A New Study Quantifies The Impact Of Time Horizon On Risk

Can you distinguish alpha from beta? Child’s play, right? Measure an investment portfolio against a relevant benchmark and, voila, all is clear. But as a new paper reminds, analyzing risk and return based on time horizon changes a black-and-white world of equity factors into 50 shades of gray.

“Different risk factors are priced over different horizons,” write the authors of “Short-horizon beta or long-horizon alpha?” The practical insight: “What looks like a beta premium to investors with a short or intermediate investment horizon may look like alpha to investors with long investment horizons,” explain Avraham Kamara (University of Washington), Robert Korajczyk (Northwestern University), Xiaoxia Lou (University of Delaware), and Ronnie Sadka (Boston College).

Surprising? Maybe not… once you think about how time changes investment results—and perspectives. But how often do we filter risk profiles through the window of time? Kamara and company effectively argue that making this a routine task will dispense a deeper level of clarity in our factor-analysis travels.

What’s driving this variation in results based on differing time horizons? “We conjecture that different investors may have different rebalancing horizons and, therefore, investors’ view of systematic risk of a given asset may be horizon dependent, leading to a clientele effect in which one horizon clientele underweights certain assets, causing another clientele to overweight those assets.”

Regardless of the underlying dynamics, the paper demonstrates that the strength of risk factors — small-cap, value, momentum, etc. — ebbs and flows across time horizons, based on analysis of data via the Center of Research in Security Prices for US stocks during 1962-2015. For example, the return for the market beta is slight at a one-month horizon, surges during horizons from two to 13 months, and collapses for 23-25 months before easing into a range of moderate performances for 31-61 months.

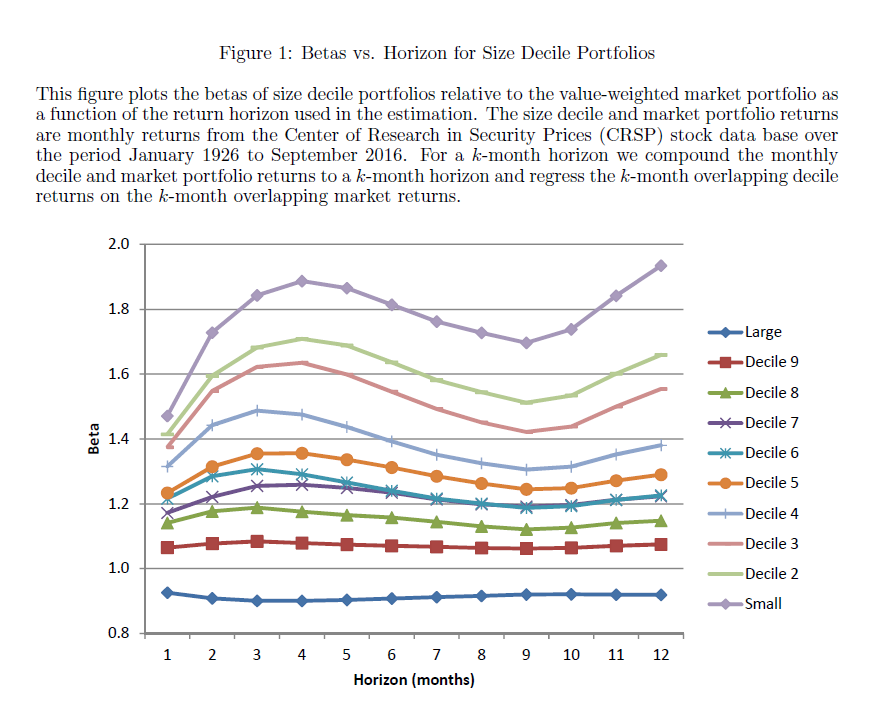

In another example, the authors compare betas across size deciles for time horizons ranging from one to 12 months, as shown in the chart below. The effect is especially pronounced for the smallest decile of stocks, which post a relatively wide range of betas for different horizons (purple line at top of chart).

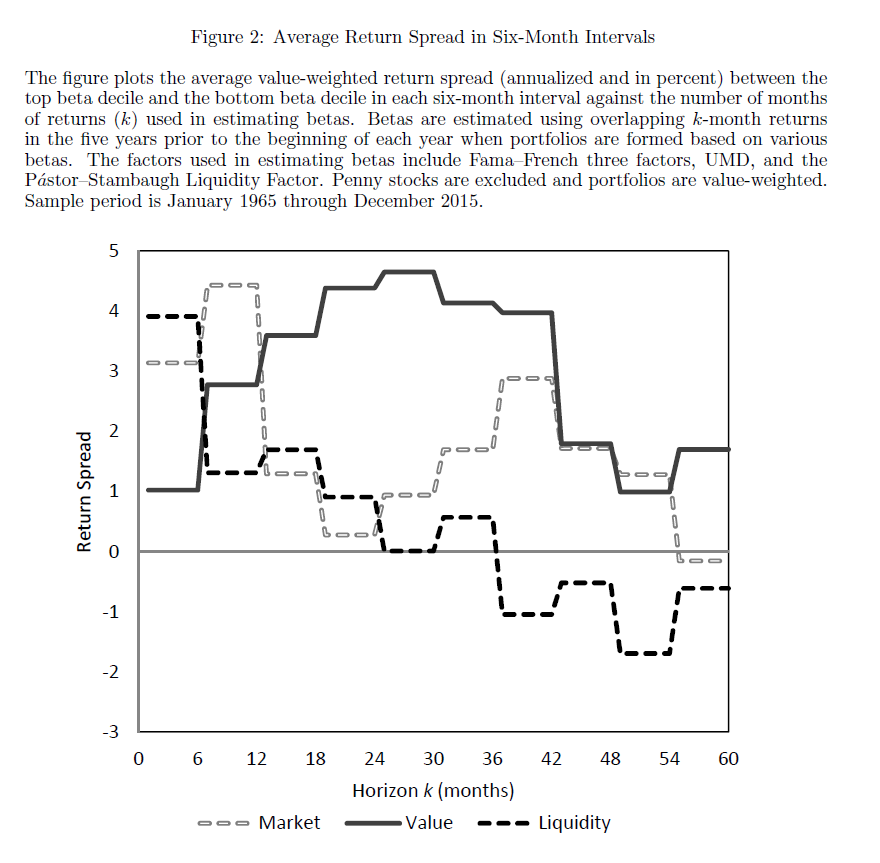

It’s also interesting to note that returns are highest at different time horizons for different risk factors. For instance, the paper finds that the liquidity beta exhibits a relatively high premium at short horizons (3-6 months); the market beta’s premium rises at 6-12 months, and the value premium (high minus low beta) jumps at 2-3 year horizons.

Note, too, that some risk premiums aren’t priced at certain horizons. For example, liquidity risk isn’t priced at long horizons while the market and value/growth risk isn’t priced at the monthly horizon, the authors report.

For a clearer view of time influence, the authors plot the average risk premia at different horizons for the market, value and liquidity factors in the chart below. As you can see, the betas show a fair degree of independence from each other, which implies that diversifying across factors can strengthen diversification benefits for an equity portfolio.

Overall, the paper reminds that time horizon is a crucial variable to consider for designing and managing portfolios. “Some factors that are risky from the perspective of short-run investors may not be so from the perspective of long-run of investors, and vice versa,” the authors observe.

Yes, we already knew that – value investing, by design, is always advertised as a relatively long-horizon strategy while momentum is typically profiled as a short-term play, for instance. But thanks to Kamara and his co-authors, we have a fresh set of numbers that validates the intuition on a deeper level.

Disclosure: None.