Short-Term Trend Continues

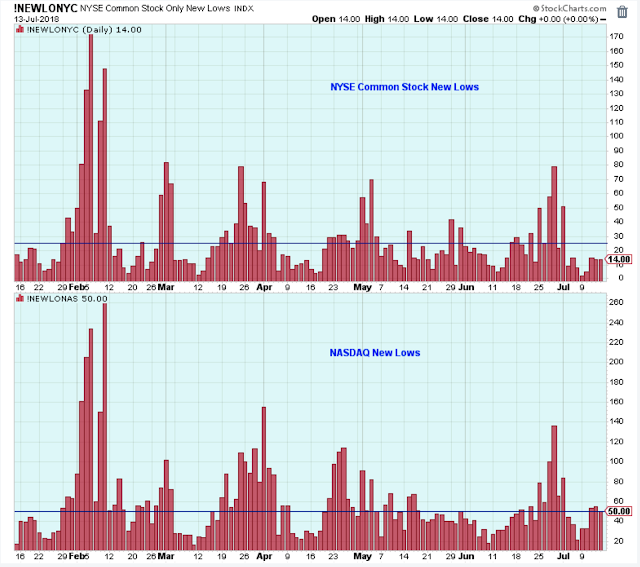

The short-term uptrend continues, although it isn't a very strong trend. There are very few new 52-week lows on the NYSE, but on the Nasdaq there are just a few too many which reveals a bit of market weakness.

The SPX is pushing upwards and taking out recent highs, but it is doing this without the help of the Semiconductors which are still below the 50-day. Without participation from this group, I am doubtful that the indexes can go much higher.

Another thing that I don't like is the weakness in this packaging index. I think these companies are being hurt by the high price of paper products, but still, this doesn't seem right because these stocks tend to move with the general market.

It isn't all bad news. The Industrials are starting to show signs of life. However, I wonder how much conviction there is for these stocks. Also, the rally in these stocks could just be part of an oversold bounce.

Bottom line: There are enough negatives that I can't blame you if you decided to sit out or take early profits on the current uptrend.

The Longer-Term Outlook

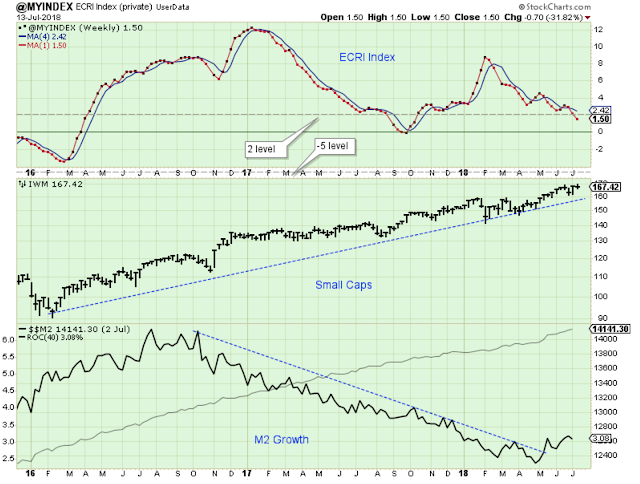

The ECRI Index has dipped under the 2-level which I think means that we need to kick up the level of caution a bit towards holding stocks.

I will acknowledge that this index took a similar dip last fall, and the stock market barely noticed. But I think the circumstances are a little different now, and the market is more vulnerable to a sell off.

Here is a look at the ECRI Index and the S&P-1500. Last fall the market was in such a strong uptrend that it just powered through any bad news or dips in the economy.

The market still looks strong, but it is under resistance in what might be a sideways pattern. So, if the ECRI Index keeps ticking lower, I would expect stocks to struggle.

Outlook Summary:

The long-term outlook is cautious.

The medium-term trend is up as of May-10.

The short-term trend is up as of Jul-06.

The medium-term trend for bond prices is up as of Jun-19 (yields lower, prices higher).

Investing Themes:

Technology

Medical Products

Cyber Security

Payment Processors

Small and Micro Caps - this period of out-performance may be ending

Gaming

Strategy:

- Buy large cap stocks and ETFs at the lows of the medium or short-term trends.

- Buy small cap growth stocks on breaks to new highs in the early stages of short-term up trends.

- Stop buying when the short-term trend is at the top of the range.

- Take partial profits when the uptrend starts to struggle at the highs.

- Never invest based on personal politics.

Disclaimer: I am not a registered investment advisor. My comments above reflect my view of the market, and what I am doing with my accounts. The analysis is not a recommendation to buy, ...

more