Zones Of Resistance

It’s very, very easy – effortless, actually – to be a bear on a day like Tuesday when the Dow closed down nearly 500 points. Days like that are a kick, and one Sloper pointed out something that hadn’t even occurred to me (even though he was mentioning a part of my personal history): that September 1 2015 was my best day ever, while September 1 2010 was my worst day ever. So – – at least 9/1 doesn’t have a completely awful meaning for me anymore!

Being a bear last Friday is a lot tougher, because the market is roaring higher, and it’s very easy to let six years of bear torture push one to paralysis. However, I shorted all kinds of tickers late last week, and they started to behave themselves Monday and really blossomed (or wilted, as the case may be) yesterday. Of course, today (Wednesday) is more akin to late last week – – – everyone is buying like mad, driven principally by the federal statute that decrees the market must be the exact opposite of whatever Gartman predicts.

In spite of Gartman completely mucking things up for the bears (and I pray that he will soon, once again, flip-flop and declare himself pleasantly short of equities) I added to my short positions today. I am understandably a bit nervous about Friday morning’s job report, since that could be a big market-mover, but on a chart-by-chart basis, there are still terrific topping patterns out there.

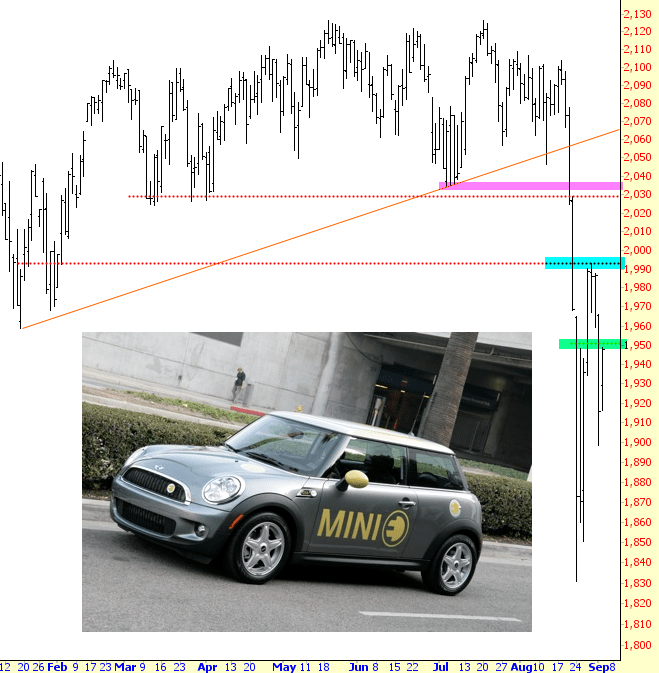

I see three “zones” of resistance above present price levels. The closest, and flimsiest, one is marked in green. We could easily sail through that. The more important one, tinted in cyan, is at about the 2000 level on the ES, which is the highest point we reached last week. Staying below that is important to the ‘things are still broken” meme. Finally, in magenta, at about 2035 or so, is what I consider a near-impenetrable wall of overhead supply.

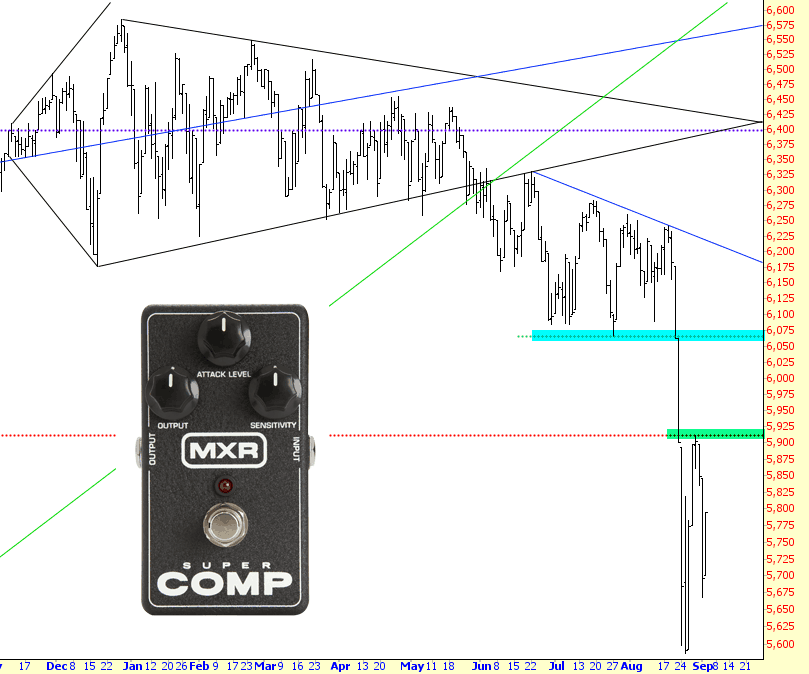

The view is kind of similar with the Dow Composite (with different price levels, naturally), although I’ve dispensed with showing the highest level, since I think it’s so unlikely.

See, the thing is, I never know when days like Tuesday are going to show up, and in spite of today’s nearly 300 point rise on the Dow, my charts are still gorgeously positioned for a hard fall down, deeply surpassing the lows of last week. Friday’s job report notwithstanding, I anticipate smooth sailing until the big Fed announcement on the 17th, at which time I think I will probably be very, very light.

This blog is not, and have never been, investment advice. It is a place that allows me to express my own views on the market and specific securities – as well as make whatever cultural ...

more