Gold Intermarket: Bullish Continuation Pattern On 2-Yr T-Yield Is Bad News

Two-year treasury yield represents short-term inflation/Fed rate hike bets, and thus rising yield is usually accompanied by a drop Gold.

Gold & 2-yr yield (shaded area) comparison chart

- Gold topped out, while the 2-year treasury yield bottomed out in July 2016.

- However, the sharp rally in Gold from December low of $1122.81 has not been accompanied by a sharp drop in the two-year treasury yield.

- Moreover, the yield has formed a bullish flag pattern during the same period.

US 2-year treasury yield - Bullish flag pattern

Daily chart

- A bullish break would mark the continuation of the rally from the November lows. That would mean the continuation of the Trump trade.

- As per the measured height technique, the bullish break would open doors for 1.844%.

- The daily RSI is above 50.00 and the DMI also shows a bullish crossover. Thus, a bullish break appears more likely than not.

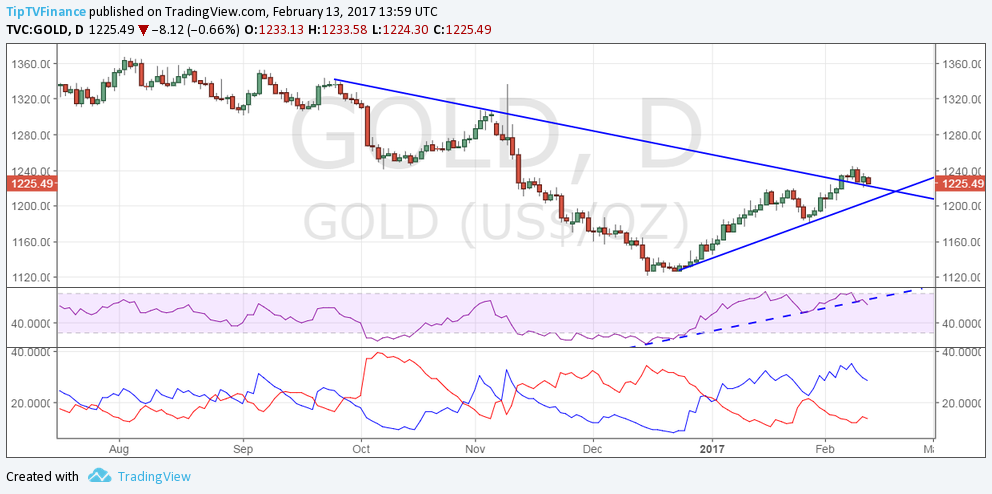

Gold - Trend reversal below rising trend line support

Daily chart

- Gold’s failure around $1245 levels last week followed by a drop to sliding trend line support suggests a short-term top is in place there and could yield a pull back to $1220 (Jan 24 high), under which a major support is seen around $1206 (rising trend line support).

- A daily close below the same would signal a trend reversal and open doors for a sell-off to $1157.30 (Dec 5 low).

- The daily RSI has breached the rising trend line… plus also shows a double top formation, thus the odds of a more pronounced drop to sub 1200 levels looks likely… especially if the two-year yield break from flag pattern.

To conclude

- Bullish break in the 2-year yield would open doors for break below $1200 levels.

- Gold demand could rise again if prices see a daily close above $1244.71 (Feb 8 high).

Comments

Please wait...

Comment posted successfully.

No Thumbs up yet!