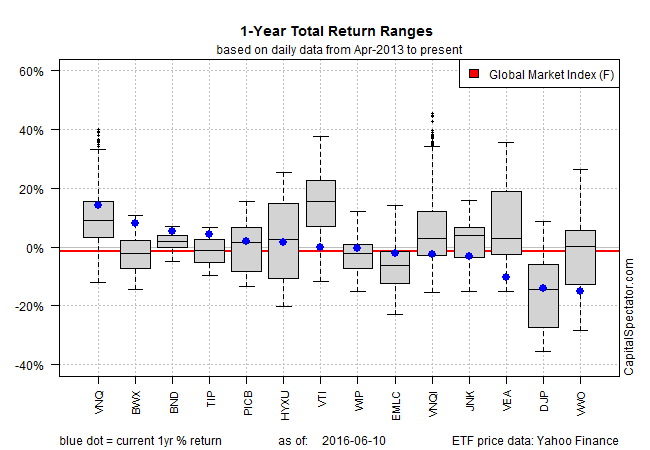

For the trailing one-year return, US real estate investment trusts (REITs) continue to hold the top spot. The Vanguard REIT ETF (VNQ) is ahead by roughly 15% in total return terms for the 12 months through June 10.

Note, too, that broadly defined commodities are no longer dead last for the trailing one-year period. For the first time in recent history, DJP’s performance wasn’t at the bottom of the 12-month ranking—a distinction that now goes to emerging-market stocks. After last week’s slide, Vanguard FTSE Emerging Market (VWO) has tumbled more than 15% for the year through June 10, earning the title of the biggest setback for one-year return among the major asset classes.

For perspective, note that GMI.F is down fractionally for the past year, shedding 0.8% for the 12 months through June 10.

Disclosure: None.