Quick Win by the Algorithm

Bovie Medical Corporation (BVX)

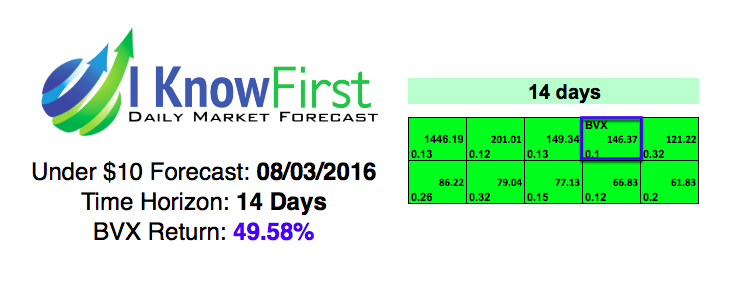

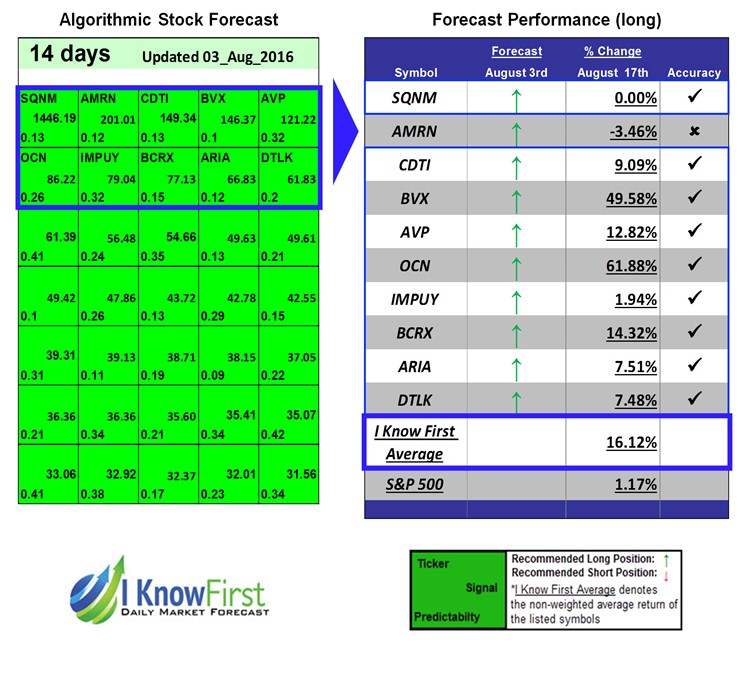

On August 3, 2016, the I Know First algorithm had given a bullish signal of 146.375 for the ticker BVX with a predictability indicator of 0.1 . As the algorithm correctly predicted in the Stocks Under 10 Dollars package, BVX quickly experienced a rise in share price of 49.58% in a mere 14 day period.

The forecast, in general, is color coded, green meaning bullish and red meaning bearish. A bright green, as shown below, signifies that the algorithm is very bullish. The signal is the number flush right in the middle of the box and the predicted direction (not a specific number or target price) for that asset while the predictability (bottom left-hand corner) is the historical correlation between the prediction and the actual market movements. In other words, the signal represents the forecasted strength of the prediction while the predictability represents the level of confidence

Bovie Medical Corporation (BVX) is an energy-based medical device company. It designs, develops, and manufactures electrosurgical equipment used in doctor’s offices, surgery centers, and hospitals worldwide. Bovie Medical Corporation was incorporated in 1982 and is based in Clearwater, Florida.

The main reason behind the jump in share price for BVX is related to the better than expected Q2 2016 earnings announcement. The company had reported earning per share (EPS) of $-0.02, beating the Wall Street estimated average of $-0.06 EPS. Revenues were at $9.29M, up 27.8% year on year. Thus was mainly as a result of growth in sales of not only the core products sales, but as well as high growth and record sales from J-plasma product. Investors were pleased with an increase in overall demand for BVX products. In addition to a rise in sales, operating expenses had been significantly reduced on year on year basis from 64.4%of sales to 56% of sales.

Additional factors such as stock momentum had helped share prices jump, whereas the initial share price increase further caused a higher price rally due to positive expectations of investors in the market. Investors as well received news that the Food and Drug Administration had approved clearance for production for the PlazXact, a tool for surgeons to aid in performing arthroscopic procedures, in a positive manner, as it will be seen to further improve BVX total bottom line and future cash flow.

Strong sales growth, specifically as a result of strong demand, specifically for the J-Plasma and cost-effective measures by CEO Robert L. Gershon, have allowed BVX to continue to narrow its losses.

Investors will be giving special attention to Q3 results to see how the CEO's strategic plans will continue to develop.

This forecast for BVX was sent to current I Know First subscribers on August 3rd, 2016.