Hello fellow traders. Here is the chance to test your Elliott Wave knowledge again and eventually make some improvements. You probably know that we do a lot of free educational blogs, presenting various Elliott Wave Patterns through real Market examples. We also constantly teach our members through our services like Live Sessions and 24h Chat Room . So ,if you follow us , chances are that you’ll be able to answer on all questions correctly. Now let’s check how good are you at recognizing Elliott Wave Patterns.

In this short quiz we’re going to take a look at past Elliott Wave chart of EURGBP published in members area of www.elliottwave-forecast.com and challenge you to answer correctly on 3 questions.

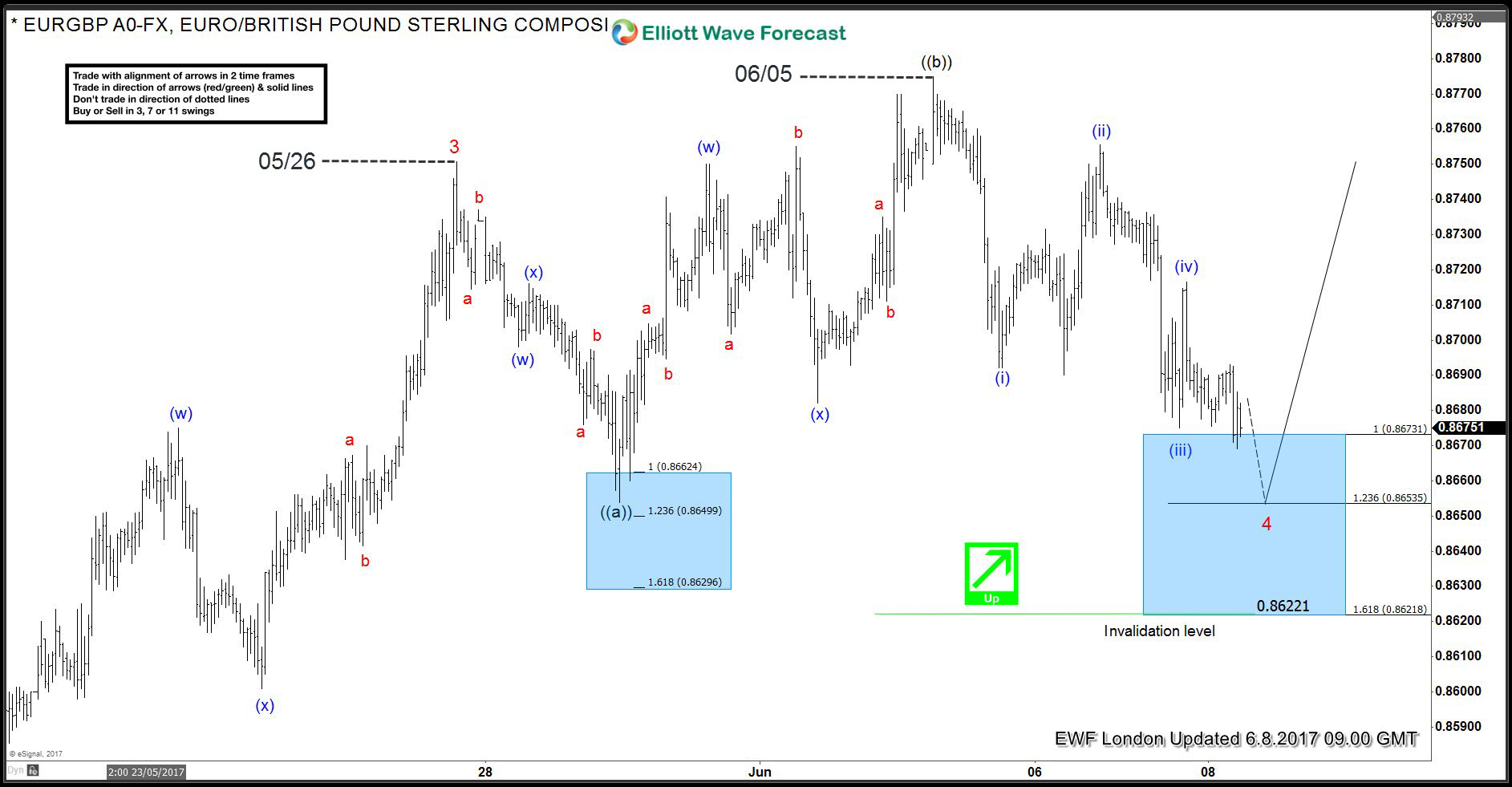

EURGBP Elliott Wave 1 Hour Chart 6.8.2017

Take a close look at the price structure and try to answer on the questions below:

I : Wave 4 red correction is labelled as which Elliott Wave pattern ?

1) Triple Three Pattern

2) Flat pattern

3) Zig Zag Pattern

II: What’s the inner labeling of wave 4 ?

1) (w),(x),(y) blue

2) (i),(ii),(iii),(iv),(v) blue

3) ((a)) , ((b)), ((c)) black

III: Wave ((b)) black has ended on 06/05 peak , and it’s labeled as :

1) Expanded Flat

2) Double Three

3) Triple Three

Win the potential discount

Send us the answers to vlada@elliottwave-forecast.com and win 30% Discount on any Subscription Plan you choose. These discounts are available only to new members who send the correct answers. Existing members can get discount on Educational Seminars.

Note: number of discount codes is limited so you need to hurry up. We’re going to answer on every E-mail we get , giving you correct answers with explanation , hopefully helping you to improve understanding of Elliott Wave Theory.

If you’re not able to answer on these questions, you have opportunity to get 14 days of EWF membership for Free and learn from our Market Experts.

In Free Trial you get access to Professional Elliott Wave analysis of 50 instruments in 4 different time frames, 2 live webinars by our expert analysts every day, live trading room, 24 hour chat room support, market overview, daily and weekly technical videos and much more…

Thanks for taking the quiz.