Trumponomic And Great Recession Nuggets From Market Monetarists

With the advent of Trumponomics, I try to glean information from market monetarists. I will point out important nuggets that have come across recently.

I embrace some monetarism, like the concept of real helicopter money. I like the way market monetarists track the real growth in the economy. I don't know how NGDP targeting would work out, but a futures market could help. But clearly the Fed has done and could do more to help stabilize the economy, and it has done some things to destabilize it, like mispricing risk in the MBSs last decade.

But there are a few nuggets from the MM boys to share. For example, Lars Christensen pointed this out in a tweet:

Republicans are Austrians when they are in opposition and Keynesian when they are in power. They are never monetarists.

Scott Sumner has a few very important nuggets:

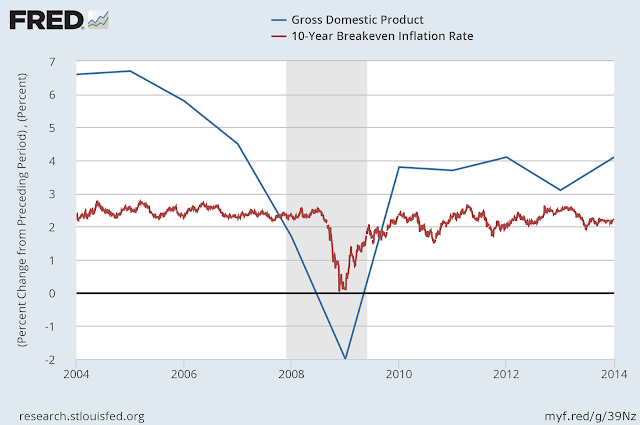

1. Bond yields depend more on NGDP than on inflation, according to Professor Sumner. They usually move together, but don't always move together, and in the Great Recession, bond yields tracked the decline of NGDP while inflation stayed steady for awhile. I have FRED charts showing this relationship of NGDP decline to inflation during the Great Recession. NGDP declined while inflation was stubborn:

Graph 1

Graph 2

Chart 2 shows that bond traders were likely fooled. The rates for the 10 year declined starting in mid 2007. Then they picked back up as traders noticed that inflation held steady through much of 2008. That did not have a happy ending for those who sold early as 2009 approached. Had the bond people been watching NGDP instead of inflation they would have understood what was happening. This is just my take from looking at the graph.

Sumner says supply side will increase yields over time. Of course we didn't have trillions of dollars working as collateral in the derivatives markets back then. We do now. This part of the new normal may cause this relationship to fail as rates rise. There is likely a cap on rates or the system will disintegrate. Since this has not happened yet, I certainly don't know what that disintegration would look like. So this is just another puzzle that could seriously confuse bond traders down the road.

2. Sumner says that supply side Trumponomics will likely be modest due to two factors:

A. Supply-side policies are simply not that effective; they don’t boost growth as much as the advocates claim.

B. The market sees only a very modest probability that Trump will enact major supply-side reforms, either because he doesn’t want to, or because Congress will water it all down.

Sumner does not believe in massive and reckless supply side economics. He says he supports modest supply side economics. Since I think everything in moderation is good, his call for restraint makes sense.

I am guessing that Scott Sumner would be uncomfortable with anything over 3 percent RGDP growth and 2 percent inflation totaling 5 percent NGDP.

3. The United States, for once, does not lead the world in globalization. He refers to the ending of the TPP and the Asian-Pacific players' advancement of a trade deal lead by China. The discussions are called Regional Comprehensive Economic Partnership (RCEP) trade talks. It turns out that this is not a big free trade deal, so China will push for the Free Trade Area of the Asia Pacific (FTAAP).

It appears that China leads the world in globalization. How that will work out for the USA remains to be seen. Perhaps we could be invited later.

I don't like abuses of globalization. However, raising barriers to trade when we are likely headed into a recession does not seem wise, unless Trump wants to turn Austrian on us and liquidate everything like the Nowhere Man we hope he isn't.

As for the charts above, keeping track of NGDP is a useful tool for bond traders. The idea of a futures market that would track NGDP is a fascinating idea that would give traders some heads up on what really matters, because inflation tracking can let them down.

Disclosure: I am not an investment counselor nor am I an attorney so my views are not to be considered investment advice.