Fitbit Beat Q2 2017 Expectations With Channel Inventory Levels Improving

Fitbit (FIT) entered its Q2 2017 quarterly report with its stock performing at its lowest valuation since becoming a publicly traded company. With analysts largely moving to the sidelines earlier in 2017 and others lowering their rating and earnings’ forecasts, the stock price recently fell below $5 per share. But when Fitbit reported its Q2 results, they weren’t as bad as many of the analysts had anticipated and Fitbit managed very well through a tough transition period. Some of the Q2 2017 results are as follows:

- Non-GAAP loss per share (excluding growing stock-based compensation and some litigation expenses) of -$0.08 exceeded estimates by $.07 a share.

- Sold 3.4 million devices in the quarter or a total of 67 million devices sold to-date. Devices sold in Q2 2017 were down 40% YOY from the second quarter of 2016.

- The Fitbit app was the #1 downloaded health and fitness application, based on U.S. downloads, on both the iOS and Android platforms.

- Generated $353 million in revenue (-39.8% YOY), beating estimates by $11.43mm. Sell-in unit growth up 14% sequentially.

- For the second quarter in a row, using North America as a proxy and consumer demand, sell-through surpassed sell-in unit shipment numbers. Sell-through is now expected to match sell-in looking forward.

- Average selling price increased 4% sequentially from the first quarter of 2017 and 2% YOY from the second quarter of 2016 to $100.76 per device. Accessory and other revenue added the equivalent of $3.98 per device.

- Gross margin was 42.2% and non-GAAP gross margin was 43.0%, up 100bps YOY and nearly 300bps sequentially. Each favorably impacted by product mix, the increase in average selling price and lower warranty expense.

- GAAP operating expenses declined 10% to $213 million and non-GAAP operating expenses declined 7% to $191 million, both year-over-year from the second quarter of 2016.

- Direct channel continued to be an area of strength, advancing 34% year-over-year to $48 million.

That last bullet point regarding Fitbit’s direct-to-consumer digital sales growth is a key point. This segment today represents almost a 1/6th of the total business in terms of revenues, as it continues growing year-over-year. Additionally, this business is a stabilizing factor for the overall business model that highlights the brands strength while leveraging profit margin performance. Investors would be wise to recognize and/or correlate direct-to-consumer sales as exhibiting core business stability that maintains a long tailwind of growing sales.

Fitbit is a global company with sales in dozens of countries from North America to Australia and everywhere in between. The regions for which Fitbit conducts selling activities are quite differentiated and consisting of unique market challenges that exist from both a consumer and competitive standpoint. Having said that, Fitbit has maintained a leading market share position in most every major region around the world. Even in regions whereby Fitbit competes directly with the likes of Samsung and Apple (AAPL), the consumer goods Company has performed very well with its product distribution, sales and brand image given its market share position to-date. Having said that, let’s now take a look at Fitbit’s regional performance during the 2nd quarter of 2017 below:

- International revenue grew 9% to $154 million, representing 44% of revenue.

- Asia Pac turned the corner with revenue up 46% to $21 million.

- EMEA revenues up 9% to $109 million.

- In Americas, excluding the U.S., revenue declined 11% to $24 million.

- U.S. sales declined 55% to $199 million, representing 56% of revenue.

- Overall average selling price increased YOY and sequentially to $100.76. This primarily was a result of product mix shift, including better demand for the Blaze device.

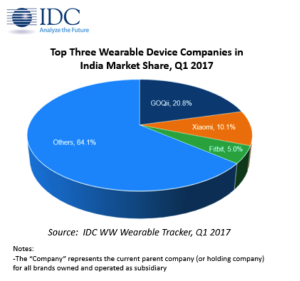

As always, I look at the respective regional results to examine or extrapolate any anomalies in the reporting. Certainly the turn in the Asia-Pac results represents an anomaly to better understand. It should be understood by investors that Australia is one of the more mature markets for Fitbit in the Asia-Pac region while the Company expanded into China, Singapore, India and other countries only a year ago. Even with this expanded distribution channel throughout Asia-Pac that continues to this day, the Company has found many difficulties going up against the likes of Xiaomi and GoQii in Asia-Pac as they offer lower price points and better distribution models in the region. The Q2 2017 Fitbit Asia-Pac upturn was likely the result of a major new distribution deal and not true sell-through results. This will make next year's performance in the region for the same period a difficult comp to achieve.

Now let’s talk a little more about what has given rise to improving gross margins and the improved confidence Fitbit’s management team exhibited with respect to the back half of the year. One of the hardest cycles to manage for a rapidly growing company is the dichotomy that exists between sell-in and sell-through. Sell-in is the process whereby a vendor/manufacturer will sell product into the retail channel or a distributor. These sell-in sales are what the company reports in their quarterly results. Sell-through is very different than sell-in and it is not reported in the quarterly results, but rather discussed on conference calls. Sell-through is the activity whereby a retailer or distributor sells product to a consumer. So when Target (TGT) or Best Buy (BBY) sell a Fitbit Charge 2 to a consumer this is known as sell-through.

During Fitbit’s expansionary business cycle the company grew sales through massive pipeline builds into retailers and distribution partners around the world and while the category of wearables was immature. It’s during this phase of the business cycle that companies build a lot of “fat” around the business operation. Manufacturing, suppliers, supply lines, staffing, warehousing and more all have to be expanded to meet the demands of the expansion cycle. But when the expansion cycle comes to an end as there are limited countries to expand into and limited retailers left to discover, Fitbit was left with true demand also known as sell-through. Unfortunately, sell-through is always a slower sales cycle than sell-in during the expansion phase. Picture this: Fitbit sells case packs of 4-6 units per carton to a retailer all in one large shipment on a quarterly basis (sell-in). However, the retailer that receives hundreds of case packs to divide amongst the total retail chain may find that each store sells 1.5-2.5 units a month to consumers (sell-through). There in lay the problem that lends itself to most every single consumer goods company and throughout history. Inventory of product has been built in the sales channel that exceeds the sell-through to consumers and it takes time to work off this inventory. That’s why sales, all of sudden, begin to fall as orders from retailer and distribution partners slow until a supply-demand equilibrium can be found.

So Fitbit’s rise and fall was not a factor of poor business standards and practices but rather a factor of normal business operations. It literally happens to every consumer packaged goods company, but it finds its greatest impact on non-essential consumer packaged goods companies. And let’s face it a fitness tracker is a non-essential good. For more information regarding sell-in vs. sell-through I offer to readers a review of my January 4, 2016 article titled Fitbit's Total Addressable Market Hype May Leave Investors With Disappointment. The article has been one of the most read Fitbit-dedicated articles since the company IPO’d in 2015.

Fitbit enacted a large write-down, increased markdowns and increased dedication to clear the sales channels since the beginning of 2017. With most sales channels having excess inventory, orders were slow coming and Fitbit understood sales and profits would fall. It is largely what resulted in the previous decrease in average selling price (ASP) as well as gross margins. To some extent this still exists in the current sales cycle, but to a lesser degree as witnessed in the most recent rise in ASP, but that rise is largely due to the sales associated with accessories and subscriptions. Not for nothing, but I’d be ok with those types of sales as it identifies user engagement around the brand.

During the 1st Quarter of 2017, Fitbit indicated that its restructuring plans and dedication to lowering inventory levels in the sales channels was showing improvement. The share price largely reacted to this news more so than the company narrowly beating expectations for the quarter. But now we have a more favorable investment thesis in the company as Fitbit outlined on its Q2 2017 Conference Call that inventory channels were largely clean or at a supply-demand equilibrium, as I like to recognize the operation. And it is an operation to maintain profitability long-term for such a narrow business model as Fitbit’s. The company offers a very specific product and largely benefits from the one-time sale of the product to that consumer. There are limited recurring revenues for Fitbit although that has seen minor improvements with each passing quarter through its FitStar subscription business and corporate business segment products. Another improving factor of the business is repeat customers and revisiting of the product category form customers. During the 2nd quarter of 2017, 38% of Fitbit device activations in the quarter came from customers who made repeat purchases. Of the repeat purchasers, 39% came from customers who were inactive for 90 days or greater. That metric is a “give or take” for me, as the attrition rate for Fitbit devices remains relatively high.

Having equilibrium in the sales channel with respect to sell-in vs. sell-through is critical to a product’s ASP. Fitbit now has the ability to set more stable pricing strategies for future product launches with inventory and sales levels at equilibrium. This phase of Fitbit’s business cycle is largely recognized as the bottoming phase, before Fitbit inevitably returns to growth and expresses profits once again. Now growth may not always be defined by achieving all-time revenue highs near term. That should be understood. What it means is that Fitbit may show growth from the previous year’s declines. A perfect example of the phases of the business cycle that Fitbit has and is going through would be the SodaStream (SODA) boom-to-bust, to boom cycles. SodaStream saw its peak sales form 2012-2013 and before sales declined for two consecutive years only to return to growth in 2016. But it’s only in 2017 that SodaStream may eclipse those peak sales from 2012 based on the company’s current sales guidance. Seeing how Fitbit is ahead of the bust/bottoming phase presently it may not take Fitbit as long to recover peak revenues/sales, but that remains to be seen.

Fitbit’s gross profit margins should continue to improve YOY so long as consumer spending and income continue on the current growth path. My forecast for gross profit margin is consistent with Fitbit’s sentiment and with consideration of the company’s following statement taken from the Q2 2017 Conference Call:

Excluding these offsets, gross margins would have been materially higher, giving us confidence in our full-year gross margin forecast. We ended the second quarter with $676 million of cash and short-term investments and no debt. Cash flow from operations was minus $46 million and CapEx was $12 million.

While Fitbit has done a good deal of “heavy lifting” regarding its restructuring program and by reducing expenditures along all aspects of the business operation, product innovation is a key component to long-term growth. A business can only cut so much before finding there is no more cuts available to regain growth. The upcoming launch of Fitbit’s smartwatch will play a role in this future growth. I’m not convinced that smartwatches are a subcategory of wearables that will grow long-term. But tucked within a larger assortment of products such as fitness trackers it can be a viable product for Fitbit and shareholders. Here are some of the limited details offered by Fitbit regarding its upcoming smartwatch launch:

Our smartwatch will be water resistance to 50 meters, industry-leading GPS tracking, and an easy-to-use software developer kit that will enable innovation and deeper connections to the healthcare system. All of this will come with multi-day battery life at an attractive price. The launch of our smartwatch is on track and it will be available for the holiday season. We believe it is a well-positioned product to tackle and gain share in this $10 billion-plus addressable market.

Fitbit’s robust distribution network is it’s largest asset with respect to “tackling and gaining” market share in the $10 billion-plus smartwatch market. The company will have ample opportunity through its retail and distribution partners to flood the market with its smartwatch. What will obviously prove more difficult is selling that product to the consumer.

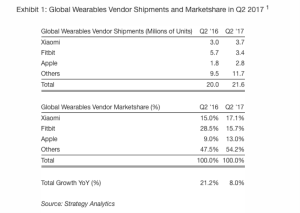

The smartwatch subcategory is a floundering category that has largely only shown growth for its top vendors when those vendors increase skus or introduce a new iteration. Apple is a perfect example of this characterization of the category and its participants. The first Apple Watch fell on deaf ears with the product failing to gain adoption and YOY sales falling for the device as it was widely reported. So in 2016 and through the first half of 2017 it is evident that Apple Watch sales grew only as the company increased its sku count and distribution reach. From 2015-early 2016 Apple only had one smartwatch. But in late 2016 the tech giant increased that sku count by offer the Apple Watch Series 2 and the Special Edition Nike/Apple Watch. Since Q4 2016, however, sales for the Apple Watch have declined sequentially and in both Q1 2017 as well as Q2 2017 as recognized by both IDC WorldWide and Strategy Analytics. The following table is from Strategy Analytics’ Q2 2017 Global Wearable Vendor Shipments tracking and as reported by Business Insider.

In Q4 2016, Apple sold 4.6mm wearable devices. In Q1 2017, Apple sold 3.6mm wearable devices and in Q2 2017 Apple sold only 1.8mm devices. The trend clearly indicates that both seasonality and demand factor quite negatively for Apple’s Apple Watch Series smartwatch sales. And it’s for this reason that the company is aiming to launch its next generation smartwatch likely in time for the holidays. It’s been speculated and reported by Bloomberg that the next generation Apple Watch will be LTE capable, operating as a stand-alone communications device. In other words, the Watch aims to be the equivalent of the iPhone. The only problem with that objective is the same problem I’ve outlined since the commencement of smartwatch sales. The smartwatch fails to operate the applications of photography, gaming and private conversations. Those are the three biggest use-case scenarios that dominate smartphone usage and why they have become a staple as opposed to a non-essential good. It’s why when Apple first began selling the iPhone it sold 10s of millions of iPhones every quarter and why it hopes to sell 10 million smartwatches all year in 2017.

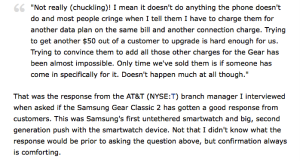

The smartwatch, very simply put, is anything but smart. Samsung and others have already tried to demonstrate stand-alone smartwatch communication devices in the past only to find great failure in the venture. I recall personally interviewing AT&T branch managers last year when Samsung launched the LTE-capable Samsung Gear Classic 2. The device has and remains an absolute failure for Samsung who doesn’t even rank in the top 5 for smartwatch sales.

The smartwatch comes with a connectivity charge, monthly data fees and one must still have the smartphone device for which to originate the operating system or in the case of Apple the iOS. The lack of utility for a device with additional monthly charges, not to mention another several hundred dollars to be spent on another device that does need daily battery charging, has simply proven to be a “bridge to far” for consumers to cross.

Apple really doesn’t have a choice other than to go down this road of cellular connectivity for its next smartwatch. If it doesn’t, it will most certainly find sales for its existing smartwatches declining in short order, as the trend seems inevitable. Apple must add another sku to its smartwatch line-up. Like the more than one dozen consecutive quarters of sales declines for the iPad, Apple does not wish to admit to poor product development yet again.

Moreover, Fitbit’s smartwatch simply needs to have advanced function beyond its predecessor Blaze smart fitness watch. GPS and water resistance combined with all the aspects of the Charge 2 device and deployment of 3rd party applications will be enough to grab consumer attention. Pricing the device competitively will likely be the differentiating factor in how much market share Fitbit captures in the subcategory of wearables. If they price it too high, and for a device with a lesser app library than its peers, it likely won’t capture as much market share as it otherwise would at a lesser price point. Let’s face it, price matters and its one of the reasons fitness tracker unit sales outpace smartwatch unit sales year-over-year. Barriers to consumer entry for a product can often be reduced by means of price elasticity. With that said I’m hoping to see the Fitbit smartwatch priced at $249-$269, but I wouldn’t be surprised to see it priced at $299. Apple won’t stand pat with its pricing either. More than likely the tech titan will lower its price for the AWS2 to $299 ahead of its next smartwatch launch. This will accomplish two things for Apple: Lowering retail channel inventory and getting ahead of the Fitbit smartwatch launch by capturing consumer sales.

So now let’s take a look at Fitbit’s offered update on forward-looking guidance.

- For the 3rd Quarter Fitbit expects revenue in the range of $380 million to $400 million.

- In terms of profits Fitbit expects a net loss per share of $0.05 to $0.02 and adjusted EBITDA of minus $12 million to breakeven.

- Q3 income tax is expected to be approximately 46%, stock-based compensation to be $23 million to $25 million and total shares outstanding to be approximately 230 million.

- With demand for connected health and fitness trackers running better than expected for the first half of 2017, Fitbit tightened the FY17 guidance.

- Fitbit raised the midpoint of the revenue guidance by the upside experienced in the first half.

- Fitbit now expects full-year revenue to be in the range of $1.55 billion to $1.7 billion. Up about $15mm from the previous range.

- Fitbit expects a net loss per share of $0.40 to $0.22 and tightened the cash consumption range to be between $80 million and $50 million.

Shares of Fitbit, despite the positive Q2 2017 performance, are still hovering near all-time low trading levels. With that being said, management’s upbeat guidance and confidence in that guidance may prove to propel the share price higher further out in the Q3 2017 period. Here is what Fitbit’s CFO William Zerella offered with regards to guidance on the latest conference call:

And in terms of our guidance, so we've obviously from the start baked in some quantity of shipments of our new smartwatch into our full-year guidance. Yeah, we feel very comfortable with the dollars and units that we've got baked in, and that's what I would comment on. So, our R&R, our range is such that, that we've got room obviously within that range to be, you know, to deviate on either side of where we expects. Right now we feel really good about executing against the full-year guidance ranges.

Investor Takeaways

Investors should find themselves blocking out the headlines surrounding the competitive landscape for the smartwatch subcategory as well as market share and shipment reporting by IDC and Strategy Analytics. Given that each vendor in the wearables category is at a very different point in their business cycle and addressing the headwinds in different ways, it makes for an ineffective read on market share and what brand is truly doing better or best. For that matter, the smartwatch subcategory of wearables continues to disappoint and has done so for its existence. The market share rankings have and will continue to move greatly with market saturation achievement, new device/s introduction and general demand. But one thing has not changed regardless of these business cycle variable: With each improved device iteration of the Fitbit brand being introduced, that device has found itself atop Amazon’s Best Seller list for its appropriate category. Both the Charge 2 and Blaze has been the consistent best selling device in their respective categories since they launched on Amazon.

With regards to Fitbit acquisition prospects, I continue to believe Fitbit is not an acquisition target, but rather a mainstay leader in the wearables category. Larger tech conglomerates like Microsoft (MSFT) and Intel (INTC) have exited the wearables category, finding little to no profit and no desire to focus on the category henceforth. Microsoft maintained its hardware acquisition of Nokia’s Withings brand a couple years ago only to find Withings shrinking its wearable products from the marketplace. Motorola has also given up on the category as it failed to compete profitably with its wearable products. Wearables are rapidly consolidating around a few leading brands including Fitbit, Apple, Garmin (GRMN) and Xiaomi. In the not too distant future I would be of the opinion that Garmin will be shrinking its wearable exposure as its fitness trackers have recently been found declining by upwards of 15% YOY and its smartwatch category entrance has been met with lackluster sell-through results.

And for the grand finale as I’m sure this lengthy quarterly recap has found readers wanting for a finale…. Given the strong restructuring discipline, streamlining of operations and expense controls, upbeat guidance, cleaner sales channels, pending smartwatch launch inclusive of retail support and still yet low expectations surrounding Fitbit’s total business, I am raising my rating on shares of FIT from Hold to Accumulate with a PT of $7.25 a share (12 month PT). This new PT and rating assume near-term headwinds for shares of FIT as well as a late quarterly surge not withstanding adverse macro-economic affects and/or pending litigation surrounding the Company. The risks to the long-term business prospects remain, but are subsiding around near-term catalysts that may provide share price appreciation. When Fitbit anniversaries its restructuring program, 2017 will have provided the Company with advantageous gross profit margin performance levels that are relatively easy to advance. The potential for gross profit margin improvement will largely stem from write-downs on the manufacturing front, refined SG&A expense controls as well as improved average selling price coming from clean inventory channels and product mix shift toward the higher end. In the back half of 2017, I expect to hear more details from Ftibit regarding its efforts on the digital health front. In 2018, Fitbit is likely to advance its corporate business beyond North America and to include nations in and around Europe. At present, Fitbit’s corporate business maintains less than 10% of total sales, but with growing corporate participants and partnerships.

Disclosure: I am long FIT, MSFT

I think Fitbit will eventually tank. It is one of the most 'one hit wonders' and I do not see it being around in the foreseeable future.

Thanks for your comment. Review that perspective with regards to previous years where that was about SODA, GMCR, SKUL, GPRO etc. All still around. In fact, the comment defies most every CPG that comes to market w/over $1Bn in sales. Simply put, you likely need to perform a bit more due diligence to understand the lifecycle of a CPG company i.e. boom, bust, resurgence, stagnation etc.