Below Trade Expectations Firm Corn And Soybean Prices

Market Analysis

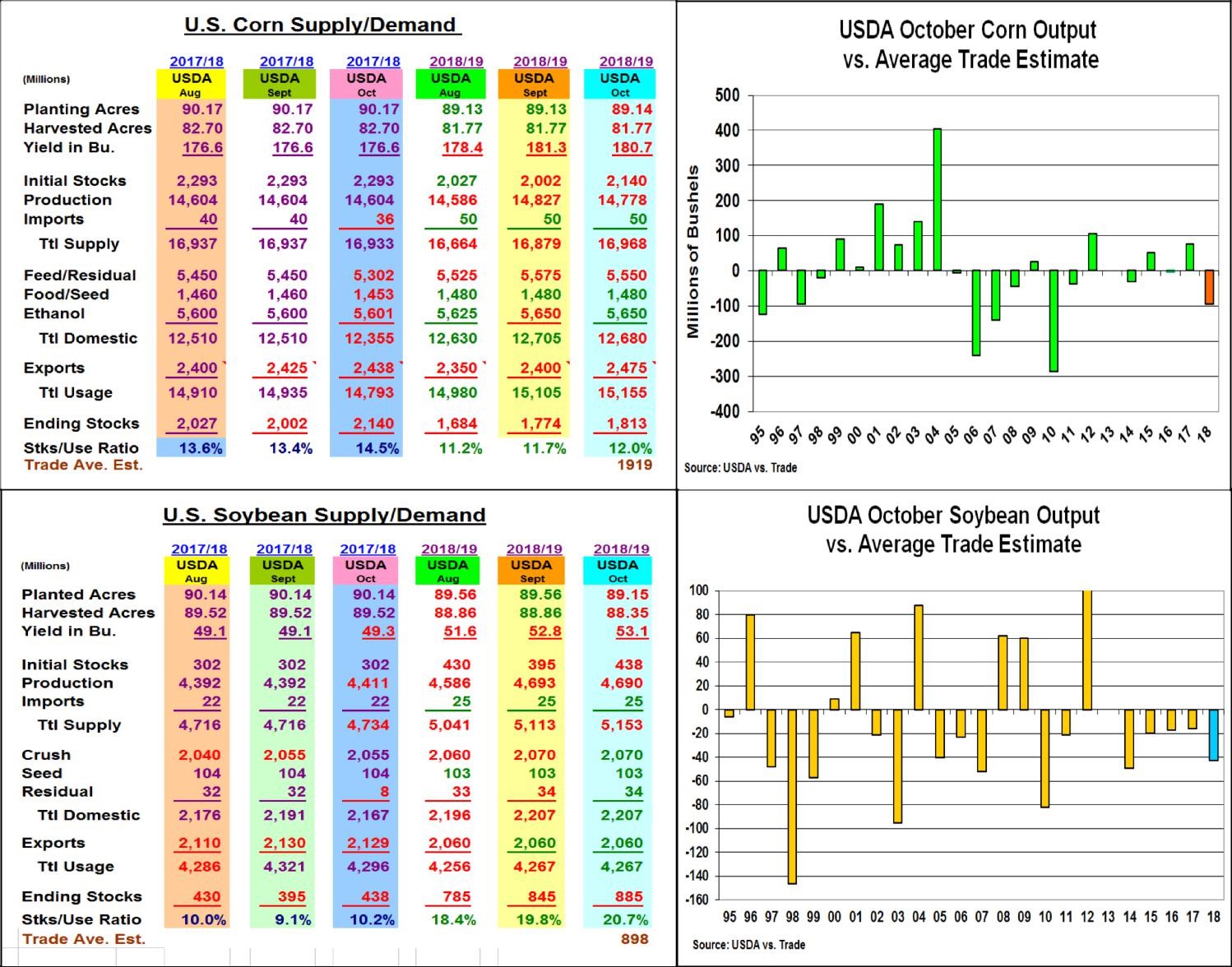

With the general market mantra “Big crops get bigger” and spillover negative economic ideas from a weakening US stock market, October’s below trade expectations in both corn & soybean outputs caught the market leaning. With the trade expecting a higher yield, corn’s 1.1 bu low-er US level provided the biggest percent price lift. Bean’s lower planting & harvested acres also limited any expansion in October’s US bean crop. Fund short-covering added to the support after prices were under pressure all week ahead of Thursday’s report.

With trade expecting 0.5 bu rise in corn’s yield, this month’s 94 million bu. drop in the US output to 14.778 billion bu. was the largest deviation from expectations since 2012 and sharpest drop vs. the trade since 2010. Yield declines across the Midwest (IL, IA & MI -2 bu, NE - 3 and SD & KS -1) were behind this smaller crop while higher ECB (IN & OH +2) yields countered this trend. A 200-250 drop in the US average ear count suggests a pick-up in field losses from last month. Despite numerous state changes, the USDA only reduce corn’s harvested area by 3,000 acres vs. June this month, After last month’s 138 million bu. jump in stocks, corn’s 49 million small crop and 50 million stronger demand (mostly exports) limited new-crop’s stocks forecast to 1.813 billion bu. vs. the trade’s 1.919 level.

The USDA increased its October bean yield by 0.3 bu to 53.1 bu, but their 514,000 lower US harvested area counters this yield jump producing a 4.690 billion bu. crop. This month’s 43 million lower USDA output vs. the trade followed the previous 4 years trend & is the highest deviation since 2014. The USDA’s dramatic 8% drop in average pod weight vs a 6% rise in US pod numbers needs watching with field losses mounting. Sept.’s 43 million higher ending stocks carried over into 2018/19’s stocks when no demand changes were made this month.

(Click on image to enlarge)

What’s Ahead

Despite a lower output than expected, soybeans supplies remain sizable with only a major weather or trade change likely opening up potential above $9.00. Look to utilize the USDA’s bean stipend in your marketings. However, corn’s better foreign demand outlook & field loss vulnerability going forward suggests feeders covering 4th quarter needs and sellers holding for post-harvest sales at $3.90 and above.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of The PRICE Futures Group, any of its ...

more