Tech Talk: Getting Cautious

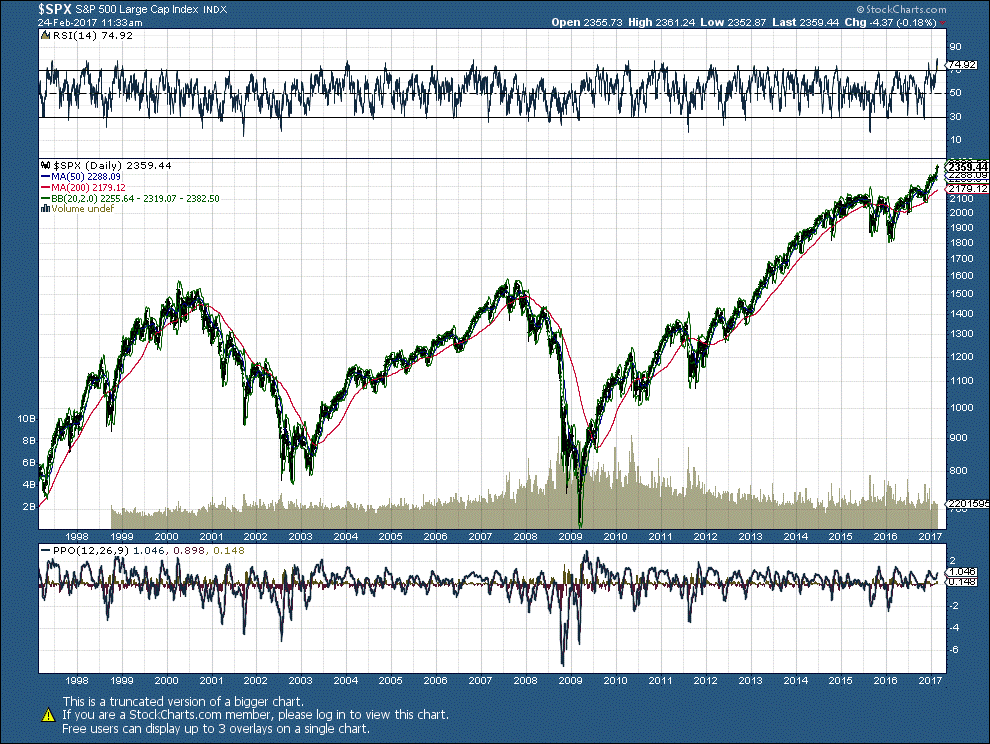

I’m getting pretty cautious in my stock holdings, and the chart above – it goes back 20 years – illustrates why. Since the 2008 crash, the S&P 500 has more than tripled. The markets were weakening last November, before the US elections, and Donald Trump’s surprise win gave them some more wind.

In my last column, I suggested that diversifying out of North America was a good idea, and suggested a couple of ETFs focused on developing world economies. Since then, I have looked carefully at my holdings and unloaded a few that were weakening – notably HAL, MGA, PDS and NBR. That gave me a stash of cash to apply as the market develops.

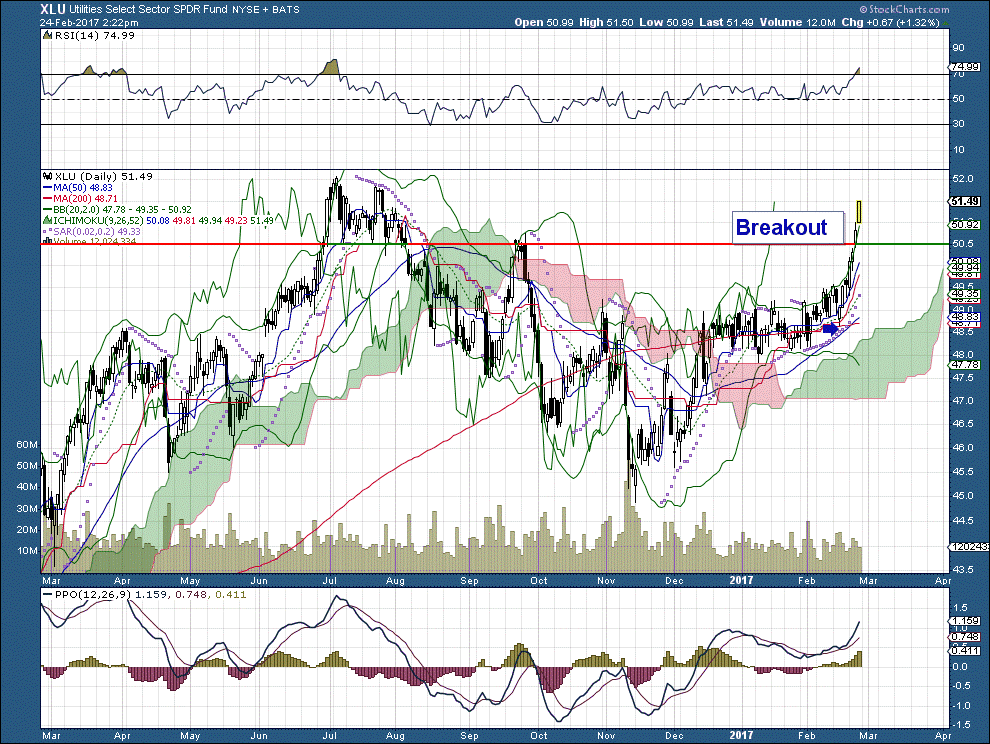

I also bought a position in the defensive utilities ETF, shown above. The blue arrow points to a golden cross, which regular readers will know is typically a bullish indicator.

I have drawn the green and red auto support resistance line at what I take to be an important breakout point – just north of the unit’s last high, in September.

Disclaimer: The analysis and ideas presented here should never be seen as a buy or sell recommendation. I am an active trader, but I discuss stocks for informational purposes only. By reading my ...

more

thanks for sharing