This is a Guest Post by well known newsletter writer Jay Taylor of MiningStocks.com. I’ve been a fan of Jay’s for years. This is the first time I’ve made one of his reports a Guest Post, but hopefully not the last. Genesis Metals Corp. [TSX-V: GIS] / [USOTC: GGISF] is a sponsor of my website, Epstein Research [ER]. Peter Epstein, CFA, MBA, of [ER], does not have any business relationship with Jay Taylor or MiningStocks.com. The following content has not been fact checked or opined on. Any takeaways or conclusions drawn from reading the following report is not necessarily supported by Peter Epstein or [ER]. Please see Jay’s disclosure at the bottom of the page.

GENESIS METALS CORP.

Includes 8,288,904 warrants with a weighted average conversion at C$0.21, with maturities ranging between April 25, 2017, and June 15, 2018. Also includes 3,900,000 options with a weighted average conversion price of C$0.22 with expiration dates between July 2, 2021, and August 5, 2024. If all warrants and options were converted, it would generate approximately C$2.6 million to the treasury. 2An Inferred 43- 101 resource of 300,000 ounces from 4.6 million tonnes from the Main Zone was calculated by MetChem in 2010. In addition, a non-compliant 43-101 calculation of between 8.5 million tonnes grading 1.8 g/t gold and 9 million tonnes grading 2.2 g/t was provided by Met Chem. Rock density data from past drilling is insufficient to enable a 43-101 compliant resource. Additional data is being gathered to do so.

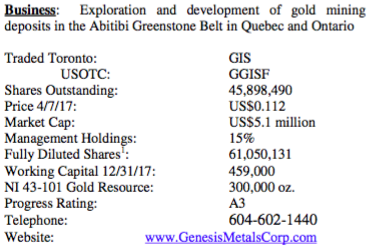

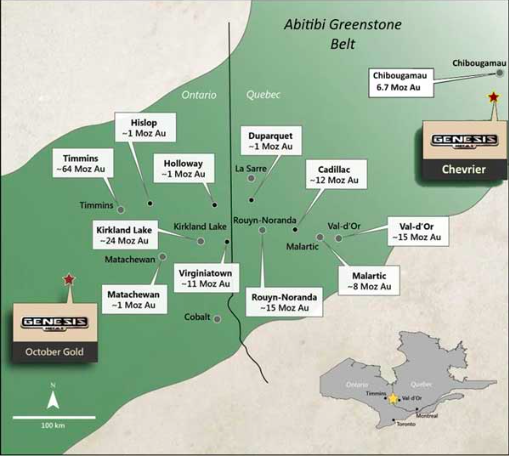

This is a pretty straightforward story as Genesis Metals [TSX-V: GIS] / [USOTC: GGISF] focuses this year on its flagship Chevrier property that covers some 95 sq. kilometers in the Abitibi Greenstone Belt. The property is located 35 kilometers to the south of Chibougamau, Quebec. The main geological plumbing structure of importance in delivering mineralization appears to be the NE/SW trending Fancamp Deformation Zone.

One of the most spectacular intercepts recently reported along this zone was an intercept grading 236.6 g/t over 5.7 meters at Monster Lake, where IAMGold (TSX: IMG) is funding to earn an interest from TomaGold on the monster Lake Project. But Genesis also has had some very impressive drill results on the Chevrier Property, which I will discuss in a few minutes.

While success for Genesis Metals and its Chevrier story is still quite speculative and still early days, there are several factors that lead me to anticipate some good news flow from this project this summer that should start to get this company and its project some recognition among the investment community, which to this point in time is virtually nonexistent despite a very successful management team that deserves attention. Here are some of the reasons I am optimistic about this story and why I purchased a few shares last week.

First, I feel confident in predicting that the current 300,000-oz. resource in the Main Zone calculated from surface or near surface from material grading 1.99 g/t gold is likely to get much larger by the end of this year. I say that because only 76 holes of some 200 holes drilled to date by predecessor operators have been factored into the existing resource. This encompasses some 80,000 meters of drill core that has neither been included in the existing resource nor modeled yet to help investors begin to understand its potential either as an open-pit project or a high-grade underground target.

In a discussion I had with management last week, based on the work they have carried out to date they believe they can bring a substantial number of ounces into a compliant resource by twinning only about 10% of the historical holes drilled to date that are not in the compliant resource. You won’t have to wait very long for verification of this potential upside because management expect to have that 10- to 12-hole program completed by June. The good news also is that it is a relatively inexpensive program of only approximately 2,000 meters.

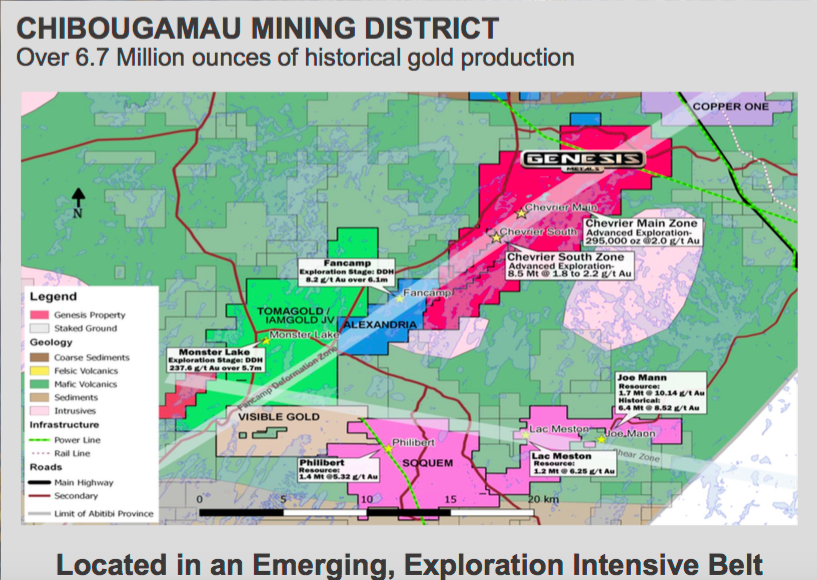

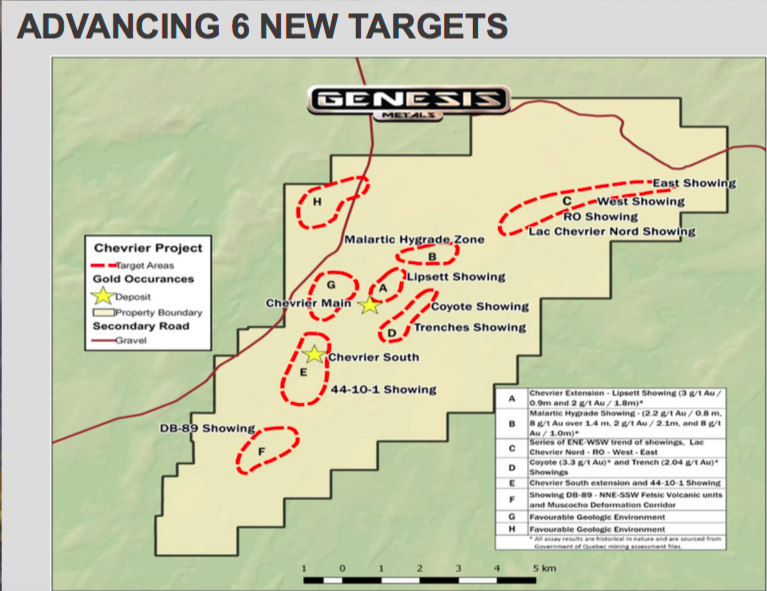

A second reason I am optimistic about this year’s exploration success is that the company is planning to begin a drilling campaign over the summer in a host of targets that are begging to be drilled, such as those to the left, where some very impressive trench results have been gathered. Between 1996 and 2002, Geonova trenched in three places in the Main Zone along or close to the mineralized corridor. Last year the company located those trenches, dewatered, and cleaned the bedrock surfaces prior to collecting its own channel sample data. The grades from the 2016 trenches are shown on the illustration above. Needless to say, these surface numbers are quite impressive. But also exciting are results from T-1 and T-4, where some high-grade trench results raise the question as to whether this may be a parallel zone to the Main Zone.

If that turns out to be the case, some much larger numbers could emerge over the next year or so. Should this summer’s drill program start to reveal continuity and depth extensions, a vision of a much larger resource would likely start to emerge especially if a second parallel zone is established.

While the immediate focus is on the Main Zone now and into this summer’s drill program, which will entail up to 10,000 meters of shallow drilling, perhaps later this year but most likely more next year, we can expect management to start poking a few holes into six other exploration targets shown above, which are in addition to the Main Zone and the Chevrier South Zone. Perhaps most promising at this stage is the C Zone to the northeastern corner of the company’s property line. It is my understanding that Falconbridge discovered gold mineralization there when they drilled some 69 holes between 1985 and 1988.

A third reason I am optimistic that we will see a much larger resource on the Chevrier Project this year or early in 2018 is historical drill results from the South Zone. As noted at the top of this report, a potential, non-compliant 43-101 resource in excess of 540,000 ounces has been outlined. The amount of drilling that took place here to date is insufficient to measure up to NI 43-101 requirements, so an estimated 19 holes will need to be drilled to tighten up the spaces and provide more accurate drill density data to more accurately calculate a resource. Given a level of statistical certainty required by NI 43-101, a range of between 8.5 million tonnes grading 1.8 g/t and 9 million tonnes grading 2.2 g/t was provided by MetChem.

Applying the higher number adds a calculation of closer to 700,000 ounces. It is my understanding that management plans to start drilling those 19 additional holes in the late fall and into the winter when marshy areas where these targets lie will be frozen. Given winter drilling, I would not expect confirmation of some resources within the historically calculated range, but we should know something by early 2018. But between now and then, there will be plenty of news that could very well drive these shares to much higher levels. At this point, the stock is in sleep mode. But assuming the gold bull market remains intact, I think that will soon change.

The abundance of gold projects in the Abitibi Greenstone Belt is shown on your left. Given the promise shown to date, it is my view that the Genesis Project could very well be put on the map. Indeed, active drilling by IAMGold and Alexandria directly to the southwest along trend is progressing aggressively.

The thing to keep in mind is that these gold-bearing structures in the Abitibi Greenstone Belt generally run to great depths. Though you need to be cautioned that these are still early days for the Chevrier Project, based on what is known now, prospects would appear to be possible for some initial open-pit bulk mining followed by underground high-grade mining. Certainly if the kinds of trench results shown along the Main Zone are continuous across the structure and at depth, with those kinds of grades and widths of between 3.3 meters and 6.4 meters, an underground mining operation would seem prospective.

As I say, it is still too early to envision a mining scenario with any degree of certainty at the Chevrier Prospect. No serious metallurgical work has yet taken place, though initial observations suggest no obvious problem. Management is still pulling together 3-D modeling that will continue to improve as more drill data is compiled this year, especially at the South Zone. But what makes this story interesting now is a steady stream of news flow that we can expect with drilling taking place very shortly.

The October Project

The location of the company’s 100%-owned October Project is southwestern Abitibi, which is the least explored area of that major belt. This property is located between the 5.8-million-ounce Borden Lake Deposit owned by Goldcorp and the 1.3-million-ounce Jerome Mine owned by IAMGold. Further to the southeast along the Cadillac-Lardner Lake break is an 8.2-million-oz. gold deposit that is also owned by IAMGold.

Genesis has spent some $700,000 to pick up two exploration targets on this property. Some more work will need to be done to establish drill targets. Management reports that Genesis has been approached by some major mining firms but at this stage the company is focused mainly on its flagship Chevrier. Management is undecided at this stage what it wants to do with the October Gold Prospect but clearly it is in the right neighborhood where big bucks are being paid for major gold deposits. Much will depend on how things develop at Chevrier as to whether management will decide to keep this as a second project or perhaps joint venture it to a neighbor. Either way, at this point in time, the October Property appears to be a definite, though unquantifiable, plus.

Financing

With a relatively low level budget, management won’t need to raise much money in the near term. At the end of the year, the company had working capital of $459,000. Management owns some 15% of the company and it is my understanding that there are some sovereign funds in Quebec that are very familiar with this project who are likely to come into the picture as funding is required. The company raised $660,000 so far this year through a units offering at C$0.15. Each provides a full warrant exercisable at $0.25 over a two-year period. With success and availability of drillers (not as abundant as a year or so ago), I would not be surprised if management raises more money before the end of the year. But hopefully it will do so at much higher prices.

While the company’s focus in primarily on the Main Zone this spring and summer and on establishing a NI 43-101 resource on the South Zone via winter drilling, these sovereign funds are reportedly interested in the bigger picture at Chevrier, a project they know well. So if not this year, I would expect next year and into the future a much larger scope of exploration may develop for this company to determine whether a large-scale gold deposit could be in the making at Chevrier.

MANAGEMENT

BRIAN GROVES – CEO and Director – Brian Groves has over 30 years of experience in Australia and Canadian mining and exploration. He has been involved in exploration for coal, gold, diamonds and base metals with AMAX Minerals, Noranda and Placer Dome. Since 2003, Mr. Groves served as chief executive officer of two TSX Venture Exchange-listed exploration companies and now is a director of two TSX Venture Exchange-listed companies. He has valuable experience in corporate strategy, capital markets, and project development and permitting.

JEFF SUNDAR – Executive VP & Director – Jeff Sundar has eighteen years of experience in the capital markets and mineral exploration sector. Mr. Sundar is responsible for the company’s corporate development, marketing, and financing. He was a Director and VP of Underworld Resources which discovered the 1.6 million oz White Gold deposit in west-central Yukon, and was subsequently acquired by Kinross Gold for $138 million in June 2010.

ROBERT MCLEOD, MSC, P. GEO – Chairman and Director – Mr. McLeod is the President and CEO of IDM Mining Ltd., advancing the Red Mountain gold deposit in British Columbia. Previously, he was founder and VP Exploration of Underworld Resources. Kinross Gold Corporation acquired Underworld for $140M after an initial resource estimate of over 1.4Moz gold at the White gold Deposit in the Yukon. He is a highly technical, creative and innovative exploration geologist. He has over twenty years’ experience in mining and mineral exploration, working for a variety of major and junior mining companies. Mr. McLeod’s exploration strategy is a multi-tiered approach, including: conceptual geologic ideas with prospecting, early-stage project advancement focusing on discovery, and advancing mid-stage projects towards feasibility.

As an exploration geologist and project manager at Miramar’s Hope Bay project, Mr. McLeod was part of the team that discovered the Naartok deposit, as well as expanding and delineating the Boston and Doris deposits. He was previously Vice-President of Exploration for Atna Resources and is currently a director of Independence Gold Corp and Gold Standard Ventures. He is graduate of Geology from the University of British Columbia, with an M.Sc. in Mineral Exploration from Queens University. He is a member of AMEBC as a Professional Geologist, and is an active member and volunteer in multiple industry and geological societies. Mr. McLeod is a member of Doug Casey’s ‘NEXTEN’ list of young mineral explorers and executives.

ADRIAN FLEMING, P. GEO – Executive Director – Adrian is an Australian geologist with over 30 years of global diversified experience in the mining industry. Mr. Fleming was the President of Underworld Resources Inc. which made a significant gold discovery on the White Gold Property in the Yukon. Mr. Fleming has held a number of senior positions, including Exploration Manager for Placer Dome in Sydney and Vice President of Exploration for Golden Star. His successes include involvement with teams that discovered, advanced, and developed gold mines, including Porgera in Papua New Guinea, Big Bell in Australia, & Gross Rosebel in Suriname.

ANDRE LIBOIRON – Exploration Manager – Andre is a geologist that has had experience in Canada and internationally for exploration companies since 1981. Most recently he served six years as geologist at Excellon Resources at the Platosa Mine – the Mexico’s highest grade silver producer. Prior to that he did field evaluation of gold epithermal properties in Peru and Mexico. Also M. Liboiron was senior geologist for Unigold in Dominican Republic, Cambior in Peru, Metco Resources in Quebec, Pershimco Resources in Abitibi and Mexico, Melkior Resources in Quebec and Ontario and Cyprus Amax Minerals in Africa. He was a project geologist with Ageos Science charged to carry out exploration programs on primary gold and base metals deposits in Precambrian formations of the Abitibi greenstone belt in Canada. Notably he supervised the exploration work which lead to the opening of the StrateMine Graphite Mine in Quebec, Canada.

SHAWN KHUNKHUN – VP Corporate Development – Shawn has over twelve years of experience in the capital markets and mineral exploration and development sector. Mr. Khunkhun is involved in the company’s marketing, financing and corporate development. He has developed long-standing relationships with an extensive network of high net worth investors, analysts, brokers, investment bankers and private equity groups.

JOHN FLOREK, P.GEO, MSC – Director – John is a geologist with over 20 years experience in exploration and development. Prior to joining Entourage Metals Ltd. He was Sr. Geologist with Barrick Gold at Hemlo Mines. He was intimately involved with extending the mine life at Hemlo Mines, and was part of the team that received the 2008 Developer of the Year Award, awarded by the Northwestern Ontario Prospectors Association.

ROBERT SCOTT, C.A. – Independent Director – Robert is an accountant with over 20 years of professional experience in the, corporate finance and merchant banking and is a CA and a CFA charterholder. Since March, 2007, Mr. Scott has served as the chief financial officer of Riverside Resources Inc., a TSX Venture Exchange-listed mineral exploration company with early-stage mineral projects in Mexico. He is also a co-founder and director of Pan American Hydro Corp., a developer of small hydro projects in Latin America.

KEENAN HOHOL J.D. – Independent Director – Keenan has over 20 years of international legal and commercial advisory experience and managerial experience. He has focused on the minerals exploration, development and production industry since 2005, including executive leadership roles since 2009. He has most recently served as the general counsel of Pan American Silver. He was the former VP of legal and general counsel at Silver Standard Resources, VP of legal, Canadian and European operations, at Walter Energy. Mr. Hohol has also served as general counsel, minerals exploration, with BHP Billiton.

THE BOTTOM LINE

The potential to see the Chevrier Deposit emerge into a million-plus-ounce high-grade deposit that can justify a market cap of 2 or 3 times this company’s current valuation appears obvious to me. Whether something much larger could be in the making is hard to say. We should have a better idea of that with this year’s drill program. A parallel zone west of the Main Zone would be positive news in that regard. And I think it’s fairly safe to say we should see a major boost in the company’s compliant resource based on additional drilling on the South Zone. A significant boost in ounces before this year ends should be achievable without the company needing to spend much money on exploration, thanks to the ability to use past drill results with only about 10% confirmation drilling required. With good results, future financing should be done at much higher levels.

The clincher for me in adding this story to my list and in buying some shares myself is a very impressive management team. It’s a team that knows success and they have monetized a bit of their past success to take an early stake in Genesis Metals Corp. That fact coupled with competence and an interest that aligns with mine as a shareholder is why I felt compelled to bring Genesis to your attention. It’s early and risky. But those facts are built into a low share price.

My view is the odds favor a successful exploration program this year that should allow this company to double or triple its share price by yearend or early into 2018. Something much larger could be in the offing longer term if the Chevrier system proves to be much larger, as certainly seems possible. Of course, there are no promises regarding share price outcomes. My optimism is based on assumed exploration success and a continuation of the newly emerged gold bull market, both of which are probable in my view but neither of which are 100% certain.