A Look At The Current Cryptocurrency Market Setback

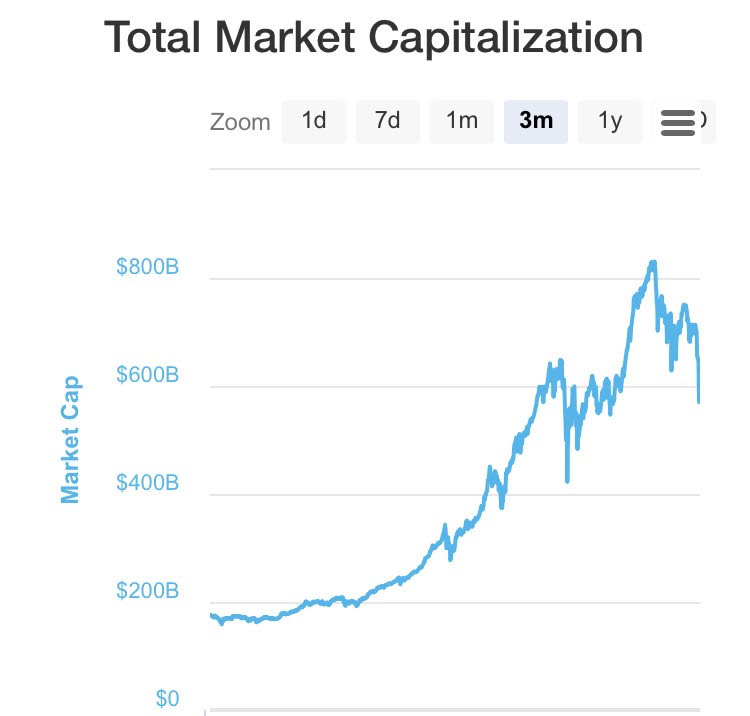

The cryptocurrency market suffered a major setback last night. In just a 24 hour window, CoinMarketCap.com data tells that the industry’s total valuation shrunk from over $700 billion to under $550 billion.

Of the top 100 coins as ranked by market cap, astonishingly all of them regressed during this time, save for just Tether (USDT), a currency tied directly to the US dollar. The impact on notable coins affected include Bitcoin (BTC) sinking below $12,000 for the first time since early December, Bitcoin Cash (BCH) dipping under the $2,000 mark, Ripple’s (XRP) price hitting a 3-week low under $1.30, and Ethereum (ETH) bottoming out at $1,000. Essentially no asset acted as a safe haven during the sell-off, with top coins seeing decreases as high as 40%.

Amidst all the downward activity, Bitcoin’s market dominance rose a few percentage points up to 36% as altcoin investors likely sold their smaller assets and moved capital into the market-leader to curtail larger losses. Bitcoin’s dominance had been hovering in the low 30% range after declining essentially non-stop for the past year due to a glut of alternative digital assets breaking into the cryptocurrency realm.

Many are chalking up the red numbers to the recent uncertainty accumulating in Asia, where regulatory pressure from Beijing and Seoul have somewhat halted global confidence on cryptocurrency integration. It’s likely, too, that many investors were taking profits during this stretch, as most of the industry’s assets had continued seeing major growth over the past month.

But while investors’ portfolios took a major hit, recent history might offer some optimism as to how it could rebound. Similar market losses that occurred around Christmas time, as well as multiple other market regressions in November, show that the historical response to such downturns has simply been more capital pumped in as a result.

Confident cryptocurrency investors are calling to buy the dips and still maintain that the industry hitting a $1 trillion market valuation is just around the corner. Those more skeptical view this development as a mere preview of what’s to come with the budding digital assets sector: an impending fatal collapse.

Regardless of stance, the sector is, by all means, creating a tremendous amount of buzz that few within the finance and tech industries can wholly ignore.

Disclaimer: The ideas expressed in this writing are my own personal opinions and should not be taken as financial advice in any regard. Individuals or institutions seeking to invest in the any of the ...

more

What's your take on #Kodak getting into the cryptocurrency game?

Firstly, I think it's a trend that we're going to see more and more of. Because of both the growing popularity and advantageous technology that underpin cryptocurrencies, companies will likely start integrating cryptocurrency buzzwords (i.e. "blockchain," "decentralized," etc.) into their marketing strategies and some will even launch tokens native to the companies' offerings themselves.

What Kodak is attempting to do here is to solve the seemingly perpetual problem of image rights management amongst photographers through the KodakCoin ecosystem, which will be sold through an "initial coin offering" in late January. It is a practical idea which many photographers who have run into licensing issues in the past will be especially enticed by.

It is yet to be seen how the project pans out. For example, if the platform is not user-friendly or the tokens not easily accessible, the project will have a difficult time gaining widescale adoption and use amongst its intended audience. Should it be a success, however, expect many more companies to turn to blockchain-based solution to tackle issues unique to their respective industries.

In the meanwhile, ever since the announcement, Kodak's stock price has more than tripled.

How long do you think the uncertainty in Asia will last?

That's the million dollar question now, as the uncertainty underpinning cryptocurrency all along has played such an integral role in how its markets behave. South Korea, which ranks third for global Bitcoin trading, said the country is currently in discussion about future regulation, yet no date has been announced for its next comment. Read more here: www.cnbc.com/.../...pto-exchanges-after-talks.html

China's stance has been clear on cryptocurrency for some time now, but the potential for further crackdown is now what's in question. Again, it's unclear exactly when upcoming developments might occur, but 2018 will be a very defining moment for the cryptocurrency industry, especially with regards to how it's treated in the far east. Here's more on the recent China news: www.cnbc.com/.../...-cryptocurrency-crackdown.html

Stay tuned for more!

Good answers Nathan!

Thanks, Aaron!

What's the highest bitcoin has gone, and how high do you think it can go?

What's the 2nd most valuable cryptocurrency?

Great questions!

1) Around a month ago in mid-December, Bitcoin's trading value peaked at around $19,800-$20,000 depending on the exchange. It's tough to say definitively how it will fare in the future, as it's part of such a young market where we're awaiting upgrades to the network, potential regulation, new channels of adoption, and more. Until these developments take shape, it is extremely difficult to predict the future trajectory of Bitcoin. Stay tuned to see where it goes next!

2) If the metric you're going by is market capitalization, then Ethereum (ETH) is currently #2 in valuation. However, both Ripple (XRP) and Bitcoin Cash (BCH) have held the runner-up spot as well in the past few months.