Major Asset Classes | April 2015 | Performance Review

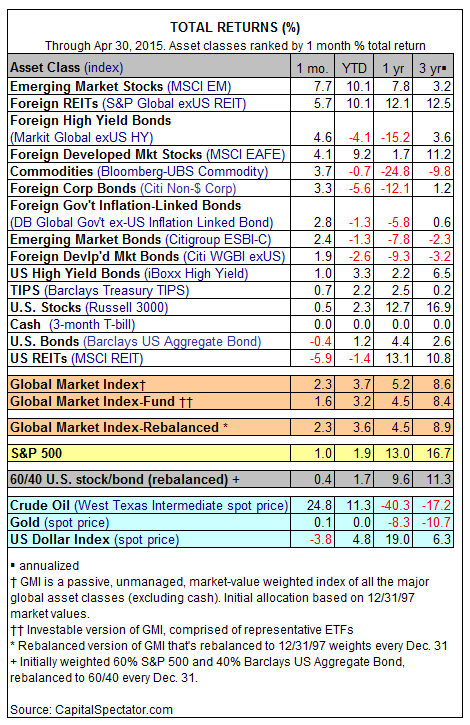

In a change of pace relative to recent history, virtually all of the major asset classes posted gains in April… with one glaring exception: US real estate investment trusts (REITs). This formerly high-flying market tumbled a hefty 5.9% last month (MSCI REIT Index)—its biggest monthly slide in nearly two years. Otherwise, April witnessed gains across a broad spectrum of assets. The big winner last month: stocks in emerging markets. The MSCI Emerging Markets Index soared 7.7% in April, the strongest monthly advance for this benchmark in more than three years.

Commodities broadly defined also bounced back in April, rising 3.7% (Bloomberg Commodity Index), led by a solid gain for crude oil. Meanwhile, the US dollar finally stumbled in April after a powerful rally that began last summer. The US Dollar Index suffered its first monthly round of red ink in ten months, although the greenback’s weakness reversed a headwind on pricing foreign assets in dollar terms.

The US stock market kept its head above water in April, but just barely. The Russell 3000 Index edge up 0.5% last month. US bonds, meanwhile, ticked lower by 0.4%, based on last month’s total return for the Barclays Aggregate Index.

As for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights, April was kind to this broadly diversified index. GMI gained a solid 2.3% last month, delivering one of the stronger monthly gains in recent history.

Disclosure: None