Update Portfolio Builder: Now Including 3x Leveraged Universal Investment Strategy (SPXL/TMF)

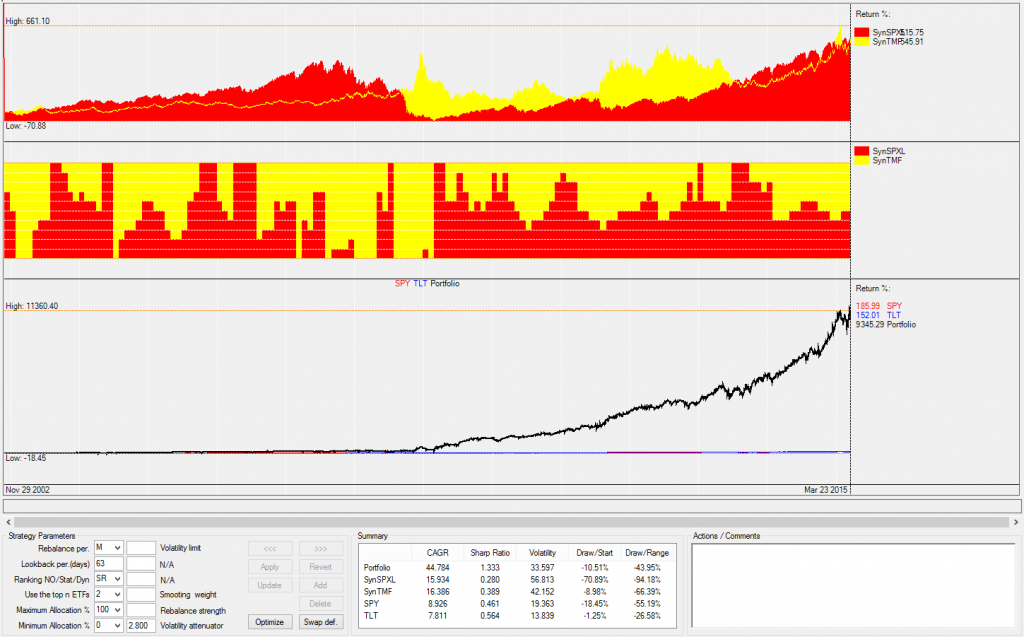

By request of several followers, we have now included the 3 times leveraged version of the Universal Investment Strategy using synthetic SPXL and TMF data from 2002.

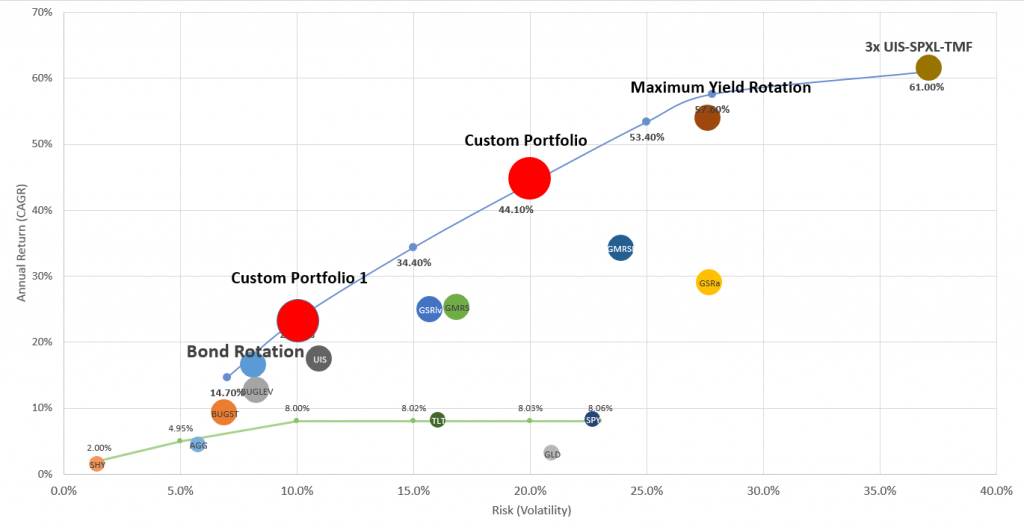

We’re about to publish a full article on this exciting option for this weekend, but want to pre-alert you about this upcoming adition. While this is a very aggressive strategy, it blends very nicely with a 10%-20% allocation into a portfolio targeting Maximum annual return with a 10% or 20% volatility constraint. We have therefore also updated the optimized portfolios, and by another request included the MaxCAGR with volatility constraint of 20% and 25% volatility.

Here is a preview of the full backtest since 2002:

A visualization of the new portfolio options with blends of this strategy:

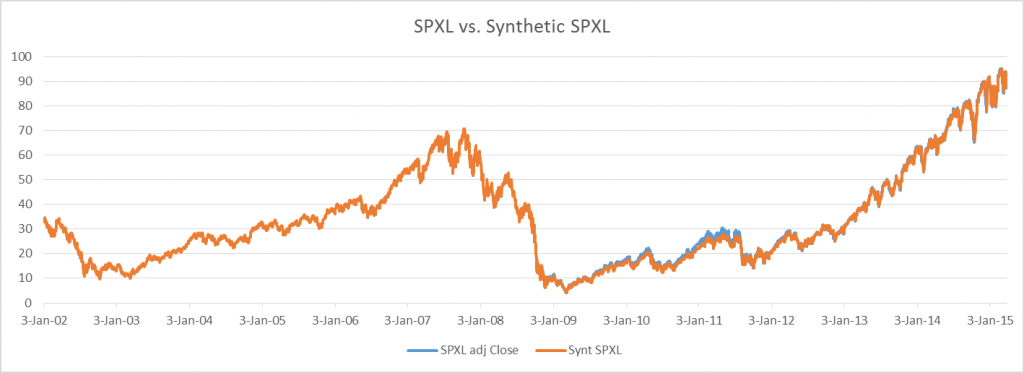

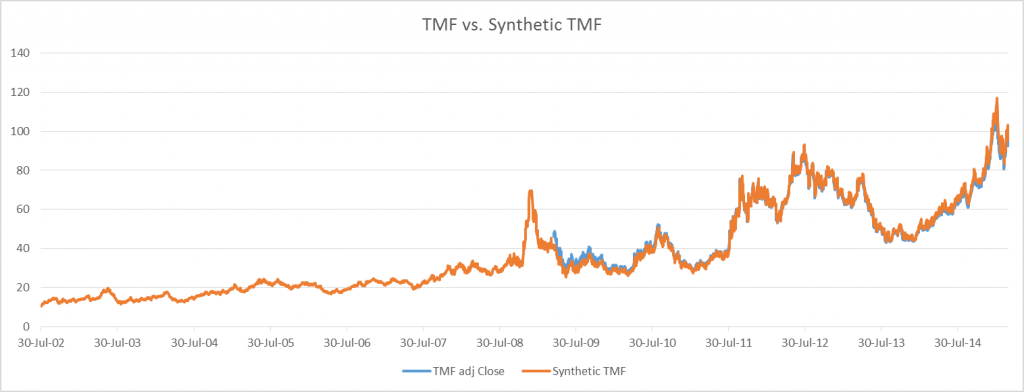

And the timeseries of the synthetically constructed SPXL and TMF since 2002 (both ETF have an inception date in 2009). We will explain the methodology of this more in detail in the upcoming post.