You Need Not Ask Why The Markets Did What They Did This Past Week

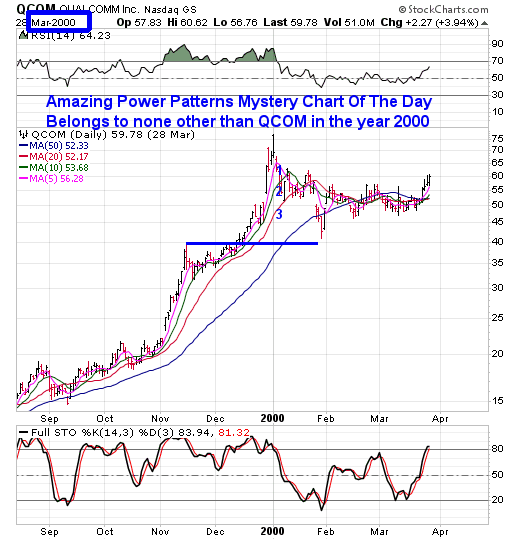

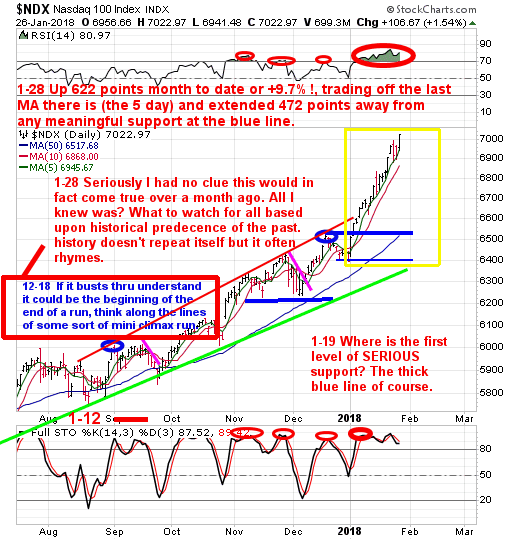

Remember that Moving Average Countdown Clock I warned about in part three of the Mystery Chart Of The Day on January 29th? No? Lets review a little from that article, with key points in blue print.

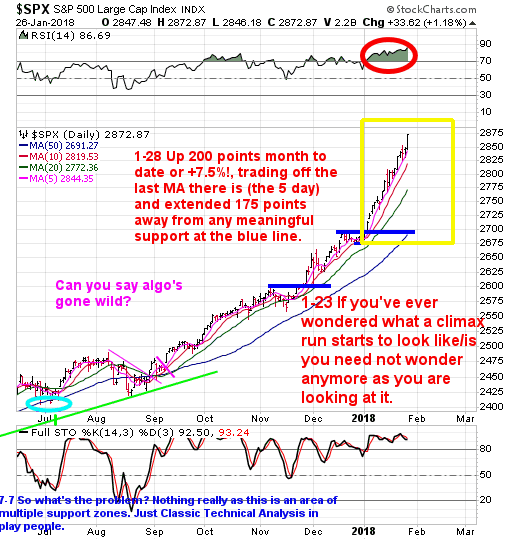

In the chart above we walked thru what I call the countdown clock when it came to moving averages in extended market climates and what it leads to once there are no more moving averages to trade off of. 1-27-18 As I write this our indexes are currently above the 5 day moving average. Its only a matter of time before it burns itself out to the upside much like our mystery chart did as shown above.

So, now that I've walked you thru the mechanics of what climax runs can lead to, at the least consider this the first step towards being prepared when the time comes.

Remember, like I've said climax runs are the beginning of the end of a bull market cycle. We've seen that in the year 1929, 2000, and 2007. Know what else those periods of time leading up to those tops had in common?

All the news out there was good, great and over the top (sound familiar?). All the Wall St. analysts were constantly raising estimates and projections for the year to come (sound familiar?) all AFTER the market has already ran for months on end.

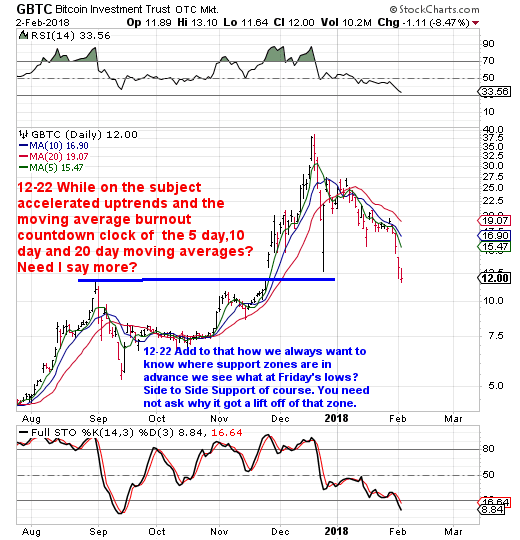

Does all this sound familiar? It should, here is another example, can you say bitcoin in December 2017 when it made its moving average burnout climax run and was sitting at like 20,000 or whatever absurd number it was with people coming out of the woodwork saying sky's the limit and throwing out crazy numbers like 40,000 AFTER its gone from like 1000 to 20,000? And lets not forget our FB feeds and every financial news web portal littered with advertising about it being the next big thing AFTER it already WAS the big thing.

2-4-18 See bitcoin this week?

Look, I don't know if indeed we are currently going to follow the same script here in our markets like QCOM did and Bitcoin currently is. All I am pointing out are the similarities and they are strikingly similar. I'd rather you all be aware of what this could lead to over time than to be a deer in the headlights.

Its because of all that we've just gone thru the last four or so days with this educational segment that we are sitting in a high cash position. Believe me, its been a long time since our markets have gone thru what we just went thru month to date.

Heck, I heard the other day that the last time the markets have ran this long WITHOUT so much as a 5% correction was 90 years ago. Let that sink in.

Now given complacency reigns supreme and also that the last time we had an actual real normal correction, it also means there is a lot of emotional money that has forgot what happens to growth stocks (and in this instance mom and pop Dow type stocks which one could say are trading like growth stocks this go around) when a traditional 5%er hits the tape.

FAST FORWARD TO THIS WEEKEND

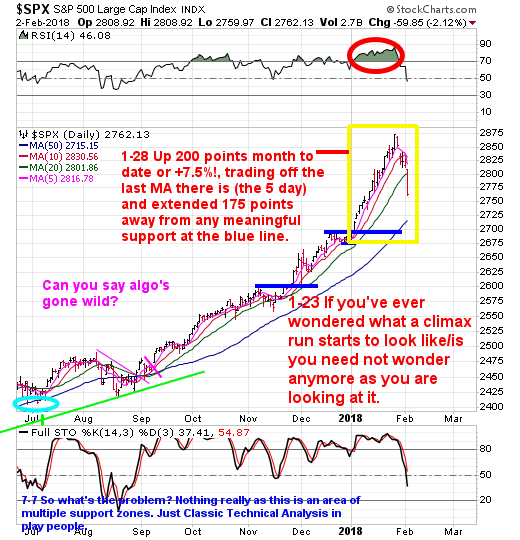

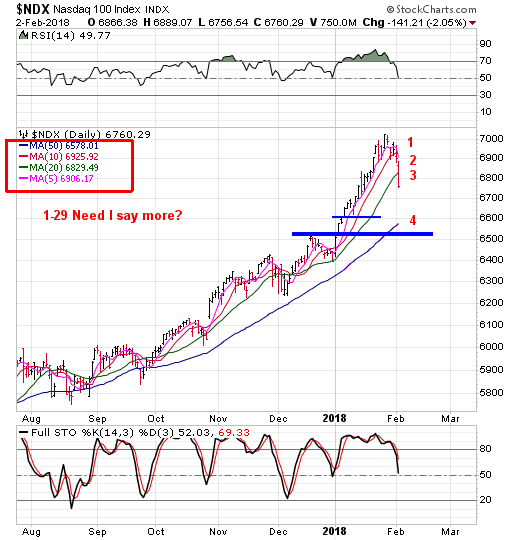

2-4-18 Given what we saw this week? I don't think I need to tell you how the emotional Greedy Gus types are feeling do I? If only they would have paid attention to what the Moving Average Countdown clock was saying. Below are the charts from the previous article. I've marked them in both BEFORE and as of this weekend just to show you the POWER OF THE MOVING AVERAGE COUNTDOWN CLOCK when properly made aware of it. I hope you were all able to take advantage of the "What to Watch Out For" before the clock ran out. Can't say you weren't made aware of Thursday and Friday's cliff dive in advance.

BEFORE

AFTER

BEFORE

AFTER

As you can see in each before and after the Moving Average Countdown Clock strikes again. So, the next time you see something on a tear that doesn't allow you to get in just relax and don't feel the need to chase it because the issue is in the process of burning itself out.

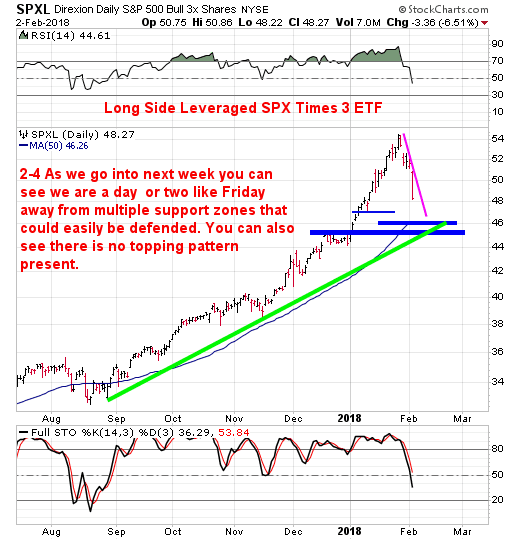

So now what? Well you need only ask one question and that is where is support. For that lets look at SPXL which is the Leverged SPX Index ETF.

Disclosure: None.

Disclaimer: THESE ARE NOT BUY RECOMMENDATIONS! Comments contained in the body of this report are technical opinions only. The material herein has been obtained from sources ...

more