Bakken Update: Tracking Oil E&Ps With The Lowest Breakeven Prices Starting With Reeves County Texas

Breakeven oil prices are very important with today’s issues. We have a significant glut of both oil and refined product. It will take time to work through inventories. During this time, opportunities to build positions exist. Many could make a huge mistake in looking at highly levered names that have been hit the hardest in this low oil price environment. Sometimes it is better to err on the side of caution, and look at high quality names that can survive today and do very well tomorrow. Low prices are here, but those prices could rise next year. If this is the case there may be significant opportunities in higher quality names. Keep in mind, operators with leverage may feel a squeeze as interest rates increase. Some names have been lucky the Fed has decided to be dovish, but this may change in the coming quarters. Most think rates will rise this year, with additional moves in 2017.

Oil prices and the US Oil ETF (USO) look to have upside next year. This should aid in the appreciation of stock prices. I have covered some names in the Delaware Basin and STACK/SCOOP in recent articles. I will look at specific counties with low breakeven prices across the US, in a series of analyses.

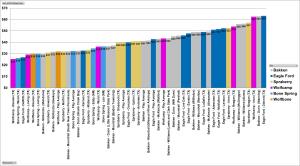

(Source: Bloomberg)

The above graph shows us the difference in breakeven prices across individual counties in the US. Reeves County, Texas may be the best according to Bloomberg. The Wolfcamp interval has provided the lowest breakeven oil price at $25.32/bbl. The Wolfbone in Reeves County may be the best vertical unconventional play. It has a breakeven of $29.93/bbl.

There are a large number of players in Reeves. The southern Delaware Basin play has expanded faster and further than expected. At one time, most believed the Wolfcamp was the main and only play. The Bone Spring interval is economic further south, making Reeves County much more attractive. The only question is how far south does it produce well, and how many Bone Spring levels are productive.

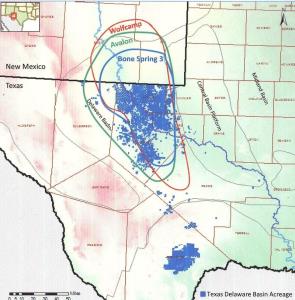

(Source: Shell)

The blue outline provides the reach of the 3rd Bone Spring. The Wolfcamp is in red and Avalon in green. These maps are never completely correct. Operators keep testing the fringe and when one hits the outline is extended. It is possible the reach is much greater than expected, with the Bone Spring butting up against the Alpine play to the southwest.

(Source: Welldatabase.com)

|

Name |

Well Count |

CUM Gas (Mcf) |

CUM Oil (bbl) |

|

OXY USA WTP LP (OXY) |

74 |

3,269,359 |

2,633,988 |

|

COG OPERATING LLC (CXO) |

59 |

4,417,970 |

2,812,328 |

|

ANADARKO E&P ONSHORE LLC (APC) |

50 |

333,401 |

95,854 |

|

Apache Corporation (APA) |

47 |

1,764,730 |

530,069 |

|

BHP BILLITON PET(TXLA OP) CO (BHP) |

43 |

12,356,226 |

2,645,408 |

|

EOG RESOURCES, INC. (EOG) |

36 |

2,944,938 |

935,324 |

|

OXY USA INC. (OXY) |

31 |

1,802,085 |

1,554,047 |

|

CENTENNIAL RESOURCE PROD (SRAQU) |

30 |

545,534 |

280,415 |

|

THOMPSON, J. CLEO |

24 |

1,399,343 |

739,886 |

|

CIMAREX ENERGY CO. (XEC) |

22 |

2,543,100 |

520,651 |

|

ENERGEN RESOURCES CORPORATION (EGN) |

22 |

1,549,191 |

207,612 |

|

RESOLUTE NATURAL RES. CO., LLC (REN) |

21 |

1,712,790 |

363,839 |

|

CHEVRON U. S. A. INC. (CVX) |

19 |

63,165 |

41,412 |

|

PATRIOT RESOURCES, INC. |

16 |

526,693 |

405,357 |

|

XTO ENERGY INC. (XOM) |

15 |

0 |

0 |

|

PRIMEXX OPERATING CORPORATION |

14 |

645,299 |

271,918 |

|

ROSETTA RESOURCES OPERATING LP (NBL) |

14 |

160,858 |

45,003 |

|

ENDURANCE RESOURCES LLC |

13 |

1,134,846 |

125,333 |

|

PANTHER EXPLORATION, LLC |

13 |

480,381 |

96,387 |

|

PARSLEY ENERGY OPERATIONS, LLC (PE) |

10 |

489,632 |

250,155 |

(Source: Welldatabase.com)

There are a large number of operators in Reeves County. The data above is provided through Welldatabase.com. It covers wells and permits since January of 2015. Occidental is the most active operator with 74 wells. Concho is second followed by Anadarko. BHP Billiton (BHP) is the largest producer of natural gas by a large margin. Concho has produced the most oil.

It is very important to know where the lowest breakeven prices are when investing in unconventional oil and gas. Knowing the players with leasehold there is also important. The economics of each E&P can still be different, but it provides a basis for comparison. By knowing geology, it is also possible to weigh the prospects of increases to valuation. If an area already has an economic interval, and operator can work this while it de-risks other source rock. The addition of another target can cause stock prices to pop in a hurry, and stimulate growth within an operator. Knowing when and where upcoming tests also may provide an opportunity. In part two, we will look at some of the operators in Reeves County.

Continue to Part 2 >>

Data for the above article is provided by welldatabase.com. This article is limited to the dissemination of general information pertaining to its advisory services, together with access to additional ...

more

Thanks for sharing